How To Import Goods For Resale In The USA? A 2025 Guide

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Exporting a car from the USA to Canada can be a smooth process if you understand the necessary requirements. Both countries have specific regulations regarding vehicle importation, including documentation, safety, and emission standards that must be met.

The process involves ensuring your car complies with Canadian regulations, including modifications like the speedometer and emissions system. Additionally, you’ll need to pay attention to tariffs and taxes based on the car’s value and age.

Artemus: AES Filing Software for Exporting Cars from the USA simplifies the process by helping you file Automated Export System (AES) forms accurately and efficiently, reducing errors and saving time.

Table Of Contents

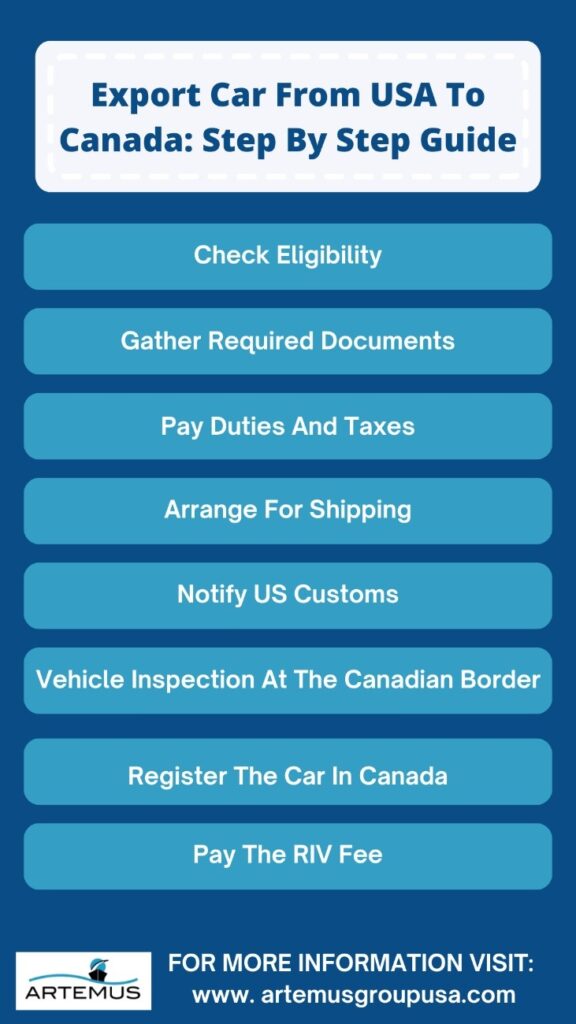

Exporting a car from the USA to Canada involves several important steps to ensure the process goes smoothly. Understanding the requirements and preparing the necessary documents is essential for a successful import.

Before exporting, ensure the car complies with Canadian import regulations. Verify that the vehicle meets Canadian safety standards and emissions regulations. You can check this information with the Registrar of Imported Vehicles (RIV) and the Canada Border Services Agency (CBSA).

Ensure you have all the necessary documentation:

When importing a car into Canada, you may need to pay duties, taxes, and customs fees. The amount will depend on the car’s value and where it was manufactured. Contact the CBSA for details on tariffs and taxes.

Decide whether to ship the car via sea or land. You can either drive it to the border or use a shipping service. Choose a reliable company that specializes in international car shipping for the safest and most cost-effective option.

Once the AES filing is completed and US Customs clears the vehicle, it can proceed with exporting to Canada. Make sure all necessary forms are filed well in advance to avoid delays in the export process.

Once the car arrives at the border, Canadian customs officers will inspect the vehicle. Make sure to have all your documents and proof of compliance-ready. If the vehicle meets Canadian standards, it will be cleared.

After the car has cleared Canadian customs, it must be registered with the appropriate provincial authorities. You’ll need to provide the RIV form, proof of insurance, and the inspection certificate.

Once the vehicle passes inspection, pay the RIV fee, which covers the cost of ensuring the vehicle complies with Canadian standards. After payment, you will receive a Canadian registration number and license plates.

Following this guide ensures a smooth and efficient car export process from the USA to Canada. By preparing the necessary documents and understanding the steps involved, you can navigate the requirements with ease.

Related: What Is AMS In Shipping Industry? A Beginner’s Guide

Before importing a vehicle from the USA to Canada, it is essential to check if the car meets Canadian import regulations. This process helps ensure that the vehicle complies with Canadian safety and emissions standards.

