How To Import A Car From Japan To USA? A 7-Step Process

Are you dreaming of importing a car from Japan but feeling overwhelmed by the process? Look no further! In this

Becoming a licensed customs broker is like gaining a golden key to the world of international trade. With the Customs Broker License Examination (CBLE), this key comes with a rigorous test of your knowledge and expertise in customs regulations and procedures. Successfully passing the exam opens doors to a rewarding career in facilitating the smooth flow of goods across borders, ensuring compliance with laws, and simplifying the complexities of international trade.

But before we dive into the nuances of the Customs Broker Exam, here’s a quick tip: Artemus Transportation Solutions offers efficient Customs Broker Software that can make the life of customs brokers a whole lot easier. Now, let’s delve into the CBLE and what it takes to ace it!

Table Of Contents

The Customs Broker Exam, conducted by the U.S. Customs and Border Protection (CBP), assesses an individual’s expertise in customs brokerage—an essential role in facilitating international trade by ensuring compliance with complex regulations. This exam covers customs rules, tariff classification, valuation, and documentation, serving as a prerequisite for a customs broker license.

It’s notoriously challenging, comprising multiple-choice, written, and oral sections. Passing showcases the ability to navigate global trade rules and opens doors to working with importers, exporters, and customs authorities, vital for efficient cross-border commerce.

Related: What Are The Likely Customs Broker Exam Pass Rate For 2024?

Becoming a customs broker involves several essential steps. Candidates must initially meet eligibility requirements, including U.S. citizenship, a clean background check, and demonstrating good character. After meeting these criteria, they must prepare for and pass the challenging Customs Broker Exam, covering topics like customs regulations and tariff classification.

Upon successful completion of the exam, candidates can apply for a customs broker license through the CBP’s online system. This license authorizes them to act as intermediaries between importers, exporters, and customs authorities, ensuring compliance with import and export laws.

Customs brokers must also stay updated on changing regulations, fulfill annual requirements, and often join professional organizations and networks for industry insights and best practices, enhancing their expertise in international trade.

Related: Custom Broker Fees Explained: The Figures You Need To Know

The upcoming Customs Broker License Examination (CBLE) is scheduled for October 25, 2023. Unfortunately, as of now, the registration period for this examination has officially concluded on CBP. This means that individuals interested in taking the exam must have already completed the registration process within the specified timeframe.

It’s important to note that registration deadlines for CBLE are typically set well in advance of the exam date, allowing candidates to prepare adequately for the test. Missing the registration period means that aspiring customs brokers will need to wait for the next available exam cycle and ensure they register within the designated timeframe for that particular session.

Related: Customs Bond Renewal: All Facts You Need To Know

Becoming a customs broker involves several essential steps. Candidates must initially meet eligibility requirements, including U.S. citizenship, a clean background check, and demonstrating good character. After meeting these criteria, they must prepare for and pass the challenging Customs Broker Exam, covering topics like customs regulations and tariff classification.

Upon successful completion of the exam, candidates can apply for a customs broker licence through the CBP’s online system. This licence authorises them to act as intermediaries between importers, exporters, and customs authorities, ensuring compliance with import and export laws.

Customs brokers must also stay updated on changing regulations, fulfil annual requirements, and often join professional organisations and networks for industry insights and best practices, enhancing their expertise in international trade.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

Eligibility Criteria For The CBLE Exam

The eligibility criteria for the customs broker exam in the United States are established by the U.S. Customs and Border Protection (CBP) agency. Here are the general eligibility requirements:

Related: What Is A Customs Bond? A Guide For Importers & Others

The Customs Broker Exam in the United States follows a structured format to evaluate candidates’ knowledge and expertise in customs regulations and international trade. Here’s a brief overview of its structure and format:

1. Multiple-Choice Questions (Part 1): This section of the exam consists of multiple-choice questions that cover a wide range of topics related to customs laws, regulations, and procedures. These questions may involve scenarios or practical situations that test candidates’ ability to apply their knowledge. There were 80 multiple-choice questions in this part.

2. Essay Questions (Part 2): The second part of the exam consists of essay questions. Candidates are required to provide detailed written responses to these questions. Essay questions often present real-world scenarios that test candidates’ ability to analyze and apply customs regulations effectively.

3. Time Limit: The Customs Broker Exam typically lasts for approximately four and a half hours. There is a break between the multiple-choice and essay sections to allow candidates to regroup and prepare for the essay questions.

4. Pass/Fail: The Customs Broker Exam is graded on a pass/fail basis. Candidates are not assigned a numerical score. To pass the exam, candidates must achieve a score that meets or exceeds the passing threshold established by CBP.

