What Does Norway Export To The US? Key Products & Trade Data

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Whether you’re a seasoned importer or delving into international trade for the first time, understanding the ins and outs of customs clearance is essential for a successful and compliant import operation.

Every year, billions of dollars worth of goods cross U.S. borders, each shipment requiring meticulous attention to detail to ensure smooth clearance through customs. From submitting the right paperwork to paying duties and taxes, the customs clearance process can be complex and daunting.

At Artemus Transportation Solutions, we understand the challenges importers face in terms of customs compliance. Our solutions cover essential aspects of customs compliance, including Importer Security Filing (ISF), Automated Manifest System (AMS), and support for Customs Brokers.

With our cutting-edge technology, importers can streamline their customs clearance process and ensure compliance with U.S. customs regulations.

Table Of Contents

Customs clearance is a critical process that ensures the legal entry of goods into a country and compliance with its customs regulations. It involves a series of procedures and documentation that must be completed before imported goods can be released from customs control and enter the domestic market.

At its core, customs clearance involves the verification of import documentation, assessment of duties and taxes, and inspection of goods to ensure compliance with import regulations and standards set by the country’s customs authority. In the United States, this authority is primarily managed by the U.S. Customs and Border Protection (CBP).

Related: How Long Does Customs Clearance Take? Key Takeaways

Customs clearance is necessary for several reasons, all of which are vital for maintaining the integrity of a country’s borders, protecting domestic industries, ensuring public safety, and facilitating international trade. Here are some key reasons why customs clearance is necessary:

1. Regulatory Compliance: Customs clearance ensures that imported goods comply with the laws and regulations of the importing country. Each country has its own set of customs regulations governing the importation of goods, including requirements related to tariffs, quotas, labeling, safety standards, and prohibited items.

By undergoing customs clearance, importers demonstrate their compliance with these regulations, helping to prevent illegal or unauthorized imports.

2. Revenue Collection: Customs clearance plays a crucial role in revenue collection for governments. Import duties, taxes, and fees collected during the customs clearance process contribute significantly to a country’s revenue stream. These funds support various government functions, including infrastructure development, public services, and social programs.

Proper customs clearance ensures that importers pay the appropriate duties and taxes based on the value and classification of imported goods.

3. Trade Facilitation: Customs clearance facilitates the smooth flow of international trade by providing a framework for the lawful movement of goods across borders. By ensuring compliance with customs regulations, importers can expedite the clearance process, minimize delays, and avoid penalties or fines.

Efficient customs clearance processes enhance predictability and transparency in international trade, fostering economic growth and development.

4. Protection Of Domestic Industries: Customs clearance helps protect domestic industries from unfair competition and safeguard national interests. Import regulations, including tariffs, quotas, and trade remedies, are designed to protect domestic producers from cheap or subsidized imports that could undermine their competitiveness.

Customs authorities may impose measures such as anti-dumping duties, countervailing duties, or safeguard measures to address unfair trade practices and protect domestic industries from harm.

5. Public Safety & Security: Customs clearance plays a crucial role in ensuring public safety and security by preventing the entry of dangerous or hazardous goods, illicit substances, counterfeit products, and other threats. Customs authorities conduct inspections and screenings to detect and intercept prohibited items, including narcotics, weapons, and contraband.

By enforcing strict import controls, customs clearance helps safeguard the health and well-being of citizens and protects national security interests.

6. Compliance With International Agreements: Customs clearance ensures compliance with international agreements and commitments, including trade agreements, customs conventions, and treaties. Many countries are party to bilateral or multilateral trade agreements that govern the terms and conditions of trade between participating countries.

Customs clearance helps ensure that imports and exports comply with the provisions of these agreements, promoting cooperation, harmonization, and mutual recognition of standards and procedures.

Related: Shipment Has Been Given A Release Status By Customs

The United States Customs and Border Protection (CBP) is the nation’s largest federal law enforcement agency, responsible for safeguarding America’s borders and facilitating lawful trade and travel.