The vehicle must meet Canada’s Motor Vehicle Safety Standards (CMVSS). To check this, you can visit the Registrar of Imported Vehicles (RIV) website, which provides a list of eligible vehicles that comply with these standards. If the vehicle does not meet the requirements, modifications may be necessary.

Canadian vehicles are required to meet specific emissions standards. The Environmental Protection Agency (EPA) in the US sets emissions standards that align with Canada’s regulations. Ensure that your vehicle complies with these standards by verifying its emissions certification. If it does not comply, modifications may be needed before it can be imported.

Certain vehicles, especially those that are over 15 years old, may be eligible for importation under relaxed rules. The Canada Border Services Agency (CBSA) provides detailed guidelines for importing older vehicles that may not meet current safety or emissions standards.

Ensure that the vehicle has not been subject to any unresolved safety recalls. If the vehicle has been recalled, it must be rectified before importing it into Canada. You can check for recalls with the National Highway Traffic Safety Administration (NHTSA) or the manufacturer’s website.

The Registrar of Imported Vehicles (RIV) is responsible for processing all imported vehicles to Canada. They provide a list of approved vehicles and offer guidance on how to ensure your vehicle meets all requirements. You can also register your vehicle with them to begin the importation process.

By ensuring that your vehicle meets Canadian eligibility criteria, you can avoid delays and additional costs during the importation process.

Related: What Is Import Compliance & Why It Matters?

Exporting a car from the USA to Canada permanently requires several key steps to ensure the vehicle complies with Canadian regulations and is properly processed through customs. Below is a detailed guide to help you through the process.

Before exporting, verify that the vehicle meets Canadian safety and emissions standards. Visit the Registrar of Imported Vehicles (RIV) website to confirm if the car is eligible for import. If the vehicle does not meet Canadian requirements, you may need to modify it before importing.

You will need several documents to complete the export process:

Inform US Customs about your intention to export the vehicle. The vehicle must be cleared by US Customs before it can leave the country. Complete the CBP Form 7501 and submit it along with other relevant documents to US Customs for approval. Additionally, you must file an Automated Export System (AES) declaration if the vehicle’s value exceeds $2,500 or if it is subject to Export Control Classification Number (ECCN) restrictions. The AES filing is required to track the export and ensure compliance with U.S. export laws. Once US Customs clears the vehicle, it is ready for export.

You have two main options for getting the car to Canada:

When entering Canada, you may be required to pay duties, taxes, and other fees. The exact amount will depend on factors like the vehicle’s age, value, and origin. Be prepared to pay these at the border.

Upon arrival at the Canadian border, Canadian Customs (CBSA) will inspect the vehicle to ensure it meets all safety, emissions, and import requirements. Ensure you have all required documents ready. If the vehicle passes the inspection, it will be cleared for entry.

After the vehicle clears customs, you must register it with the provincial or territorial motor vehicle department. You’ll need to:

For vehicles that need modifications to meet Canadian standards, pay the RIV Fee. This fee covers the cost of ensuring the vehicle complies with Canadian regulations, and you will receive a Canadian registration number and license plates once everything is processed.

By following these steps, you can successfully export your car from the USA to Canada permanently. Be sure to carefully prepare the required documents and follow all Canadian regulations to ensure a smooth process.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

When exporting a vehicle from the USA to Canada, preparing the necessary documents is a crucial step in ensuring the process goes smoothly. These documents are required to clear both US and Canadian customs and to meet import regulations.

The Vehicle Title is the primary document proving that you legally own the car. You will need to provide this document to US Customs to ensure that you have the right to export the vehicle. If the vehicle is financed or leased, you may need permission from the lender or leasing company.

A Bill of Sale or proof of purchase provides evidence of the transaction. This document should include details such as the purchase price, date of sale, and both buyer’s and seller’s information. It may be required by both US and Canadian customs to verify ownership.

You must provide a valid identification when exporting a car. This could include a passport, driver’s license, or another government-issued ID. It is required for both the export process from the USA and for entry into Canada.

For certain vehicles, you may need to complete the Registrar of Imported Vehicles (RIV) form. This form is essential for registering the vehicle with the RIV in Canada. It is typically needed if the vehicle is under 15 years old or does not meet Canadian safety or emissions standards.