7. Administration: The Customs Broker Exam is offered twice a year, typically in April and October. CBP announces the exam dates and registration deadlines through the Federal Register and its official website. Candidates must meet eligibility requirements, submit applications, and pay exam fees within specified timeframes.

8. Licensing Process: Passing the exam is just one step in becoming a licensed customs broker. After passing, candidates must complete the licensing process, which includes submitting a broker licence application, obtaining a customs broker surety bond, and fulfilling additional CBP requirements.

Related: When Is A Customs Bond Required? Key Factors To Consider

The following are some of the key Customs Broker Exam topics that candidates can expect to encounter:

In addition to these core topics, the CBLE may include questions related to other subjects pertinent to the duties and responsibilities of customs brokers.

Related: How To Get A Customs Bond In 5 Easy Steps: Beginner’s Guide

The customs broker exam is administered by the U.S. Customs and Border Protection (CBP) agency, a branch of the U.S. Department of Homeland Security. The exam is typically held twice a year, once in the spring and once in the fall, and it’s offered at various testing centers across the United States.

Candidates interested in taking the exam must apply to CBP during specific registration periods and meet eligibility requirements, including completing a background check. The actual exam locations may vary from one administration to another, so it’s crucial to check the CBP’s official website or contact their designated examination center for the most up-to-date information on test locations, registration deadlines, and other essential details.

Passing this exam is a significant step toward becoming a licensed customs broker and is a prerequisite for those aspiring to wo

Here are the key points to know about the registration process and fees for the Customs Broker Exam:

Related: Who Is Responsible For Filing The ISF? Know The Key Roles

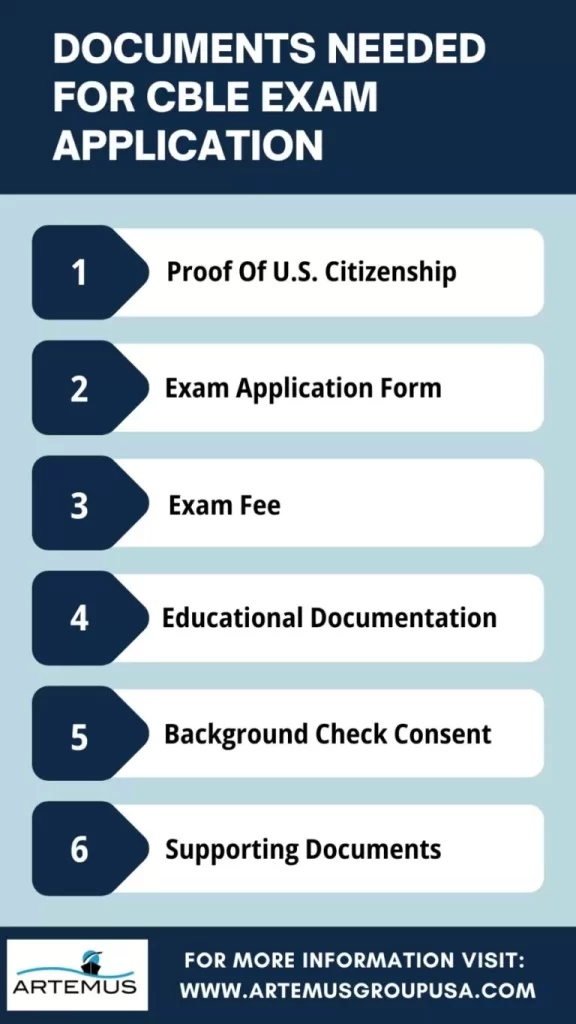

When applying to take the Customs Broker Exam in the United States, candidates need to prepare a set of documents and information to complete their application. Here’s a brief overview of the typical documents and requirements needed for the Customs Broker Exam application:

Related: What Is ISF Bond? Types, Cost, & Components To Know

Preparing for the Customs Broker Exam requires a well-structured approach and dedication. Here are five effective strategies to help you succeed in your exam preparation:

Initiate your exam preparations with ample lead time before the exam date. Initiate your exam preparations with ample lead time before the exam date. Allocate specific times for studying each topic, and be consistent in your daily or weekly study routine.

The U.S. Customs and Border Protection (CBP) provides official study guides and materials for the Customs Broker Exam. These resources are invaluable, as they are tailored to the exam’s content and format. Make sure to thoroughly review these materials as a primary part of your study plan.

Practicing with sample questions and previous exam papers can help you become familiar with the exam format and the types of questions asked. It also allows you to assess your knowledge and identify areas where you may need further study.

Many educational institutions and organizations offer customs broker exam preparation courses. These courses often provide a structured curriculum, expert guidance, and opportunities for peer learning. Consider enrolling in a course to supplement your self-study efforts.

