What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

When it comes to international trade, customs bonds play a vital role in ensuring seamless cross-border transactions while complying with various regulations. Among the different types of customs bonds, two prominent options stand out: Continuous Bond and Single Entry Bond. Each caters to specific trade needs, and understanding the difference (Continuous Bond vs Single Entry) is crucial for businesses to optimize their customs processes and financial commitments.

In this blog, we delve into the world of Continuous Bonds and Single Entry Bonds, dissecting their unique features and benefits, and shedding light on how these instruments can impact your import and export activities. Join us on this insightful journey as we compare and contrast Continuous Bond vs. Single Entry, empowering you to make informed decisions for your international trade endeavors.

Artemus offers comprehensive transport solutions with its cutting-edge software, providing seamless compliance support for AMS, ISF, and a range of other crucial requirements.

Table Of Contents

Customs bonds are essential financial instruments that play a crucial role in international trade and customs compliance. They act as a guarantee between importers, exporters, and the customs authorities, ensuring that certain obligations and legal requirements are met during the movement of goods across international borders.

In simple terms, a customs bond is a contract between three parties: the principal (importer or exporter), the surety company (bond provider), and the obligee (customs authority). The bond serves as a financial guarantee that the principal will fulfill all customs-related obligations, such as paying duties, taxes, and fees, as well as complying with relevant regulations and laws.

Related: A Quick Guide On Import Security Filing: What Is ISF?

A Continuous Customs Bond is a specialized type of customs bond that ensures seamless and uninterrupted international trade activities for businesses engaged in frequent import and export operations. Unlike Single Entry Bonds, which cover a specific shipment, a Continuous Bond provides ongoing coverage for all imports and exports made by the principal (importer/exporter) for a designated period, usually one year.

The purpose of a Continuous Bond is to guarantee compliance with customs regulations, including the payment of duties, taxes, and fees, as well as adherence to various legal requirements associated with cross-border trade. This financial instrument serves as a pledge from the principal to fulfill their obligations to the customs authorities promptly and accurately.

In simple terms, a Continuous Customs Bond serves as a pledge from the principal to fulfill their obligations and responsibilities when engaging in international trade. For businesses involved in regular and frequent import and export activities, securing a Continuous Customs Bond offers several advantages, such as time efficiency, cost savings, and consistent compliance assurance.

Related: What Is AMS In Shipping Industry? A Beginner’s Guide

A Single Entry Customs Bond, also referred to as a Single Transaction Bond or Per-Entry Bond, is a type of financial guarantee required by customs authorities for individual import or export transactions. Unlike Continuous Customs Bonds, which provide ongoing coverage for a specified period, a Single Entry Bond is specific to a single shipment or trade operation.

The purpose of a Single Entry Customs Bond is to ensure that the principal (importer or exporter) fulfills their customs-related obligations for a particular transaction. These obligations typically include paying import duties, taxes, and fees, as well as complying with relevant customs regulations and laws associated with the specific import or export operation.

Obtaining a Single Entry Customs Bond involves collaborating with a surety company authorized to issue customs bonds. The surety company evaluates the financial credibility of the principal before issuing the bond. Once the specific import or export transaction is completed, and all customs requirements are met, the Single Entry Bond is considered fulfilled, and its obligations are discharged.

