What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

Importer Security Filing (ISF-5) is a mandatory requirement for all cargo shipments arriving in the US by ocean vessel, and it provides information to the CBP (Customs & Border Protection) about the security risks of the cargo. Incorrect or omitted ISF filing may cause cargo delays, penalties, and potential seizure.

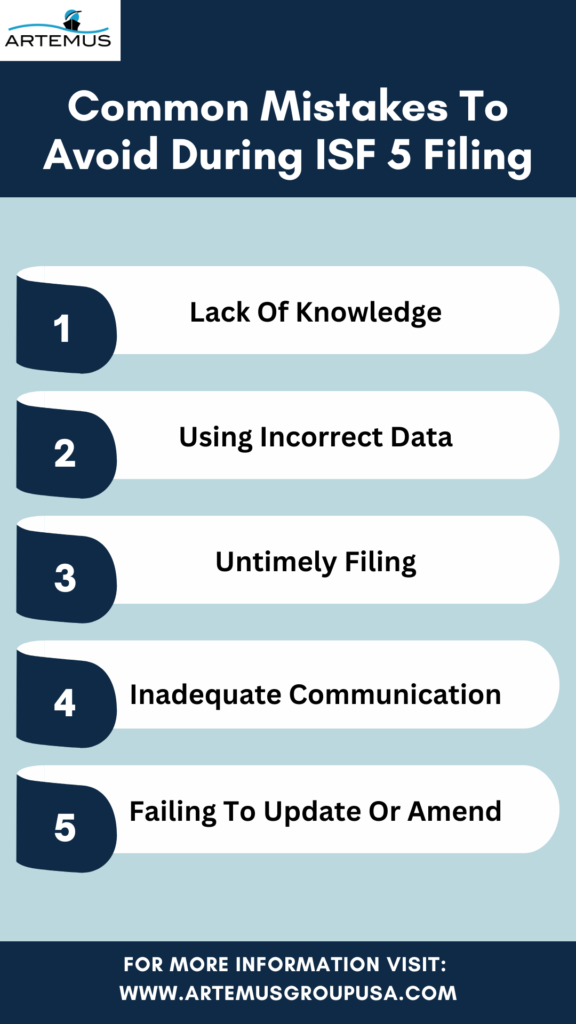

To avoid these common pitfalls, importers can follow some best practices when filing ISF, such as understanding the requirements, using reliable ISF software, effective communication, timely filing, and reviewing and amending the filings

Artemus Transportation Solutions stands out as a reliable partner in the complex world of international trade logistics, offering an ISF software solution to streamline the ISF process, including data validation, integration, and reporting. By leveraging the latest technology-driven software, importers can ensure accurate and timely ISF filing, ultimately enhancing their import operations and compliance with CBP regulations.

Table Of Contents

ISF-5, or Importer Security Filing 5, is a U.S. Customs and Border Protection (CBP) regulation that requires importers or their agents and vessels to file data electronically with CBP for ocean shipments entering the United States via vessel.

It only applies to vessel cargo arriving in the U.S. and requires only 5 data elements for FROB (Foreign cargo Remaining On Board), I.E. (Immediate Export), and T&E (Transportation and Exportation) cargo.

The required data elements for ISF-5 include the manufacturer/supplier, seller, ship-to party, container stuffing location, and consolidator. Failure to comply with ISF-5 regulations can result in penalties and fines of up to $5,000 per violation

Related: ISF Fees (Import Security Filing): When & How To Pay?

In the ever-evolving landscape of international trade, maintaining the security and integrity of the supply chain is of paramount importance. The U.S. Customs and Border Protection (CBP) addresses this concern through the Import Security Filing (ISF) program, a crucial component of the Customs-Trade Partnership Against Terrorism (C-TPAT). In this exploration, we delve into the key ISF requirements and the critical aspects of compliance.

To ensure effective risk assessment and supply chain security, ISF filing requires the submission of specific data elements. This encompasses, among other things:

Importers are required to submit the ISF data to CBP no later than 24 hours before the goods are loaded onto the vessel at the foreign port. This advance notice allows CBP to assess potential risks and take preventive measures.

ISF 5 is a distinct filing for cargo transiting through the United States to a foreign destination. It demands information on the carrier, consolidator, and the planned voyage, providing CBP with critical details for security assessment.

Related: ISF Late Filing Fee: Exact Cost & 6 Tips To Manage Appeals

Importers bear the primary responsibility for ensuring ISF compliance. This includes not only providing accurate and timely information but also maintaining a robust internal process to manage ISF filings for all relevant shipments.

