What Does Norway Export To The US? Key Products & Trade Data

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Custom clearance charges are essential fees incurred during the process of importing or exporting goods across international borders. These charges encompass various expenses levied by customs authorities, including duties, taxes, handling fees, and other regulatory costs.

Efficiently managing customs clearance charges is crucial for businesses engaged in global trade to ensure compliance with customs regulations while minimizing costs and optimizing supply chain operations.

Additionally, Artemus Transportation Solution offers a comprehensive ISF (Importer Security Filing) and AMS (Automated Manifest System) software solution to facilitate seamless customs clearance processes.

With Artemus, businesses can streamline the filing of mandatory documentation, automate data validation, and receive real-time updates, enhancing efficiency and accuracy in customs clearance operations.

Table Of Contents

Custom clearance charges, often referred to simply as clearance charges, are the fees levied by customs authorities for processing the import or export of goods across international borders. These charges are an integral part of the customs clearance process, which involves the verification, assessment, and approval of shipments to ensure compliance with applicable laws and regulations.

At its core, customs clearance is the process through which goods are inspected, documented, and authorized by customs officials before entering or leaving a country. This process is essential for maintaining the integrity of a country’s borders, protecting domestic industries, and ensuring the safety and security of its citizens.

Related: How Long Does Customs Clearance Take? Key Takeaways

Customs clearance fees are charged to cover the administrative and operational costs involved in processing international shipments. Every import or export must go through a series of checks to ensure compliance with customs laws, trade agreements, and security regulations. These steps require time, documentation, and coordination between importers, brokers, and customs officials.

The fee helps compensate for services such as filing import declarations, verifying shipment details, calculating duties and taxes, and ensuring all paperwork meets legal requirements. In most cases, these charges are applied by customs brokers or freight forwarders who handle the clearance process on behalf of the importer.

Ultimately, customs clearance fees ensure that goods can move efficiently across borders while meeting all legal and regulatory standards, helping prevent delays, fines, or shipment holds.

Related: What Does Customs Clearance Completed Mean? Key Takeaways

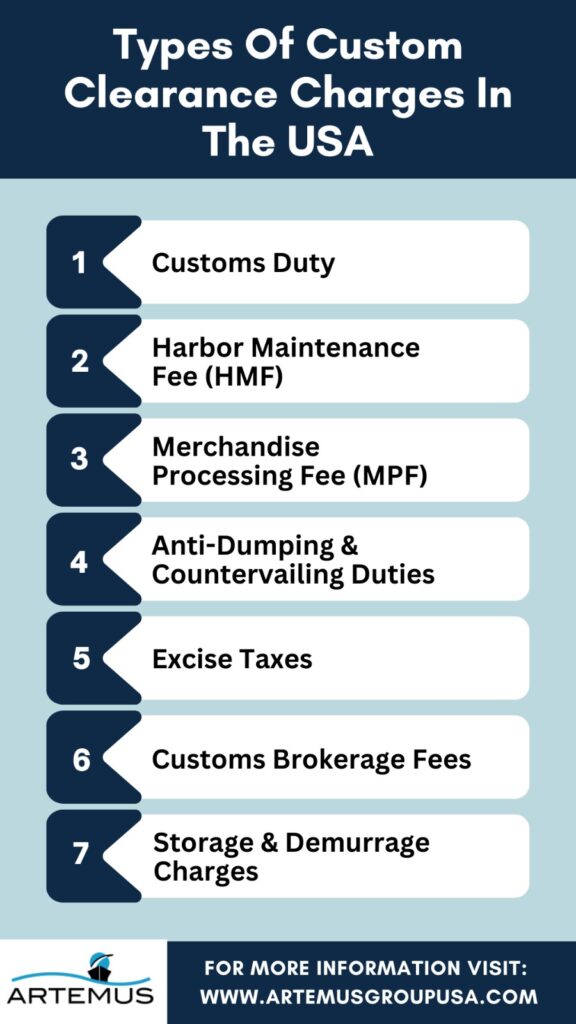

In the United States, customs clearance charges encompass a variety of fees and duties that are applied to imported goods as they undergo the customs clearance process. Understanding the types of customs clearance charges is essential for businesses engaged in international trade to accurately budget for importation costs and ensure compliance with customs regulations. Here are some of the key types of custom clearance charges in the USA:

Customs duty, also known as import duty, is a tax imposed by the U.S. government on imported goods. The duty rate is determined based on factors such as the type of goods, their country of origin, and their value. The Harmonized Tariff Schedule (HTS) categorizes goods into various tariff classifications, each with its duty rate.

