What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

When it comes to navigating the complexities of international trade, importers are well aware that compliance is paramount. Among the multifaceted regulations that govern cross-border operations, Importer Security Filing (ISF) fees hold a pivotal role. These fees aren’t just financial transactions; they are the linchpin of ensuring a seamless and efficient importation process.

In this blog, we embark on a journey to unravel the intricacies of ISF fees and provide importers with the vital knowledge they need. We’ll explore the factors that can influence these fees and underscore the significance of timely compliance.

Furthermore, Artemus Transportation Solution offers a leading ISF software solution for compliance. With this, the ISF process becomes a breeze, guaranteeing accuracy and a hassle-free experience for importers. Let’s delve into the world of ISF fees and discover the innovative solution that is Artemus Transportation Solution.

Table Of Contents

ISF fees are the charges imposed by customs brokers or filing agents for submitting the Importer Security Filing (ISF) to U.S. Customs and Border Protection (CBP) before ocean shipments arrive in the United States. These fees cover the administrative and professional services required to ensure compliance with CBP regulations.

The cost of ISF filing varies based on the service provider and the complexity of the shipment. On average, ISF filing fees range from $30 to $50. However, additional costs may apply:

Therefore, the total cost for an ISF filing, including the bond and potential penalties, can range from $80 to $120 or more, depending on the circumstances.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

The ISF program, known as the “10+2 Rule,” requires importers to submit ten data elements and carriers to submit two additional elements, providing CBP with complete details of incoming cargo. This includes information about the manufacturer, seller, buyer, consignee, and container stuffing location, submitted at least 24 hours before the cargo is loaded.

ISF fees are not charged by the government but are billed by brokers or agents for preparing and filing the ISF. Non-compliance, late filing, or incorrect information can trigger penalties up to $5,000 per violation, shipment delays, or cargo holds. Timely and accurate ISF submission ensures smooth customs processing and strengthens the security of the global supply chain.

Related: ISF Form (Importer Security Filing): Elements & Top Practices

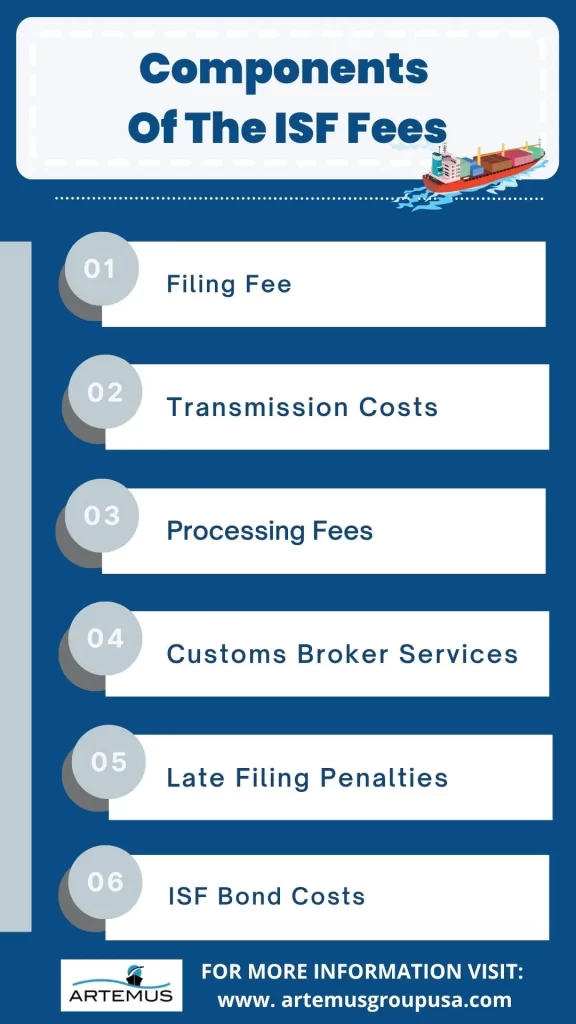

Understanding the breakdown of Importer Security Filing (ISF) fees is crucial for importers navigating the intricacies of international trade compliance. The ISF fees consist of five key components, each playing a specific role in facilitating secure and streamlined cross-border transactions.

The ISF filing fee typically ranges from $30 to $50, depending on the customs broker or service provider. This fee covers the cost of submitting the Importer Security Filing to U.S. Customs and Border Protection (CBP) before ocean shipments arrive in the United States. While CBP doesn’t charge a filing fee, customs brokers or freight forwarders charge this fee for their services.

Some brokers may also offer bundled services, combining the ISF filing with other customs clearance tasks, which can affect the overall cost.