A EPA Certification proves that the vehicle meets the emissions standards set by the U.S. Environmental Protection Agency (EPA). This is important for vehicles being imported into Canada to ensure they comply with Canadian environmental regulations.

If the vehicle has been subject to a recall, you must provide a Recall Clearance Letter from the manufacturer. This letter confirms that all recall-related issues have been addressed before the vehicle can be imported into Canada.

Before exporting the vehicle, you will need to complete CBP Form 7501 with the U.S. Customs and Border Protection (CBP). This form is used for declaring the vehicle to customs and includes details about the vehicle and its shipment.

To register the car in Canada, you will need to provide proof of insurance from a Canadian insurer. Ensure that you have arranged insurance coverage for the vehicle before attempting to cross the border.

Having all of these essential documents ready will help ensure a smooth export process and minimize delays at both US and Canadian customs. Proper preparation is key to successfully exporting your car from the USA to Canada.

Related: Late ISF Filing: What To Do If Missed The Deadline?

When exporting a vehicle from the USA to Canada, paying customs duties, taxes, and other fees is an essential part of the process. These fees are based on the value of the vehicle and other factors and must be paid at the Canadian border for the vehicle to be cleared for entry.

The amount of customs duties and taxes you’ll need to pay depends on the vehicle’s value, its country of manufacture, and its age. Generally, you will be required to pay:

The value of the vehicle for duty and tax purposes is typically the purchase price or market value. If the vehicle is a gift, you may need to provide an appraisal to determine its value. You will need to present the Bill of Sale or other documents showing the price at which the vehicle was purchased.

If the vehicle was manufactured in a country with a free trade agreement with Canada (such as the US-Mexico-Canada Agreement (USMCA)), you may be eligible for reduced or waived duties. Ensure that the necessary paperwork is submitted to show eligibility for these reduced rates.

Once the vehicle arrives at the Canadian border, customs officers will assess the appropriate duties and taxes. Be prepared to pay these fees when you submit your customs declaration. You can typically pay using:

After paying the duties, taxes, and fees, you will receive a receipt from Canada Border Services Agency (CBSA). Keep this receipt as proof of payment, as it may be required for vehicle registration and other purposes.

Paying the correct customs duties and taxes ensures a smooth import process and helps avoid any issues at the border. Be sure to check the latest regulations with the Canada Border Services Agency (CBSA) before exporting your vehicle to confirm the exact fees and requirements.

Related: AMS Fee In Shipping: Overview & 5 Key Considerations

The cost of exporting a car from the USA to Canada can vary depending on several factors such as the vehicle’s value, the method of transportation, and customs fees. Below is a breakdown of the costs you can expect during the export process.

The amount you’ll pay in customs duties and taxes depends on the vehicle’s value, its country of origin, and the applicable regulations.

Shipping costs depend on the transportation method you choose:

The Registrar of Imported Vehicles (RIV) charges a fee to process the vehicle’s compliance with Canadian safety standards. This fee is usually around $195 (Canadian dollars), but can vary depending on the province.

After your vehicle arrives in Canada, it may need to undergo an inspection to ensure it meets Canadian safety and emissions standards. Inspection fees typically range from $100 to $300 depending on the province and the inspection center.

Additional costs may include:

The total cost of exporting a car from the USA to Canada could range from $1,000 to $5,000 or more depending on the vehicle’s value, the shipping method, and additional fees. It’s essential to budget for these expenses and check the latest regulations with the Canada Border Services Agency (CBSA) and the Registrar of Imported Vehicles (RIV) to ensure you are fully prepared for the costs.

Related: AMS Filing Penalty Cost: Most Common Pitfalls & Solutions

Once your vehicle has successfully passed through Canadian customs and all duties, taxes, and fees have been paid, the next step is to register the vehicle with the appropriate provincial or territorial motor vehicle department. Here’s a step-by-step guide to registering your imported car in Canada.

In many provinces, vehicles imported into Canada need to undergo a safety inspection and an emissions inspection (if applicable). These inspections ensure the vehicle complies with Canadian safety standards and environmental regulations. The inspection will typically check:

The Registrar of Imported Vehicles (RIV) may require additional modifications or repairs if the vehicle doesn’t meet Canadian standards, such as adjustments to the lighting system, speedometer, or emissions system.

If the vehicle is subject to the Registrar of Imported Vehicles (RIV) program, you will need to submit the required RIV Form. This form verifies that your vehicle complies with Canadian safety and emission standards. The RIV fee, which is around $195 CAD, must also be paid at this stage.