The Harbor Maintenance Fee is assessed on imported cargo arriving at U.S. ports to fund the maintenance and operation of port facilities. The fee is calculated based on the value of the imported goods and is typically charged at a rate of 0.125% of the cargo’s value.

The Merchandise Processing Fee is a mandatory fee imposed by U.S. Customs and Border Protection (CBP) on most imported goods entering the United States. The fee is assessed based on the value of the imported merchandise, with a minimum fee and a maximum fee cap. As of 2024, the MPF rate is 0.3464% of the cargo’s value, with a minimum fee of $27.23 and a maximum fee of $528.33 per entry.

In cases where imported goods are determined to be sold in the U.S. at unfairly low prices or subsidized by foreign governments, anti-dumping and countervailing duties may be imposed to level the playing field for domestic industries. These duties are designed to offset the harm caused by unfair trade practices and can significantly increase the cost of imported goods.

Certain goods imported into the United States, such as alcoholic beverages, tobacco products, and motor vehicles, may be subject to excise taxes in addition to customs duty. Excise taxes are imposed on specific goods at the time of importation and are calculated based on factors such as quantity, volume, or weight.

Importers often enlist the services of customs brokers to assist with the customs clearance process. Customs brokers facilitate communication with CBP, ensure compliance with customs regulations, and handle documentation and paperwork on behalf of the importer. Customs brokerage fees vary depending on the services provided and the complexity of the clearance process.

If imported goods are held in storage at a port or warehouse while awaiting customs clearance, storage charges may apply. Demurrage charges may also be incurred if cargo is not picked up from the port within a specified time frame after arrival. These charges can accrue quickly and add to the overall cost of importing goods.

Understanding these types of customs clearance charges is crucial for importers to accurately estimate the total cost of importing goods into the United States and ensure compliance with customs regulations. Importers should work closely with customs brokers and logistics providers to navigate the customs clearance process efficiently and minimize the impact of these charges on their bottom line.

Related: Shipment Has Been Given A Release Status By Customs

Customs clearance costs in the United States depend on several factors that shape how duties, taxes, and fees are calculated. Understanding these factors helps importers estimate total landing costs more accurately and avoid unexpected expenses during clearance. Here are some of the key factors that influence custom clearance charges:

The declared value of imported goods directly impacts customs duties, Merchandise Processing Fees (MPF), and Harbor Maintenance Fees (HMF). U.S. Customs uses the transaction value method based on the price actually paid or payable to assess duties. Under or overvaluation can trigger audits, penalties, or shipment delays.

Certain product categories such as electronics, apparel, or food items face additional inspection or compliance costs. Restricted or regulated goods may require extra documentation or permits from agencies like the FDA, USDA, or EPA, which can increase clearance fees.

Duties vary depending on trade agreements and tariff schedules. Goods imported under Free Trade Agreements like USMCA may qualify for reduced or zero duties, while imports from countries under trade restrictions or tariffs such as China for specific goods often attract higher charges.

Every imported product must be assigned a Harmonized Tariff Schedule (HTS) code. The correct classification determines applicable duty rates and admissibility requirements. Errors in HTS codes can lead to incorrect duty payments and potential customs audits.

U.S. Customs determines the dutiable value of goods using methods like transaction value, computed value, or deductive value. Factors such as royalties, assists, or transportation costs up to the port of import may be included, affecting overall clearance charges.

Air freight, ocean freight, and courier shipments each involve different clearance costs. Incoterms like CIF or FOB define who is responsible for paying duties and handling customs fees. Under DDP (Delivered Duty Paid), the exporter covers all customs charges in the U.S.

Licensed customs brokers handle documentation, filing, and duty payments on behalf of importers. Their fees vary based on shipment complexity, the number of entries, and value-added services such as ISF filing or post-entry adjustments.

