What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Today, we dive into the world of international shipping and focus on a crucial aspect: AMS filing requirements. When it comes to importing goods, compliance with customs regulations is essential for a smooth and efficient process. One key component of this compliance is the Automated Manifest System (AMS) filing. In this article, we will explore what AMS filing entails, why it is important, and the implications of not fulfilling the requirements.

Whether you are an importer, exporter, or simply curious about the logistics behind global trade, this blog post will provide valuable insights into AMS filing and its significance in international shipping operations. So, let’s embark on this informative journey and uncover the essentials of AMS filing requirements.

Artemus provides a comprehensive software solution that assists businesses in achieving AMS compliance and streamlining their international shipping operations.

Table Of Contents

AMS (Automated Manifest System) filing involves several key components that are essential for accurate and efficient shipment documentation. These components include the Bill of Lading (B/L), Entry Summary, and Importer Security Filing (ISF).

Related: Who Is Responsible For AMS Filing? Know All Parties Involved

AMS (Automated Manifest System) filing requirements are important for importers to comply with to facilitate the smooth movement of goods through customs. Importers must adhere to specific guidelines and provide accurate information to ensure compliance and avoid delays or penalties. Here are some key AMS filing requirements for importers:

Importers need to submit the AMS filing within specific timelines, typically 24 hours prior to the vessel’s departure from the foreign port. Timely submission is crucial to ensure customs authorities have the necessary information to process the shipment.

Importers must provide essential details about the shipment, including the consignee’s information, a detailed description of goods, value, quantity, weight, and other relevant data. This information helps customs authorities assess duties, taxes, and potential risks associated with imported goods. The required documentation may include:

Importers have various options to transmit their AMS filings, including through the Automated Broker Interface (ABI), Electronic Data Interchange (EDI), or using approved third-party software. Choosing the appropriate transmission method is crucial to ensure accurate and timely submission.

Complying with AMS filing requirements is vital for importers to facilitate efficient customs clearance processes, minimize shipment delays, and maintain regulatory compliance. By providing accurate and timely information, importers can ensure the smooth flow of goods through the supply chain and avoid unnecessary complications.

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

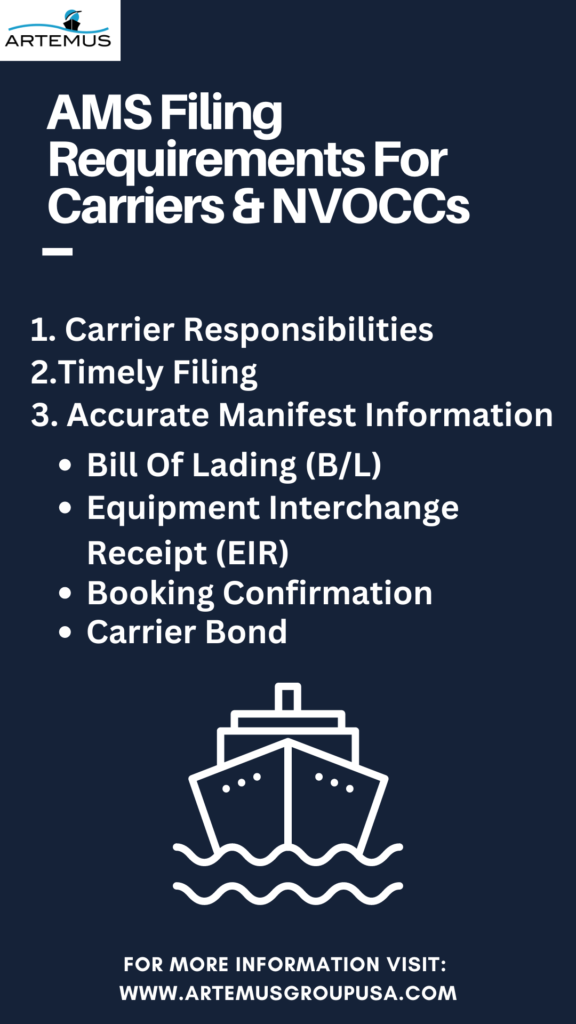

AMS (Automated Manifest System) filing requirements are not limited to importers alone but also extend to carriers and Non-Vessel Operating Common Carriers (NVOCCs). These entities play a crucial role in the transportation and movement of goods and must comply with specific AMS filing requirements. Here are the key aspects of AMS filing requirements for carriers and NVOCCs:

