What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Navigating the intricate pathways of international trade demands more than just moving goods across borders. It requires a deep understanding of customs regulations, financial commitments, and the complexities of compliance. Central to this process is the renewal of customs bonds, a pivotal requirement that ensures the seamless flow of trade activities while upholding legal obligations. In this blog, we delve into the significance of customs bond renewal, exploring how it shapes the global trade landscape and safeguards businesses against disruptions.

Amidst the intricacies of customs bond renewal, Artemus emerges as a beacon of support, offering cutting-edge solutions to simplify and streamline the process. With its unrivaled #1 AMS (Automated Manifest System) and ISF (Importer Security Filing) software solutions, Artemus empowers businesses to transcend the complexities of compliance. Seamlessly navigating the renewal process, Artemus’ technology assists in timely submissions, meticulous financial assessments, and smooth interactions with surety companies.

Table Of Contents

Customs bond renewal is the process by which businesses ensure the continued validity of their customs bonds, which are financial guarantees required by government agencies for import and export activities. These bonds serve as a commitment from the bondholder to comply with customs regulations and fulfill financial obligations related to trade. When a customs bond approaches its expiration date, the bondholder must initiate the renewal process to maintain uninterrupted trade operations.

During customs bond renewal, the bondholder typically works with a surety company that issued the original bond. The process involves submitting necessary paperwork, undergoing financial assessments, and paying any required premiums. This evaluation ensures that the bondholder remains eligible for the bond and reassesses the bond amount based on potential business operations or financial standing changes.

Upon successful renewal, a new customs bond is issued, allowing the business to continue importing and exporting goods in line with regulatory requirements. Custom bond renewal is crucial for maintaining a smooth supply chain, avoiding disruptions in trade, and upholding legal and financial commitments within the international trade landscape.

Related: ISF Filing Process: A Detailed Step-By-Step Guide

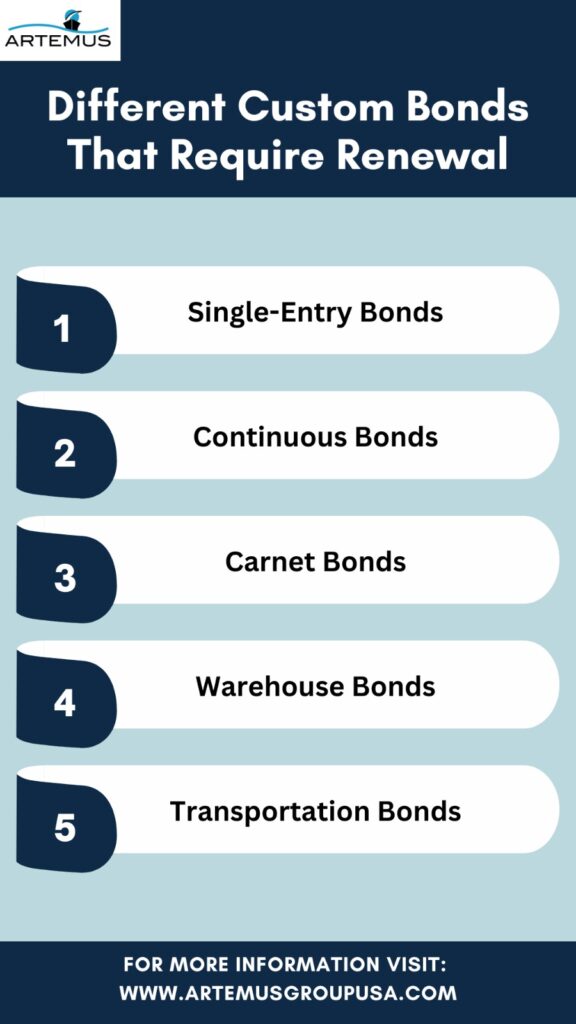

Several types of customs bonds require renewal to ensure the continuous compliance of businesses engaged in international trade. Some of these include:

Single-entry bonds are required for infrequent importers or exporters who don’t conduct trade activities on a regular basis. These bonds are valid for a single transaction or a limited period. After the transaction is completed or the bond’s validity period expires, renewal is necessary for any future import or export activities.

Continuous bonds are a popular choice for frequent importers and exporters engaged in regular trade activities. These bonds cover a 12-month period and provide coverage for all transactions within that timeframe. Continuous bonds often come with an automatic renewal feature, simplifying the process and eliminating the need for businesses to initiate renewal for each trade transaction.

Carnet bonds, also known as ATA Carnets, are used for temporary importation of goods for exhibitions, trade shows, or other temporary purposes. These bonds allow goods to enter a foreign country temporarily without paying duties or taxes. Carnet bonds need to be renewed if the temporary stay of the goods extends beyond the initial bond period.

Warehouse bonds are required when goods are stored in a customs-bonded warehouse. These bonds ensure that the goods are properly accounted for and duties are paid when the goods are eventually released from the warehouse. Renewal of warehouse bonds may be necessary if the goods remain stored beyond the original bond period.