Shipments requiring compliance with U.S. government regulations such as safety standards, labeling rules, or import licenses face higher administrative costs. Non-compliance can result in re-inspection, fines, or seizure of goods, adding to overall clearance expenses.

Regular importers often benefit from lower per-shipment costs due to established customs profiles, automated filing, and volume-based brokerage rates. One-time or low-volume importers usually pay higher processing and handling fees.

Programs like the Customs-Trade Partnership Against Terrorism (C-TPAT), Importer Self-Assessment (ISA), and Duty Drawback reduce costs through expedited clearance and duty refunds. Enrolling in these programs can improve compliance ratings and minimize clearance delays.

Related: Customs Compliance Software: Key Benefits & Top Suggestions

Customs clearance fees in the United States are typically the responsibility of the importer of record, the party listed on the shipment as legally responsible for the goods. These fees include duties, taxes, Merchandise Processing Fees (MPF), Harbor Maintenance Fees (HMF), and any costs for inspections or compliance documentation.

The payment of these fees can also depend on the agreed Incoterms between the buyer and seller. Under terms like DDP (Delivered Duty Paid), the exporter covers all customs charges and delivers the goods ready for import. With terms like FOB (Free on Board) or CIF (Cost, Insurance, Freight), the importer assumes responsibility for customs fees once the goods arrive in the U.S.

Using a licensed customs broker is common to manage these payments. Brokers handle filing, calculate fees accurately, and ensure compliance with U.S. Customs regulations, which helps importers avoid delays, penalties, and unexpected costs.

Related: What Is HS Code In Shipping? The Harmonised System

Calculating custom clearance charges in the USA involves several steps and considerations, as the charges are influenced by various factors such as the value of the goods, applicable duty rates, taxes, and additional fees. Here’s a general guide on how to calculate custom clearance charges in the USA:

It’s important to note that customs clearance charges can vary depending on factors such as the nature of the goods, the country of origin, and any applicable trade agreements or regulatory requirements. Importers should carefully calculate and budget for these charges to ensure compliance with customs regulations and avoid delays or penalties during the clearance process.

Related: ISF Filing: A Compliance-Related Guide & Software Solution

Minimizing customs clearance charges is crucial for businesses engaged in international trade to maintain competitiveness and profitability. Here are some effective tips to help reduce custom clearance charges:

Related: What Is HTS Code (Harmonized Tariff Schedule)? A Quick Guide

Artemus is an innovative ISF (Importer Security Filing) software designed to streamline the customs clearance process for importers and customs brokers in the USA. It simplifies the filing of mandatory ISF documentation required by U.S. Customs and Border Protection (CBP) for ocean freight shipments.

The software allows users to efficiently submit accurate and timely ISF filings, ensuring compliance with CBP regulations and preventing costly penalties for non-compliance. Its user-friendly interface and intuitive features make managing filings for multiple shipments easy, helping businesses save time and resources while maintaining smooth logistics operations.

The platform provides advanced capabilities such as automated data validation, real-time status updates, and customizable reporting tools. Leveraging these features enhances efficiency and accuracy in ISF filing, ultimately improving the overall customs clearance process for importers and brokers alike.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

A customs clearance fee is a charge imposed for the processing and verification of imported or exported goods by customs authorities, ensuring compliance with regulations and facilitating their entry or exit across international borders.

Customs clearance charges in India are typically paid through authorized banking channels or online platforms, where importers can make payments electronically via electronic funds transfer (EFT), online banking, or through designated bank branches.

The clearance entry fee is a charge levied by customs authorities for processing the documentation and entry of goods into a country, facilitating their clearance through customs and compliance with regulations.

If customs fees are not paid, U.S. Customs can hold or seize your shipment, impose fines, and block future imports until the fees are settled.

You cannot completely avoid legitimate customs fees, but using trade agreements, exemptions, or low-value shipment thresholds can help reduce them legally.

In conclusion, understanding and effectively managing customs clearance charges are essential aspects of international trade. These charges encompass various fees, duties, and taxes imposed by customs authorities during the import or export process.

By carefully calculating and budgeting for custom clearance charges, businesses can ensure compliance with regulations while minimizing costs and optimizing supply chain operations.

Related: How To Do Custom Clearance In USA For Goods? The Process

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.