It’s important to note that this fee is separate from other potential costs, such as ISF bond fees, processing fees, or late filing penalties. Therefore, importers should budget accordingly to ensure compliance and avoid unexpected expenses.

Importers may incur expenses associated with the transmission and submission of ISF data to CBP. This component covers the costs related to electronic data interchange (EDI) or other means of data transmission, typically ranging from $5 to $15 per filing depending on the broker or service provider.

Reliable data transmission is essential for the accuracy and timeliness of ISF submissions, as it allows customs authorities to assess and process cargo shipments effectively.

ISF fees can include processing costs, which involve the review and validation of the submitted ISF information. These fees are associated with the administrative tasks performed by customs brokers or service providers to ensure that the ISF data complies with CBP regulations, typically ranging from $10 to $25 per filing for standard shipments.

Processing fees support the meticulous examination of the data, including cross-referencing it with customs and trade databases to prevent errors and discrepancies that could lead to non-compliance issues.

Importers often opt to engage customs brokers or third-party service providers to assist with ISF compliance. These services can encompass various aspects, including data submission and compliance support.

Customs brokers play a crucial role in ensuring that the ISF is accurately prepared and submitted in a timely manner. Their expertise in navigating complex customs regulations and maintaining compliance is invaluable in the importation process.

While not initially included in the ISF fees, late filing penalties are a consequential aspect of ISF compliance. If the Importer Security Filing is not submitted to CBP within the specified time frame, penalties of up to $5,000 per violation may be imposed.

Importers must be acutely aware of these potential penalties, which can result in financial repercussions, cargo delays, and compliance issues. To avoid such penalties, importers must prioritize timely and accurate ISF submissions, making them an essential part of the ISF compliance process.

An ISF bond acts as a financial guarantee to ensure compliance with CBP regulations. Single-entry bonds, required for individual shipments, typically cost around $60 to $75 for the bond itself, with total costs including entry fees reaching approximately $300 per shipment.

Continuous bonds, suitable for importers with multiple shipments, generally cost $350 to $550 annually and cover up to $50,000 in duties and fees. Choosing the right bond type depends on shipment frequency and value, with continuous bonds often being more cost-effective for frequent importers.

Related: ISF Late Filing Fee: Exact Cost & 6 Tips To Manage Appeals

Understanding when and how to pay Importer Security Filing (ISF) fees is a critical aspect of navigating the intricacies of international trade. Here’s a comprehensive guide on when and how to pay ISF fees:

Timing is crucial in the world of international trade, and understanding when to pay Importer Security Filing (ISF) fees is pivotal for a smooth and compliant cross-border journey.

1. At The Time Of Filing: ISF fees are typically due at the time of filing the Importer Security Filing. Importers must ensure that these fees are paid before or during the submission of their ISF to the U.S. Customs and Border Protection (CBP). This proactive approach helps avoid delays in cargo clearance.

2. Before Arrival Of Goods: To prevent disruptions in the importation process, it’s crucial to pay ISF fees well in advance of the goods’ arrival at the U.S. port. This ensures that all financial obligations are met before the cargo reaches its destination.

3. Early Planning: Proactive planning is essential. Importers should budget for ISF fees as part of their overall shipment planning process. This includes considering the fees as part of the overall cost structure and ensuring that funds are allocated accordingly.

Embarking on the journey of international trade requires a nuanced understanding of Importer Security Filing (ISF) fees. Learn how to navigate this financial landscape with precision, ensuring timely and accurate payments to facilitate a seamless flow of goods across borders.

1. Electronic Payment: The most common and efficient method of paying ISF fees is through electronic means, such as Electronic Funds Transfer (EFT) or Automated Clearing House (ACH) payments. The CBP encourages electronic payments for their speed and accuracy.

2. Customs Broker Assistance: Customs brokers play a crucial role in the ISF process. They can assist importers in handling ISF fees, guiding them through the payment process, and ensuring that all financial aspects are accurately addressed.

3. Payment Methods & Channels: ISF fees are typically paid through the Automated Broker Interface (ABI), which is the CBP’s electronic system. Importers may need to provide specific details about the transaction, such as the Importer of Record (IOR) number and the bill of lading number.

4. Stay Informed: Keeping abreast of the current ISF fee payment processes and any changes in regulations is crucial. Regulations can evolve, so staying informed ensures that importers are well-prepared to fulfill their financial obligations accurately and on time.

5. Plan For Potential Delays: While electronic payments are generally efficient, it’s wise to initiate payment well in advance of the filing deadline. This accounts for any potential technical issues or delays that may arise.

