Japan Imports And Exports 2024: Top Products & Their Impact

Japan’s trade system is central to its economy, with imports like raw materials and food supporting its industries and population.

Customs clearance delays can halt shipments, disrupt supply chains, and lead to unexpected costs. Understanding what causes these setbacks and how to prevent them is crucial for maintaining smooth operations and ensuring timely delivery.

In this blog, we’ll delve into the common reasons behind customs clearance delays, explore strategies to avoid them, and provide insights on how to effectively manage any issues that arise.

Artemus offers comprehensive software solutions that streamline the ISF and AMS filing processes. The platform automates these critical filings, ensuring accuracy and compliance with U.S. Customs and Border Protection (CBP) regulations. By leveraging Artemus’s technology, businesses & importers can reduce the risk of customs delays, minimize errors, & enhance the efficiency of their shipping operations.

Table Of Contents

A customs clearance delay occurs when a shipment is held up at the border due to issues with the required documentation, compliance with regulations, or additional inspections. This delay can be triggered by a variety of factors, such as incomplete paperwork, discrepancies in declared values, or failure to meet specific import/export requirements.

When a shipment is delayed, it means that goods cannot be released for delivery until the issues are resolved, which can impact the supply chain and lead to increased costs.

Understanding and addressing the root causes of customs clearance delays is crucial for businesses to minimize disruptions. Ensuring that all documentation is accurate, complete, and compliant with customs regulations can significantly reduce the risk of delays.

Effective communication with customs authorities and prompt resolution of any issues can help expedite the clearance process and ensure that shipments reach their destination in a timely manner.

Related: What Happens After Custom Clearance Completed? 9 Next Steps

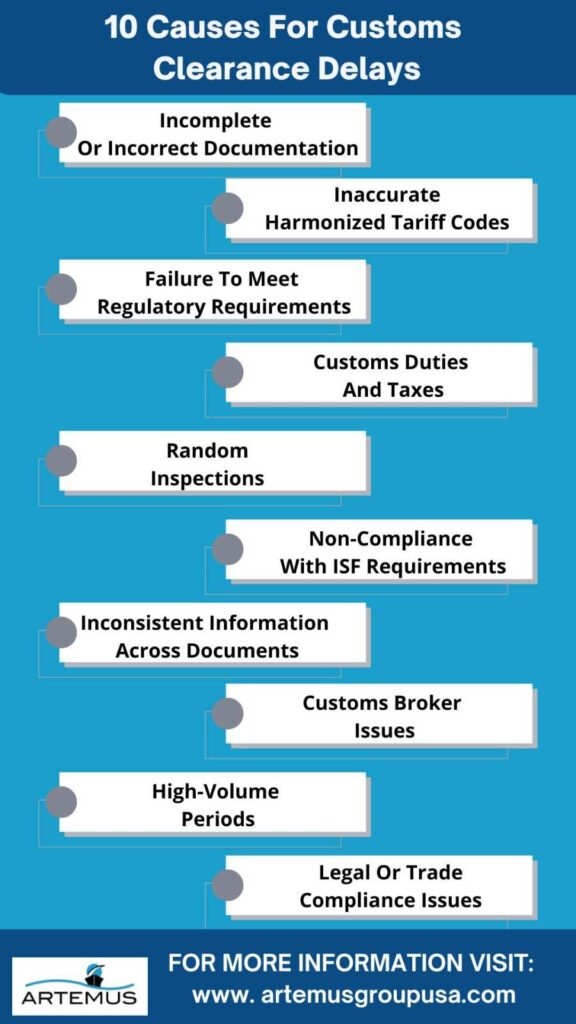

Customs clearance delays can be a significant obstacle for international trade, impacting the timely delivery of goods and adding to operational costs. Understanding the common causes of these delays can help businesses navigate the complexities of customs processes more effectively.

Below are ten frequent causes of customs clearance delays, each highlighting a potential issue that could disrupt the smooth flow of goods through customs.

1. Incomplete Or Incorrect Documentation

One of the most frequent causes of customs delays is the submission of incomplete or inaccurate documentation. Missing or incorrect information on documents like the bill of lading, commercial invoice, or packing list can halt the clearance process.

2. Inaccurate Harmonized Tariff Codes

Incorrectly classified goods or mismatched Harmonized System (HS) codes can lead to delays. Customs authorities rely on these codes to determine the applicable duties and regulations, and any discrepancies can cause processing delays.

3. Failure to Meet Regulatory Requirements

Each country has specific regulatory requirements for certain types of goods. Failure to comply with these regulations, such as obtaining necessary permits or licenses, can result in delays.

