What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

Navigating the import process into the U.S. can be complex, especially when it comes to complying with Importer Security Filing (ISF) requirements. With the growing emphasis on security and efficiency, filing your ISF online has become an essential step for importers.

This guide will walk you through the online ISF filing process, providing you with the insights and tools you need to ensure accurate and timely submissions.

Embracing online ISF filing not only simplifies compliance but also enhances the efficiency of your import operations. By understanding the digital submission process and leveraging advanced tools, you can streamline your import workflow, reduce the risk of errors, and maintain adherence to U.S. Customs and Border Protection regulations.

Discover how Artemus‘s innovative software can transform your ISF filing experience, making compliance straightforward and hassle-free.

Table Of Contents

When it comes to international trade, complying with customs regulations is essential. One crucial aspect of the customs clearance process is filing the Importer Security Filing (ISF), also known as the 10+2 filing. ISF filing requires importers to provide specific information about the incoming shipment to the customs authorities in advance.

With the advent of online platforms, ISF filing has become more streamlined and convenient. In this article, we will explore the information required for ISF filing online.

Accurate and complete information is vital for successful ISF filing. It is essential to double-check all the details before submitting the ISF filing to avoid delays or penalties.

Related: ISF Filing Requirements: A Step-By-Step Guide

Filing the Importer Security Filing (ISF) online has become increasingly popular due to its convenience and efficiency. Online platforms streamline the process, allowing importers to submit the required information to customs authorities with ease.

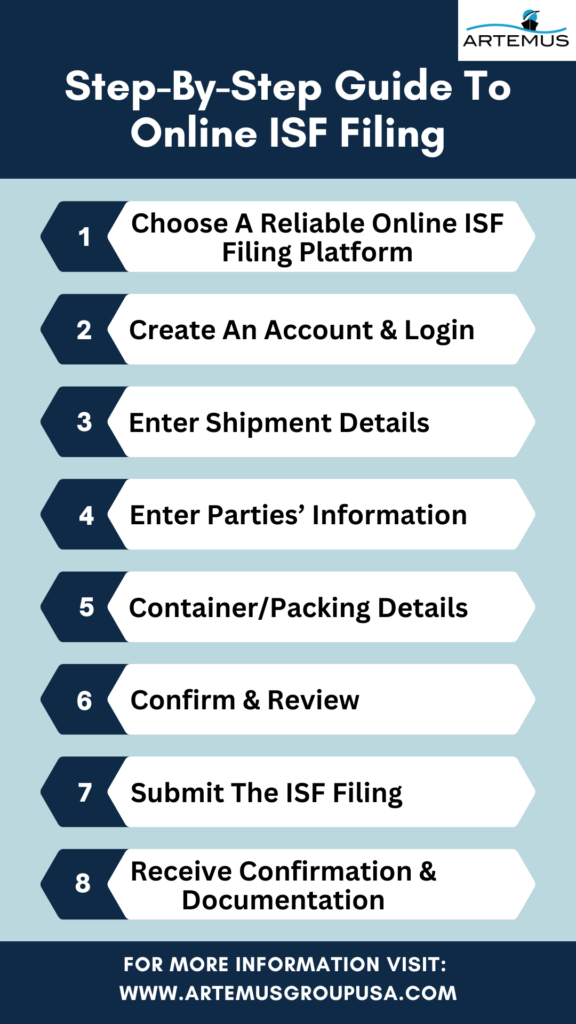

If you’re new to online ISF filing, this step-by-step guide will walk you through the process.

Research and select a reputable online ISF filing platform that aligns with your needs and requirements. Ensure that the platform is user-friendly, secure, and compliant with customs regulations. Let Artemus help you!

Visit the chosen online ISF filing platform’s website and create an account by providing your relevant details. Once the account is created, log in using your credentials to access the filing system.

Start by entering the necessary shipment information, such as the bill of lading (B/L) or airway bill (AWB) number, vessel or flight details, and foreign port of loading. Provide the estimated arrival date at the U.S. port of discharge and the name and address of the place of delivery.

Enter the required details for various parties involved, including the importer/consignee, seller/supplier, buyer/owner, and manufacturer/supplier.

Provide their full legal names, addresses, and contact information (phone number and email address).

Input container-related information, including container numbers and seals used for packing the goods. Describe the goods being shipped accurately, specifying the number of packages, weight, and dimensions, and providing Harmonized System (HS) codes or detailed product descriptions.

Review all the entered information carefully to ensure accuracy and completeness. Double-check the details provided for each section, making sure all the necessary information has been accurately entered.

Once you have confirmed that all the information is correct, submit the ISF filing through the online platform. Some platforms may require a fee for their services, so ensure that any payment requirements are fulfilled.

After submitting the ISF filing, the online platform will generate a confirmation or transaction number. Keep this number and any other relevant documentation provided by the platform for future reference and customs compliance.

By following these step-by-step instructions, you can successfully complete the online ISF filing process. It is crucial to ensure that all the information provided is accurate and up to date to avoid any potential delays or penalties.

Remember to consult with customs experts or refer to official guidelines to ensure compliance with your country’s specific customs regulations and requirements for ISF filing.

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

When it comes to filing the Importer Security Filing (ISF) online, selecting the right service provider is crucial. The online ISF filing service you choose should not only be reliable and efficient but also meet your specific needs.

Here are some key factors to consider when choosing the right online ISF filing service:

By considering these factors, you can choose the right online ISF filing service that aligns with your needs and requirements. Conduct thorough research, compare different providers, and take advantage of trial periods or demos to assess the suitability of the service before committing.

Related: ISF 5 Filing Requirements: Data Elements & Audit Process

Artemus Transportation Solutions offers the premier ISF filing software designed to streamline compliance with U.S. Customs and Border Protection regulations. Our advanced solution simplifies the ISF filing process, ensuring accuracy and timely submissions while minimizing the risk of errors and delays.

With Artemus, businesses can efficiently manage their import documentation and maintain seamless compliance with ease.

Related: ISF 5: Meaning, Compliance Requirements, & Best Practices

Yes, you can file an ISF (Importer Security Filing) yourself, but many choose to use a customs broker or specialized service to ensure accuracy and compliance with regulations.

The cost to file an ISF (Importer Security Filing) typically ranges from $25 to $100 per filing, depending on the service provider and the complexity of the filing.

The ISF (Importer Security Filing) procedure requires importers to submit specific cargo information to U.S. Customs and Border Protection (CBP) at least 24 hours before cargo is loaded onto a ship bound for the U.S., to ensure security and facilitate risk assessment.

The importer or their designated agent is responsible for filing the Importer Security Filing (ISF) with U.S. Customs and Border Protection (CBP).

ISF filing online has revolutionized the way importers handle their compliance obligations. It offers a streamlined and efficient process that saves time, enhances accuracy, and ensures adherence to customs regulations. By embracing ISF filing online, importers can enjoy the convenience of digital platforms, simplified data entry, and real-time updates.

With a few clicks, importers can submit their ISF filings, eliminating the hassle of manual paperwork and reducing the risk of errors. Whether you’re a small business or a large enterprise, ISF filing online is a game-changer that streamlines your import process and paves the way for seamless trade operations.

Embrace the power of technology and take advantage of ISF filing online to unlock a world of efficiency and compliance in international trade.

Related: ISF Fees (Import Security Filing): When & How To Pay?

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.