Transportation bonds, also known as carriers’ bonds, are necessary for carriers that transport imported goods within the country. These bonds guarantee the payment of duties if the goods are not delivered to their designated location. Renewal is required to maintain the bond’s coverage as the carrier continues to transport goods.

In each case, timely renewal of these customs bonds is essential to avoid trade disruptions, ensure compliance with regulations, and facilitate the smooth movement of goods across international borders.

Related: Who Is Responsible For Filing The ISF? Know The Key Roles

The duration of custom bonds varies depending on factors such as the type of bond, the nature of trade activities, and the regulations of the importing or exporting country. Typically, custom bonds have a validity period ranging from one year to 12 months. Single-entry bonds, which are often used for occasional trade transactions, are usually valid for the duration of a specific transaction or a short-term period that could extend from a few weeks to several months. These bonds require renewal for any subsequent trade activities.

Continuous bonds, on the other hand, are favored by businesses engaged in frequent import and export activities. These bonds provide coverage for a continuous 12-month period, encompassing all trade transactions occurring within that timeframe. One notable advantage of continuous bonds is the potential inclusion of an automatic renewal feature, simplifying the renewal process for businesses that consistently conduct trade operations.

The varying duration of custom bonds reflects the need for businesses to navigate trade regulations while ensuring the smooth flow of goods across international borders. It is essential for businesses to proactively monitor bond expiration dates and initiate the renewal process in a timely manner to avoid any disruptions in their trade activities and uphold their commitment to customs compliance.

Related: What Is ISF Bond? Types, Cost, & Components To Know

Initiating the customs bond renewal process promptly is essential to ensure uninterrupted trade operations and regulatory compliance. It’s advisable to begin renewal efforts about two to three months before the bond’s expiration date. This timeframe allows adequate time for meeting paperwork demands, undergoing financial assessments, and addressing potential unforeseen challenges.

By taking a proactive approach to starting the renewal process, businesses can minimize disruptions, expedite paperwork handling, and consistently uphold their commitment to customs obligations.

Starting the renewal process early also mitigates the risk of trade disruptions due to administrative delays or unforeseen issues. It provides the business with sufficient time to review and update any changes in its operations or financial status that might impact the bond renewal evaluation. By adopting a proactive approach and initiating the renewal process ahead of time, businesses can ensure a smooth transition between bond periods, maintain compliance with customs regulations, and uphold the efficiency and integrity of their trade activities.

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

Here’s a step-by-step process for custom bond renewal:

Following these streamlined steps ensures a successful customs bond renewal process, enabling uninterrupted trade activities and adherence to regulatory norms.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

Customs bond renewal plays a pivotal role in the landscape of global trade, ensuring the uninterrupted flow of goods and adherence to regulatory requirements. As a financial guarantee, these bonds demonstrate a business’s commitment to compliance with customs regulations and financial obligations.

Renewal of customs bonds before their expiration is crucial for preventing disruptions in trade activities, enabling the smooth movement of goods across international borders, and maintaining the stability of supply chains.

Furthermore, customs bond renewal reinforces the ethical and responsible image of businesses in the global trade arena. Timely renewal showcases a proactive commitment to meeting legal standards and upholding transparency in trade operations. Non-renewal could result in shipment delays, financial penalties, and reputational risks.By promptly initiating the renewal process, companies underscore their dedication to regulatory compliance, foster trust with trade partners, and contribute to the efficiency and reliability of the global trade ecosystem.

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

Not renewing custom bonds on time can lead to various penalties and consequences, including:

Artemus stands at the forefront as the leading provider of #1 AMS (Automated Manifest System) and ISF (Importer Security Filing) software solutions, offering a robust pathway for businesses to ensure impeccable compliance in their international trade endeavors.

With unwavering dedication to precision and efficiency, Artemus empowers clients to effortlessly navigate intricate customs regulations, streamlining operations and optimizing supply chain processes.

Renowned for its expertise, Artemus’ advanced AMS and ISF software solutions offer comprehensive cargo tracking, robust data management, and detailed reporting capabilities, ensuring businesses adhere to the highest standards of regulatory compliance

By harnessing Artemus’ cutting-edge technology, companies can establish a solid foundation for sustained success, minimizing risks, and maximizing efficiency in the dynamic landscape of cross-border trade.

The cost of an annual customs bond can vary significantly depending on factors such as the type of bond, the bond amount, the nature of trade activities, and the surety company issuing the bond.

When a customs bond expires, the ability to import or export goods is compromised, potentially leading to trade disruptions, delays, and regulatory non-compliance.

Customs bonds are generally not refundable, as they serve as a financial guarantee for compliance with regulations and obligations related to international trade activities.

In conclusion, customs bond renewal is an indispensable process in the intricate landscape of international trade. As a vital link between businesses and regulatory compliance, it ensures the uninterrupted flow of goods across borders, upholds supply chain stability, and showcases an enterprise’s commitment to responsible trade practices. By proactively navigating the renewal process, businesses not only avoid disruptions but also reinforce their credibility, contributing to a seamless and efficient global trade ecosystem.

Related: ISF Filing Online: A Beginner’s Guide To Your Import Process

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.