6. Maintain Payment Records: Importers should maintain meticulous records of their ISF fee payments. These records serve as proof of compliance, assist in tracking financial obligations, and can be valuable in resolving any disputes or discrepancies that may arise.

Related: ISF Bond Cost Breakdown & Management For Import Success

Here are the key factors that can affect the amount of Importer Security Filing (ISF) fees

ISF fees typically increase with the number of filings. Each shipment or container generally requires a separate ISF submission, so importers handling multiple shipments may incur higher overall fees. Importers with frequent shipments should track the number of filings to anticipate costs and plan their budgets accordingly.

The nature and complexity of the cargo can affect fees. Shipments containing multiple commodities, high-value goods, or hazardous materials often require more detailed ISF data. Complex shipments may also require additional documentation or verification, which can further increase the service provider’s workload and fees.

The customs broker or third-party provider you use can influence ISF costs. Providers have different pricing models and fee structures, which can include flat fees, per-filing fees, or additional charges for complex shipments. Some brokers offer bundled services that include ISF filing along with other compliance support, which can sometimes lower overall costs.

Submitting ISF filings on time is critical. Late filings or non-compliance with U.S. Customs and Border Protection (CBP) requirements can result in penalties, which increase the total cost. Maintaining a compliance checklist and setting reminders for deadlines can help importers avoid penalties and unexpected fees.

Accurate and complete ISF data is essential. Errors or missing information may require corrections or resubmissions, which can add to the total fees. Regularly reviewing data before submission and using automated validation tools can minimize mistakes and reduce potential additional costs.

Related: Late ISF Filing: What To Do If Missed The Deadline?

Many importers often confuse ISF filing costs with ISF fees, but the two are distinct. ISF fees are the charges associated with complying with U.S. Customs and Border Protection (CBP) requirements for Importer Security Filings. These fees are set by CBP regulations and can include penalties for late or inaccurate filings.

On the other hand, ISF filing costs refer to the amount you pay to a customs broker or third-party service provider for preparing and submitting your ISF. These costs vary depending on the complexity of your shipment, the number of filings, and the pricing structure of the service provider.

In simple terms, ISF fees are mandatory government-related charges, while ISF filing costs are service fees charged by brokers to handle the paperwork. Understanding this difference helps importers budget more accurately and avoid surprises when managing international shipments.

Related: ISF Declaration: Meaning, Purpose, Timeline, & Process

Managing ISF fees effectively can help importers save money while staying compliant with U.S. Customs and Border Protection (CBP) regulations. Implementing practical strategies for accurate filing, timely submissions, and efficient data management can significantly reduce costs.

Related: ISF Filing: A Compliance-Related Guide & Software Solution

Artemus emerges as the premier ISF (Importer Security Filing) software solution, offering an all-encompassing answer to compliance needs in international trade. Its user-friendly interface, robust features, and seamless integration with customs processes make it a standout choice for importers seeking efficient and accurate ISF submissions

Artemus simplifies data entry, validation, and transmission, reducing the risk of errors and late filing penalties. With Artemus, compliance is not just a goal; it’s a guarantee, ensuring a smooth and cost-effective importation process.

Related: When Does ISF Need To Be Filed? Know The Deadline

The information needed for ISF (Importer Security Filing) includes details about the shipper, consignee, cargo description, and more.

Failure to file ISF (Importer Security Filing) can result in penalties, delays, and cargo holds by customs authorities.

An ISF info sheet typically contains essential details about the shipment, including cargo descriptions, parties involved, and shipment particulars, to facilitate the ISF filing process.

The purpose of ISF filing is to provide U.S. Customs and Border Protection (CBP) with advance information about imported cargo. This helps CBP identify high-risk shipments, enhance supply chain security, and prevent illegal or unsafe goods from entering the United States.

In conclusion, navigating the realm of Importer Security Filing (ISF) fees is not merely a financial obligation but a critical aspect of ensuring the integrity, security, and efficiency of international trade. The intricate dance of compliance, timely submissions, and accurate payments are fundamental to the seamless flow of goods across borders.

ISF fees, encompassing processing fees, penalty fees, consultation fees, government fees, service fees, and amendment fees, represent more than just monetary transactions. They embody a commitment to collaboration between importers, customs brokers, and regulatory authorities to fortify the global supply chain.

The timely payment of ISF fees is a strategic move, ensuring not only compliance with U.S. Customs and Border Protection regulations but also the prevention of costly delays, penalties, and potential disruptions to the supply chain.

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.