Related: ISF Filing Online: A Beginner’s Guide To Your Import Process

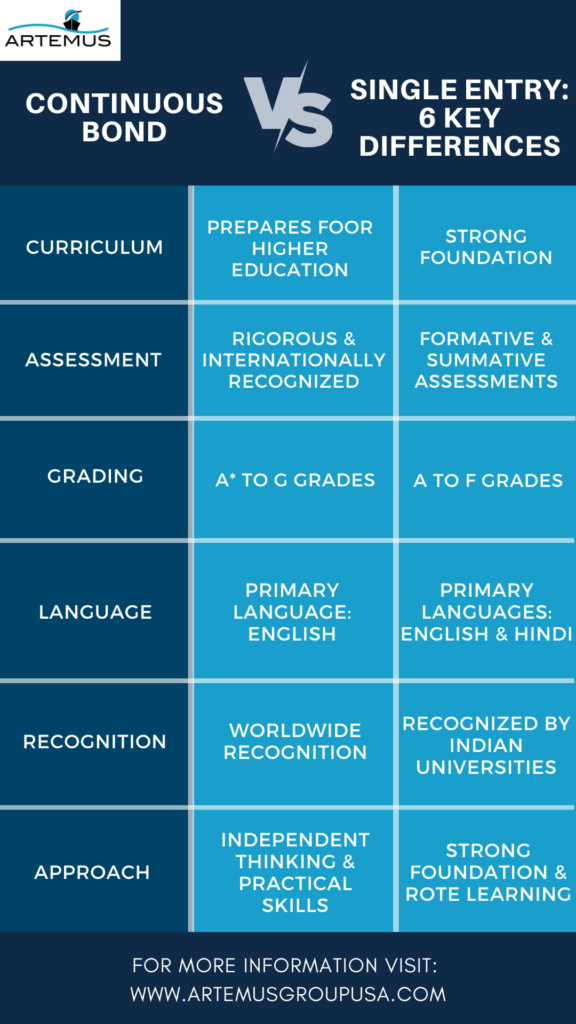

Continuous Customs Bonds and Single Entry Customs Bonds are two distinct types of financial guarantees that businesses can obtain to ensure compliance with customs regulations during international trade. Understanding the key differences between these bonds can help importers and exporters make informed decisions about which option best suits their specific trade needs. Here are the key points of differences:

Continuous Bond: Provides ongoing coverage for all import and export activities conducted by the principal for a specified period, typically one year.

Single Entry Bond: Offers coverage for a single, specific import or export transaction and becomes void once the transaction is completed and customs obligations are met.

Continuous Bond: Remains valid for the agreed-upon period (usually one year) without the need to obtain a new bond for each shipment or trade operation.

Single Entry Bond: Has a short-term validity, applicable only to the particular transaction it is issued for.

Continuous Bond: Suitable for businesses engaged in regular and frequent import and export activities.

Single Entry Bond: Ideal for occasional importers and exporters or those with infrequent shipments.

Continuous Bond: Involves a higher upfront cost compared to a Single Entry Bond due to its extended coverage period.

Single Entry Bond: Generally more cost-effective for businesses with infrequent trade operations since it requires payment for each individual transaction.

Continuous Bond: Provides continuous assurance of compliance with customs regulations throughout the bond’s validity period.

Single Entry Bond: Ensures compliance only for the specific transaction it covers, making it less suitable for businesses with regular trade activities.

Continuous Bond: The bond amount is determined based on the importer’s historical import duties and taxes, financial standing, and other factors.

Single Entry Bond: The bond amount is calculated based on the value of the goods being imported or exported, as well as applicable duties and taxes for the particular transaction.

In conclusion, the choice between Continuous Bond and Single Entry Bond depends on the frequency of international trade activities, budget considerations, and the level of administrative convenience required by the business.

Related: What Does ISF Stand For In Shipping? The 10+2 Rule Explained

Choosing between a Continuous Bond and a Single Entry Bond requires careful consideration of your business’s specific trade needs and frequency of import or export activities. Here are some key factors to help you make an informed decision:

Related: Who Is Responsible For AMS Filing? Know All Parties Involved

The purpose of a Continuous Bond is to provide ongoing coverage for importers and exporters engaged in frequent international trade activities, guaranteeing compliance with customs regulations, and ensuring the timely payment of duties, taxes, and fees for all shipments within the bond’s validity period.

A Single-Entry Bond is a specific customs bond covering a single import or export transaction, ensuring compliance with customs regulations and obligations for that particular shipment only.

A Continuous Bond is typically valid for one year from the date of issuance, providing ongoing coverage for all import and export activities conducted by the principal within that specified period.

In the realm of international trade, the choice between Continuous Bond and Single Entry Bond holds significant implications for businesses aiming to navigate the customs landscape efficiently. Throughout this blog, we’ve explored the key differences between these two customs bonds, shedding light on their unique advantages and suitability for various trade scenarios.

For businesses involved in regular and frequent import or export activities, a Continuous Bond emerges as a powerful tool, providing ongoing coverage and compliance assurance without the hassle of obtaining separate bonds for each shipment. On the other hand, Single Entry Bonds offer flexibility and cost-effectiveness for businesses with sporadic trade engagements.

Related: Ocean AMS Filing Requirements: 7 Must-Have Documents

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.