4. Customs Duties And Taxes

Delays often occur when there are issues with the payment of customs duties and taxes. If there are discrepancies in the declared value or if payments are not made promptly, customs clearance can be stalled.

5. Random Inspections

Customs authorities may select shipments for random inspections. These inspections, although random, can cause delays if they uncover issues that need further investigation or documentation.

6. Non-Compliance With ISF Requirements

For imports into the USA, failure to comply with Importer Security Filing (ISF) requirements can lead to delays. The ISF requires detailed information about the cargo before it arrives in the U.S., and missing or late filings can hold up the clearance process.

7. Inconsistent Information Across Documents

Inconsistencies between various documents (e.g., the commercial invoice versus the packing list) can lead to delays. Customs officers need to verify that all documentation is aligned and accurate.

8. Customs Broker Issues

Problems with the customs broker, such as lack of responsiveness or errors in filing, can also contribute to delays. A customs broker plays a crucial role in ensuring smooth clearance, and any issues here can have a ripple effect.

9. High-Volume Periods

During peak seasons or high-volume periods, such as holidays or major sales events, customs processing can slow down due to the sheer volume of shipments being handled.

10. Legal Or Trade Compliance Issues

Any issues related to legal or trade compliance, such as sanctions or trade restrictions, can cause delays. Customs authorities need to ensure that goods meet all legal requirements before they can be cleared.

Related: What Does Customs Clearance Completed Mean? Key Takeaways

Customs clearance delays can be a significant bottleneck in the logistics and supply chain process, affecting everything from delivery timelines to customer satisfaction. To help you navigate and prevent these delays, we’ve compiled five practical tips and solutions that can make a substantial difference in ensuring your shipments clear customs smoothly and efficiently.

Proper and thorough documentation is essential for ensuring a seamless customs clearance process.

Tip: Double-check all forms for errors or omissions before submission. Discrepancies or missing information can lead to delays as customs officials may need to request additional information or clarification.

Each country has specific customs regulations and import requirements. Staying informed about these regulations is essential:

Tip: Regularly review changes in customs regulations and compliance requirements. Using a customs broker or compliance software can help streamline this process and keep you updated.

Random inspections by customs can delay clearance if not properly prepared. To minimize delays:

Tip: Have a checklist for inspection readiness and maintain good communication with your shipping partners to address any issues promptly.

Partnering with experienced freight forwarders and customs brokers can greatly reduce the risk of delays. They offer expertise in:

Tip: Choose partners with a strong track record and good reputation. Their expertise can help you anticipate and resolve potential issues before they impact your shipment.

Investing in technology can streamline customs clearance and help you manage potential delays:

Tip: Integrate tracking and management systems with your existing logistics processes to ensure seamless operations and quick response to any issues that arise.

Related: Custom Clearance Charges & Fees: A Complete Guide

Artemus offers a state-of-the-art solution for ISF (Importer Security Filing) and AMS (Automated Manifest System) compliance, streamlining the complex process of customs documentation. Our software automates the submission of critical data, ensuring accurate and timely filings with U.S. Customs and Border Protection (CBP).

By integrating seamlessly with your existing systems, Artemus simplifies compliance, minimizes delays, and helps you avoid costly penalties, making international trade more efficient and secure.

Related: How Long Does Customs Clearance Take? Key Takeaways

Customs clearance delays can result from incomplete or incorrect documentation, additional inspections, or high volumes of shipments, all of which can slow down the processing time.

Your parcel may be delayed at customs due to incomplete or inaccurate documentation, additional inspections, or compliance checks. Issues such as discrepancies in declared values, missing information, or customs backlogs can also cause delays.

Customs clearance can take anywhere from a few hours to several days, depending on factors such as the complexity of the shipment, the accuracy of documentation, and the volume of cargo being processed.

Customs clearance can take anywhere from a few hours to several days, depending on factors like the complexity of the shipment, the completeness of the documentation, and whether additional inspections or audits are required.

Customs clearance delays can significantly impact supply chains and business operations, often caused by incomplete documentation, regulatory changes, or increased scrutiny. To mitigate these delays, it is crucial for businesses to ensure all paperwork is accurate and complete, stay informed about current regulations, and work closely with experienced customs brokers.

By proactively addressing these factors, companies can reduce the risk of delays and ensure smoother, more efficient international trade operations.

Japan’s trade system is central to its economy, with imports like raw materials and food supporting its industries and population.

Exporting cars from the USA involves complying with legal and customs regulations. It requires proper documentation, including title and registration,

The United States exports a wide range of products to China, making it one of the largest trading relationships globally.

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.