As part of the Department of Homeland Security (DHS), CBP plays a critical role in protecting the United States from various threats, including terrorism, illegal immigration, smuggling, and the entry of illicit goods.

CBP operates at air, land, and sea ports of entry across the country, enforcing immigration laws, conducting customs inspections, and intercepting contraband. CBP’s mission encompasses a wide range of responsibilities, including border security, customs enforcement, immigration control, and trade facilitation.

The agency employs a multi-layered approach to border security, leveraging advanced technology, intelligence analysis, and partnerships with other federal, state, and local agencies to detect and deter threats to national security.

CBP officers and agents are stationed at ports of entry and along the border to inspect travelers, cargo, and vehicles, ensuring compliance with immigration and customs laws while expediting the flow of legitimate trade and travel.

Related: Customs Compliance Software: Key Benefits & Top Suggestions

Preparing for customs clearance is essential for a hassle-free import process. Smart preparation reduces delays, avoids fines, and improves certainty. Here are some essential steps to prepare for customs clearance:

Before importing goods into the U.S., know the different charges involved. Duties and tariffs depend on the product’s Harmonized Tariff Schedule (HTS) code, country of origin, and trade agreements.

Most formal entries require a Merchandise Processing Fee (MPF) of 0.3464% of the declared value, with a minimum of USD 32.71 and a maximum of USD 634.62 (as of October 2024).

Ocean shipments also incur a Harbor Maintenance Fee (HMF) of 0.125%, applicable only to sea freight. Some goods may face antidumping or countervailing duties, or additional fees from agencies like the FDA, USDA, or EPA.

Include costs for customs bonds, broker services, and possible inspections when calculating total import expenses.

Each imported product must have the correct HTS code, which determines duty rates and import restrictions. Errors can lead to fines or shipment delays.

If unsure, importers can request a binding ruling from U.S. Customs and Border Protection (CBP) for an official classification decision. Customs brokers can assist, but the importer is legally responsible for accuracy.

Accurate documentation is key to clearance. Core documents include the commercial invoice, bill of lading or air waybill, packing list, and CBP Form 7501 (Entry Summary). Depending on the goods, you may also need certificates of origin, permits, or import licenses.

For ocean freight, the Importer Security Filing (ISF or “10+2”) must be submitted to CBP 24 hours before loading at the foreign port. A customs bond, single or continuous, is required for duty and compliance assurance.

Documents should match in product details and value. Most filings now go through the Automated Commercial Environment (ACE) for faster, paperless processing.

Importers must meet U.S. regulatory standards. Products like food, chemicals, electronics, and agricultural goods may need approval from the FDA, USDA, EPA, or FCC.

Certain items, including hazardous materials, counterfeit goods, or wildlife products, are restricted or banned. Verify if your goods qualify for preferential duty benefits under trade programs like USMCA. Keep all import records for at least five years, as CBP can audit shipments.

In some cases, duties paid on re-exported goods can be refunded through the duty drawback program.

Most U.S. customs filings are processed through CBP’s ACE platform, which connects importers, brokers, and agencies. Electronic filing reduces errors and speeds up release times.

Digital tools can flag mismatched data before submission and offer real-time shipment tracking. Using these systems helps importers stay compliant and maintain clear visibility throughout the clearance process.