To register the vehicle, you must provide proof of ownership (usually the Bill of Sale or Vehicle Title), as well as a valid form of identification (such as a driver’s license or passport). In some cases, you may also need to provide proof of residency in Canada.

You will need to arrange for Canadian auto insurance before you can register the vehicle. Insurance coverage is required to ensure that the car is legally allowed to operate on Canadian roads. Be prepared to present proof of your insurance policy when you register the vehicle.

The cost to register a car in Canada varies by province or territory. The fees typically range from $100 to $500, depending on your location and the type of vehicle. You may also be required to pay additional fees for:

After completing the registration process, you will receive your Canadian license plates and a vehicle registration certificate. Make sure to place the license plates on the car immediately, as it is illegal to drive an unregistered vehicle on public roads.

If your vehicle was part of the RIV program, you may need to complete additional steps, such as submitting proof of inspection and modification, to finalize the registration. Once the RIV process is complete, you will receive a Canadian registration certificate.

After the registration is complete, your vehicle will be officially registered and ready for use in Canada. Keep your registration documents, proof of insurance, and inspection reports in the car at all times while driving.

By following these steps, you can ensure a smooth and legal registration of your imported vehicle in Canada. Be sure to check the specific requirements for your province, as they can vary.

Related: Merchandise Processing Fee (MPF): A Complete Guide

Exporting a car from the USA to Canada can be a challenging process with several steps to follow. However, understanding common challenges and knowing how to address them can help you navigate the process more smoothly.

By addressing these points, you can navigate common export challenges more efficiently. Being well-prepared and informed will help ensure a smoother experience when exporting your vehicle from the USA to Canada.

Related: ISF Filing Requirements: A Step-By-Step Guide

Artemus is an efficient AES filing software designed for exporters to streamline the car export process from the USA. It ensures compliance with U.S. Customs and Border Protection regulations, helping avoid delays and penalties.

The software simplifies data submission by automating key processes like VIN reporting and document preparation. Its user-friendly interface is ideal for both individual exporters and businesses managing multiple shipments.

With Artemus, users receive real-time updates and support to minimize errors. This makes it a reliable choice for handling the complexities of AES filings and ensuring smooth car exports.

Yes, you can export your car from the US to Canada, provided it complies with Canadian safety and environmental standards.

The cost varies but typically includes shipping fees, import duties, taxes, and compliance costs, ranging from $1,500 to $5,000 USD depending on the car and location.

Import taxes include GST (5%) and potentially provincial taxes, along with a duty of 6.1% if the car is not made in North America under the USMCA agreement.

Yes, but the car must be registered and comply with Canadian safety and environmental regulations before it can be legally sold.

A US car can stay temporarily in Canada for up to 12 months but must be imported and registered if staying longer.

Cars are generally cheaper in the USA due to lower taxes and dealership pricing, but additional import and compliance costs may offset savings.

Yes, cars that are 25 years or older can be imported to Canada without requiring modifications to meet current safety standards.

The 15-year rule allows vehicles 15 years or older to be imported without having to meet Canada’s modern safety and emission standards.

Yes, you can import your car to the USA permanently, but it must meet US safety and environmental standards and undergo formal registration.

Yes, you can purchase a car in the USA and bring it to Canada, but it must pass a Registrar of Imported Vehicles (RIV) inspection and comply with Canadian regulations.

No customs duty is required if the car qualifies under the USMCA agreement (North American-made vehicles). Otherwise, a 6.1% duty applies.

Importing a car from India to Canada can cost upwards of $5,000-$10,000 USD, including shipping, taxes, and compliance modifications.

Exporting a car from the USA to Canada requires careful preparation and understanding of the necessary regulations. Ensuring your vehicle meets Canadian standards and completing the required paperwork are essential steps to avoid complications.

Proper research and planning can help streamline the process, including arranging inspections, paying taxes, and addressing any compliance requirements. Hiring a professional broker or transporter can further simplify the journey.

With the right approach, exporting a car can be a smooth experience. Staying informed and organized ensures your vehicle arrives in Canada ready for registration and use.

Related: Which Party Issues The Export Declaration Document?

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Cargo agents are the backbone of the global logistics and shipping industries, managing the complex web of tasks that ensure

Ocean container dimensions are essential for efficient global shipping, ensuring that goods are transported safely and cost-effectively. Understanding container sizes,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.