What Does Norway Export To The US? Key Products & Trade Data

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Navigating the intricacies of international trade requires meticulous attention to detail, especially when it comes to customs regulations.

At the forefront of this regulatory landscape stands the Importer Security Filing (ISF) – a mandatory document required by U.S. Customs and Border Protection (CBP) for all ocean shipments arriving in the United States.

Designed to enhance cargo security and streamline customs clearance processes, the ISF demands accurate and timely submission of key information about imported goods.

In this dynamic environment, Artemus Transportation Solutions offers an innovative ISF software solution tailored to ensure seamless compliance for importers. Join us as we delve into the nuances of the ISF Form and explore how Artemus Transportation Solutions empowers importers to thrive in the world of international trade compliance.

Table Of Contents

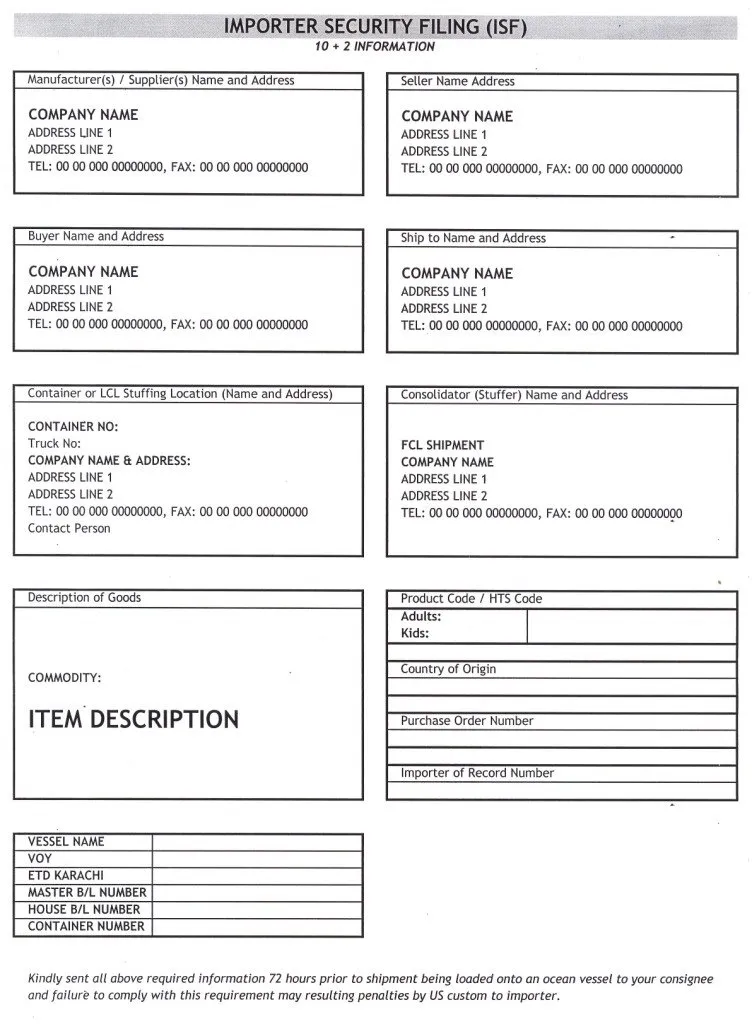

An ISF form, or Importer Security Filing, is a mandatory document required by U.S. Customs and Border Protection (CBP) for ocean shipments entering the United States. Often called the “10+2 filing,” it provides key details about the cargo, such as the shipper, consignee, importer of record, manufacturer, and the goods being shipped. The ISF must be submitted electronically before the vessel departs from the origin port.

Filing the ISF accurately and on time helps CBP assess security risks, prevent smuggling, and ensure smooth cargo clearance at U.S. ports. Failure to file, late submission, or incorrect information can lead to costly fines, shipment delays, and holds at customs. For importers, understanding the ISF process is essential to staying compliant, avoiding penalties, and keeping supply chains running without disruptions.

It’s worth noting that ISF requirements do not apply to bulk cargo. However, for break bulk cargo that is exempt from the 24-hour prior to lading rule, the Importer Security Filing must still be submitted 24 hours before the cargo arrives in the United States.