While ISF compliance is mandatory for most shipments, certain exemptions exist. These exemptions may be based on the nature of the cargo, the shipping mode, or specific trade programs. Importers must understand and correctly apply these exemptions.

Importers often engage customs brokers to facilitate the ISF filing process. Working closely with experienced customs brokers can help navigate the complexities of ISF compliance, ensuring accuracy and timeliness in submissions.

CBP places a high premium on data accuracy. Errors or omissions in ISF filings can result in penalties, cargo delays, or even the refusal of entry. Importers must invest in systems and processes that enhance the accuracy of the submitted information.

Related: ISF Bond Cost Breakdown & Management For Import Success

In this guide, we’ll explore five critical mistakes to avoid during ISF-5 filing, shedding light on key considerations for a successful and compliant submission process.

Related: When Does ISF Need To Be Filed? Know The Deadline

Non-compliance with ISF-5 (Importer Security Filing) can have serious repercussions in international trade. Understanding the consequences is crucial for importers to navigate the complexities of filing. Here are ten key points outlining the potential fallout of failing to adhere to ISF-5 requirements:

Related: ISF Filing Process: A Detailed Step-By-Step Guide

Ensuring accurate and timely ISF filing not only facilitates the seamless movement of goods but also safeguards against potential disruptions and penalties. In this exploration, we uncover a set of best practices that importers can adopt to master the art of ISF filing and enhance their overall supply chain resilience.

Initiating the ISF filing process well in advance of the 24-hour deadline is a fundamental best practice. Early filing allows for a buffer to address potential issues or corrections, reducing the risk of delayed submissions. Consistently adhering to filing deadlines ensures compliance with regulatory requirements and helps avoid penalties.

Accuracy is the bedrock of successful ISF filing. Importers must meticulously verify and provide all required data elements, including buyer and seller information, commodity codes, and container details. Regularly updating and validating data not only reduces the likelihood of errors but also contributes to efficient risk assessment by customs authorities.

Establishing clear lines of communication within the organization is essential for effective ISF filing. Importers should foster collaboration between various departments involved in the import process, including logistics, compliance, and finance. A well-coordinated internal approach ensures that all stakeholders are aligned with ISF requirements and timelines.

Embracing advanced technology, such as specialized ISF software solutions like those offered by Artemus Transportation Solutions, can significantly enhance the efficiency of the filing process. Automation not only reduces manual errors but also streamlines the submission of accurate and timely information to customs authorities.

The landscape of international trade is dynamic, with regulations evolving over time. Importers must invest in ongoing training and education for their teams to stay abreast of changes in ISF requirements. Well-informed staff can adapt to new regulations swiftly, ensuring a proactive and compliant approach.

Collaborating with experienced customs brokers is a strategic best practice. Customs brokers bring a wealth of expertise in navigating regulatory landscapes and can provide valuable insights into compliance nuances. Working in tandem with customs brokers enhances the overall efficiency and accuracy of the ISF filing process.

Related: Who Is Responsible For Filing The ISF? Know The Key Roles

Artemus is a leading ISF software solution that offers importers a comprehensive platform for efficient and compliant ISF filing. With a focus on import success, Artemus provides a range of features to streamline the ISF process, including data validation, integration, and reporting.

The software’s user-friendly interface and robust functionality make it a trusted choice for importers seeking top-notch AMS (Automated Manifest System) and ISF solutions. By leveraging Artemus, importers can ensure accurate and timely ISF filing, ultimately enhancing their import operations and compliance with CBP regulations.

Related: What Is ISF Bond? Types, Cost, & Components To Know

The ISF-5 data elements include the booking party, foreign port of unlading, place of delivery, ship to party, and commodity HTS # (6-digit level).

The timeline for ISF-5 filing is 24 hours before the loading of the vessel destined for the United States.

The ISF-5 rule is a U.S. Customs and Border Protection regulation that mandates importers or their agents to file data/information electronically regarding their cargo being imported into the US, with a focus on securing the supply chain and preventing terrorist activities.

As we conclude our exploration into the intricacies of ISF 5 filing, it becomes evident that compliance is not merely a checkbox but a strategic imperative for importers navigating the international supply chain. The seamless movement of goods hinges on the accuracy and timeliness of data submitted through ISF 5 filings, making it a linchpin for success.

ISF 5, tailored for cargo transiting through the United States to foreign destinations, demands a nuanced understanding of specific data elements, deadlines, and compliance nuances. From carrier information to container details, each piece of information plays a vital role in the secure and efficient journey of shipments. Importers must embrace best practices, from early filing and data accuracy to leveraging technology and fostering internal collaboration, to navigate the complexities of compliance successfully.

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.