Carriers are responsible for filing the AMS manifest, which includes detailed information about the cargo being transported. This information includes the shipper’s and consignee’s details, description of the goods, and voyage information.

Carriers and NVOCCs must ensure that the AMS manifest is filed in a timely manner. The filing should be done at least 24 hours before the vessel’s departure from the foreign port. Timely submission is crucial to allow customs authorities to review and process the information accurately.

Carriers and NVOCCs must provide accurate and complete manifest information. This includes the description of the goods, their quantity, weight, packaging, and any applicable identification numbers such as container numbers or seal numbers. The information should be consistent with the corresponding bills of lading and other relevant documentation.

Carriers are required to have a carrier bond in place, which serves as a financial guarantee to ensure compliance with customs regulations. The bond helps cover any potential penalties or fines for non-compliance with AMS filing requirements.

Complying with AMS filing requirements is essential for carriers and NVOCCs to facilitate the smooth movement of goods through customs and maintain regulatory compliance.

Related: Ocean AMS Filing Requirements: 7 Must-Have Documents

AMS (Automated Manifest System) filing plays a critical role in ensuring efficient and compliant shipping operations. However, there are certain challenges and considerations that importers, carriers, and NVOCCs need to be aware of when it comes to AMS filing. Here are some important points to consider:

Overcoming these challenges and considerations requires a proactive approach, attention to detail, and the use of reliable AMS software solutions or the assistance of experienced customs brokers or trade compliance professionals.

Related: AMS Fee In Shipping: Overview & 5 Key Considerations

Artemus offers the best AMS (Automated Manifest System) software solution to streamline your shipping operations. Our powerful and intuitive software is designed to simplify the AMS filing process, ensuring accuracy, compliance, and efficiency.

With Artemus’ best AMS software solution, you can automate data entry, eliminating manual errors and reducing time-consuming tasks. Our system integrates seamlessly with other shipping platforms, allowing for seamless data exchange and real-time updates. You can track and manage your shipments, generate comprehensive reports, and easily access historical data for analysis and decision-making.

By leveraging Artemus’ AMS software solution, you can optimize your shipping operations, increase productivity, and enhance customer satisfaction. Our user-friendly interface and robust features make AMS filing a seamless experience, empowering you to focus on core business activities while ensuring regulatory compliance.

Related: AMS Filing Penalty Cost: Most Common Pitfalls & Solutions

Importers, carriers, and non-vessel operating common carriers (NVOCCs) are required to file AMS (Automated Manifest System) to comply with U.S. Customs and Border Protection (CBP) regulations and provide electronic manifest information for shipments entering or exiting the United States.

If AMS (Automated Manifest System) is not filed, the shipment may be delayed or refused entry by customs.

AMS (Automated Manifest System) filling is used to provide detailed information about the cargo being imported, while ISF (Importer Security Filing) filing is focused on security-related data and is required before the shipment departs from the origin country.

AMS filing requirements play a vital role in the smooth execution of international shipping operations. By providing detailed and accurate information about the cargo being imported, AMS filing helps customs authorities ensure compliance, enhance security and facilitate the flow of goods across borders. Non-compliance with AMS filing requirements can result in delays, penalties, or even refusal of entry by customs.

Therefore, it is essential for importers and exporters to understand and adhere to AMS filing obligations to maintain a seamless and efficient supply chain. By staying informed and proactive in meeting these requirements, businesses can navigate the complexities of global trade with confidence and minimize any potential disruptions along the way.

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.