Customs regulations are subject to frequent updates. Subscribe to industry newsletters, follow CBP announcements, and stay informed about changes in trade laws and regulations. Incorporate current information into your study materials to ensure your knowledge is up to date.

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

Passing the Customs Broker Exam is a significant achievement, but it’s only the beginning of the process toward becoming a licensed customs broker in the United States. Here are the post-exam steps that candidates typically need to follow:

1. Submit A Customs Broker License Application: After successfully passing the exam, candidates must submit a Customs Broker License Application (CBP Form 3124) to the U.S. Customs and Border Protection (CBP). This application includes personal information, exam results, and details about their customs brokerage qualifications.

2. Obtain A Customs Broker Surety Bond: To become a licensed customs broker, candidates must obtain a customs broker surety bond. The bond serves as financial protection for potential customs duties, taxes, or penalties that may be owed by the broker’s clients. The bond amount is determined by CBP and must be acquired through a qualified surety company.

3. Comply With CBP’s Eligibility Requirements: Candidates must meet all eligibility requirements established by CBP, including U.S. citizenship, background checks, and any other specific requirements outlined in the application process.

4. Pay License Application Fee: Candidates are required to pay a licence application fee to CBP. The fee amount may vary, so it’s essential to check the current fee schedule provided by CBP.

5. Pass A Background Check: CBP conducts a thorough background check on each applicant to ensure they meet the agency’s suitability standards. Any issues that arise during the background check process may impact the issuance of the customs broker licence.

6. Await Licence Approval: Once the application is submitted, and all requirements are met, candidates must wait for CBP to review and approve their licence application. Given that this process may require a certain duration, exercising patience is crucial.

7. Receive Your Customs Broker License: After approval, candidates will receive their customs broker licence from CBP. This licence allows them to legally engage in customs brokerage activities, including representing clients in customs matters.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

Here are some prominent career avenues for certified customs brokers:

Many certified customs brokers work for customs brokerage firms. In this role, they facilitate international trade by assisting clients with customs clearance, tariff classification, documentation, and compliance. Brokers often serve a diverse clientele, including importers and exporters from various industries.

Certified customs brokers are highly valuable in logistics and supply chain management roles. They help organisations optimise their supply chains by ensuring efficient customs processes, minimising delays, and complying with international trade regulations.

Compliance with customs and trade regulations is paramount for businesses engaged in international trade. Certified customs brokers often transition into roles as trade compliance specialists, ensuring that their employers or clients adhere to all applicable laws and regulations.

Some customs brokers establish their own consultancy firms, providing expert advice and guidance on customs and trade matters. They assist businesses in navigating complex regulatory landscapes, managing risk, and optimising their international trade operations.

Certified customs brokers may pursue careers in government agencies responsible for customs and trade enforcement, such as working for the U.S. Customs and Border Protection (CBP) or similar agencies in other countries. They can contribute to policy development, trade security, and enforcement efforts.

Related: Continuous Bond Vs Single Entry: 6 Key Differences To Know

In the world of customs brokerage, efficiency is the name of the game. That’s where Artemus comes into play as your number one software solution. With an arsenal of powerful tools and features designed specifically for customs brokers, Artemus simplifies and streamlines the complexities of the trade.

From managing documentation and compliance to ensuring smooth customs processes, Artemus is your trusted partner in navigating the intricate world of international trade. Say goodbye to hassles and hello to seamless operations with Artemus by your side.

Related: ISF Bond Cost Breakdown & Management For Import Success

The qualification for a customs broker typically includes being a U.S. citizen, passing a background check, and demonstrating good moral character, in addition to passing the Customs Broker Exam.

There is generally no specific age limit for becoming a customs officer in the United States, as eligibility criteria may primarily focus on education, experience, and physical fitness requirements.

The strengths of customs brokers include expertise in international trade regulations, the ability to navigate complex customs processes, and a commitment to ensuring compliance, which facilitates efficient cross-border transactions for clients.

The Customs Broker Exam (CBLE) is the gateway to becoming a licensed customs broker, a profession that demands in-depth knowledge of regulations, ethical practices, and a commitment to compliance.

Throughout this journey, we’ve explored the various facets of the CBLE, from its core topics to the dedication required to succeed. Remember, the CBLE is not just an exam; it’s a stepping stone to a dynamic career that bridges the gap between businesses and global markets.

Preparation is key, and ongoing learning is essential in this ever-evolving field. Aspiring customs brokers should stay informed, seek out educational resources, and consider professional development opportunities to excel in their roles.

Are you dreaming of importing a car from Japan but feeling overwhelmed by the process? Look no further! In this

Interested in pursuing a career as a freight broker but unsure about the associated costs? Look no further! From licensing

Embarking on a career as a freight broker can be an exciting venture into the world of logistics and transportation.

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.