Related: What Does ISF Stand For In Shipping? The 10+2 Rule Explained

The Importer Security Filing (ISF), or “10+2” rule, is a mandatory requirement by the U.S. Customs and Border Protection (CBP) for all ocean-bound cargo shipments to the United States. Filing an ISF ensures timely submission of critical data, improves cargo security, and helps avoid delays or penalties.

Each component of the ISF form provides specific information that CBP uses to assess risk and facilitate the safe entry of goods. Below are the key components of the ISF form that every importer must report accurately:

This is the identification number of the party responsible for the goods entering the U.S., typically the importer. It ensures CBP can link the shipment to the correct legal entity and hold the right party accountable for duties, fees, and compliance. Accurate reporting is critical to avoid fines.

The consignee is the party receiving the shipment in the United States. Their IRS number, Social Security Number, or CBP-assigned number must be provided to establish clear responsibility for the cargo once it arrives. This helps CBP verify legal ownership and facilitates customs clearance.

The seller is the entity that sells the goods to the importer. Including the seller’s name and address provides CBP with a clear record of the transaction chain, ensuring traceability of the shipment from its origin. This information also assists in verifying the commercial legitimacy of the shipment.

The buyer is the entity purchasing the goods from the seller. Including the buyer’s details helps CBP track the intended recipient and supports risk assessment for inbound cargo. It also ensures proper documentation if any issues arise during the import process.

The manufacturer is the entity that produces or supplies the goods. CBP requires the manufacturer’s name and address to identify where the products were made, which is essential for security screening and compliance with trade regulations. This also helps in verifying the country of origin for duty purposes.

The “ship to” party is the location in the U.S. where the goods will be delivered. Including the full address ensures CBP and the carrier know the final destination, which is critical for logistics planning and risk assessment. Accurate information reduces the chance of misrouting or delivery delays.

This indicates where the goods were manufactured, produced, or grown. CBP uses this information to enforce trade laws, determine duty rates, and apply any applicable import restrictions. Correctly stating the country of origin prevents compliance issues and potential fines.

The Harmonized Tariff Schedule of the United States (HTSUS) number classifies the goods being imported. Providing the correct 6-digit code allows CBP to assess duties, taxes, and eligibility for any trade programs or restrictions. Misclassification can result in penalties or shipment delays.

This is the physical location where the cargo is loaded into the container. CBP needs this to track the container’s origin and inspect the loading process if necessary. Accurate reporting helps maintain security and ensures accountability for the shipment’s contents.

The consolidator or stuffer is the party responsible for loading or arranging cargo in the container. CBP requires this information to track who managed the container’s assembly, which is important for security verification and risk assessment. This component also clarifies responsibility if any discrepancies occur.

The stow plan details how containers are arranged on the vessel. CBP uses this to monitor potential risks, including hazardous materials or shipment integrity, during transit. Proper stow planning also assists carriers in optimizing vessel space and maintaining cargo safety.

CSMs provide real-time updates on the location and movement of the container. CBP relies on these messages to track shipments, detect anomalies, and improve overall port security. Regular monitoring helps prevent theft, misplacement, or delays during transportation.

Submitting all these components accurately and on time is essential for smooth customs clearance, compliance with U.S. regulations, and avoiding penalties for late or incorrect filings.

Related: ISF Fees (Import Security Filing): When & How To Pay?

Filing the Importer Security Filing (ISF) Form, also known as the 10+2 filing, is a crucial step for importers and other parties involved in international trade to comply with U.S. Customs and Border Protection (CBP) regulations and facilitate the smooth clearance of ocean shipments entering the United States. Understanding the process of filing the ISF Form is essential for ensuring accuracy, timeliness, and compliance with CBP requirements.

Before initiating the ISF filing process, gather all necessary information required for completing the form. This includes details such as the manufacturer and supplier information, buyer and consignee details, container stuffing location, Harmonized Tariff Schedule (HTS) codes for each product, and other pertinent shipment-related information.

Determine the method of filing that best suits your needs and capabilities. ISF filings must be submitted electronically through the Automated Broker Interface (ABI) system within CBP’s Automated Commercial Environment (ACE). You can file directly using ACE-compatible software, such as the solution offered by Artemus, or rely on a licensed customs broker or freight forwarder to handle the process on your behalf.

Artemus provides a reliable ISF software solution that integrates with ACE, simplifies filing, automates data checks, and helps importers stay fully compliant with CBP requirements.

If filing electronically through ABI or a CBP-approved software vendor, obtain a filer code from CBP. This unique identifier is necessary for accessing the CBP system and submitting ISF filings. Ensure that your filer code is up-to-date and properly activated before initiating the filing process.

Using the gathered information, complete the ISF Form accurately and thoroughly. Input all required data fields, including but not limited to manufacturer and supplier details, buyer and consignee information, country of origin, container stuffing location, consolidator details, HTS codes, and bill of lading numbers.

Before submitting the ISF Form, thoroughly review and validate all entered information for accuracy and completeness. Ensure that all data fields are correctly populated and comply with CBP requirements to avoid potential errors or discrepancies that could lead to penalties or delays in customs clearance.

Once the ISF Form is complete and validated, submit the filing through the selected method. If filing electronically, follow the instructions provided by the chosen filing platform or software vendor to transmit the ISF data to CBP securely. Double-check that the filing has been successfully submitted and received by CBP.

After submitting the ISF filing, monitor the status of the filing and any responses or messages received from CBP. Be proactive in addressing any issues or requests for additional information promptly to ensure timely resolution and compliance with CBP regulations.

Keep detailed records of all ISF filings, including confirmation receipts, responses from CBP, and any related documentation. Maintain these records in an organized manner for future reference, and audit purposes, and to demonstrate compliance with CBP requirements.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

Achieving ISF compliance is critical for importers, but it comes with strict deadlines and detailed data requirements. Understanding the most common challenges and applying proven best practices can help importers avoid costly mistakes and keep shipments moving smoothly.

Related: ISF Bond Cost Breakdown & Management For Import Success

Artemus Transportation Solutions offers an advanced ISF software designed to make U.S. Customs and Border Protection (CBP) compliance simple and efficient. Importers can quickly file Importer Security Filings (ISF) with accuracy, reducing the risk of errors, penalties, and shipment delays.

The platform streamlines the filing process with automated data validation, real-time status updates, and user-friendly tools that help importers stay ahead of compliance requirements. By eliminating manual steps and improving visibility, it allows businesses to proactively resolve issues before they affect cargo clearance.

With Artemus ISF software, importers gain confidence in meeting strict CBP regulations, while also improving supply chain performance. The solution helps companies save time, minimize risk, and stay focused on their core operations.

Related: ISF Filing Online: A Guide To Your Import Process

The importer of record (IOR) is primarily responsible for filing the ISF (Importer Security Filing) to U.S. Customs and Border Protection (CBP) for every ocean-bound shipment arriving in the United States.

The full form of ISF is “Importer Security Filing,” a mandatory document required by U.S. Customs and Border Protection (CBP) for overseeing ocean shipments as they enter the United States.

If an ISF is not filed, U.S. Customs and Border Protection may issue fines of up to $10,000. The cargo can also be held or refused entry, causing significant delays and added costs.

Yes, importers can file an ISF directly through the Automated Broker Interface (ABI) system. However, most choose to use a licensed customs broker to reduce the risk of errors.

If an ISF is filed after the 24-hour deadline, it is considered late. Late filings can result in fines, shipment holds, and clearance delays.

The Importer Security Filing (ISF) serves as a critical component of the international trade process, ensuring the security and efficiency of ocean shipments entering the United States. By providing advance information about imported goods to U.S. Customs and Border Protection (CBP), the ISF helps enhance cargo security, facilitate customs clearance processes, and mitigate potential risks to the supply chain.

Importers play a crucial role in complying with ISF requirements, as timely and accurate filing is essential to avoid penalties, delays, and disruptions to business operations. Embracing best practices for ISF compliance, staying informed about regulatory updates, and leveraging technology solutions can empower importers to navigate the complexities of customs regulations effectively.

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.