Related: ISF Filing: A Compliance-Related Guide & Software Solution

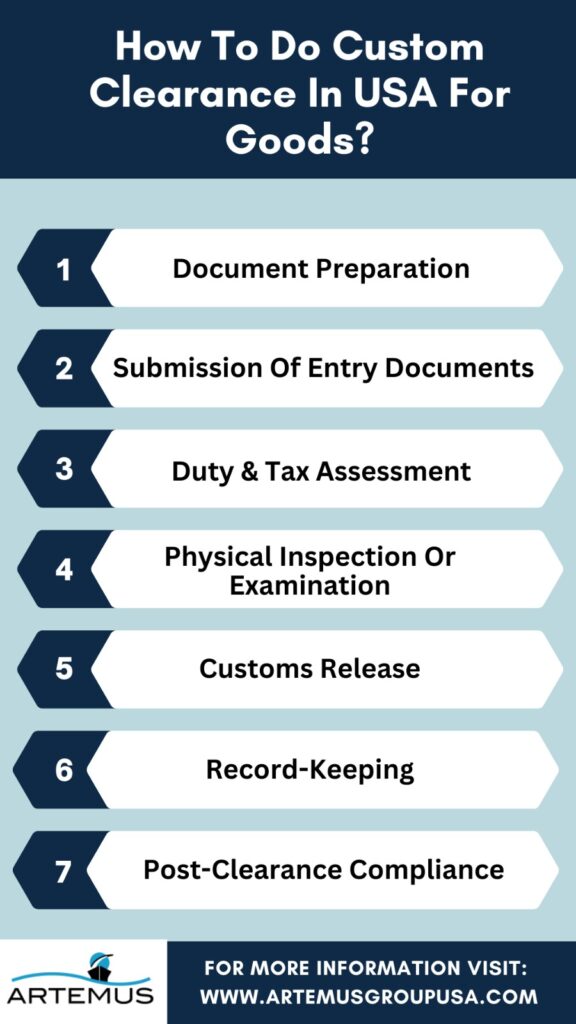

Navigating the customs clearance process in the USA for goods requires careful attention to detail and adherence to regulatory requirements. Here’s an overview of the steps involved in customs clearance:

The process begins with the preparation of necessary documentation. Importers must gather essential paperwork, including the commercial invoice, bill of lading, packing list, and any certificates or permits required for specific goods. Ensuring that all documentation is complete, accurate, and organized is crucial for a smooth clearance process.

Importers or their appointed customs brokers must submit entry documents to the U.S. Customs and Border Protection (CBP) via the Automated Commercial Environment (ACE) system. Entry documents provide details about the imported goods, such as their description, value, quantity, and country of origin. CBP reviews the entry documents to verify compliance with import regulations and assess duties, taxes, and fees.

CBP assesses duties, taxes, and fees based on the value, classification, and origin of the imported goods. Importers are responsible for paying any applicable duties, taxes, and fees before the goods can be released from customs control. Payments can be made electronically through the ACE system or by other approved methods.

In some cases, CBP may conduct a physical inspection or examination of the imported goods to verify their contents, ensure compliance with safety and security standards, and detect any prohibited or restricted items. Importers must cooperate with CBP officials during the inspection process and provide access to the goods as required.

Upon completion of the clearance process, CBP releases the goods for entry into the United States. Importers receive a customs release notification indicating that the goods have been cleared for release. Importers or their designated agents can then arrange for the retrieval or delivery of the goods from the port of entry.

Importers are required to maintain accurate records of import transactions and supporting documentation for a specified period, typically five years from the date of importation. Proper record-keeping helps demonstrate compliance with customs regulations and facilitates audits or inquiries by CBP.

Importers must remain vigilant about post-clearance compliance obligations, including any ongoing reporting requirements, duty drawback claims, or regulatory updates. Staying informed about changes in customs regulations and industry best practices helps ensure continued compliance and smooth import operations.

Related: What Is HTS Code (Harmonized Tariff Schedule)? A Quick Guide

Even a small mistake during customs clearance can lead to costly delays, penalties, or even shipment seizures. Understanding the most common errors importers make, and how to prevent them, can save time and money while keeping your supply chain running smoothly.

1. Incorrect HS Code Classification: Using the wrong HS code can lead to duty miscalculations and customs delays.

2. Incomplete or Inaccurate Documentation: Missing or mismatched details in invoices or packing lists often cause clearance holds.

3. Under-Declaring the Value of Goods: False or undervalued declarations can trigger heavy fines or shipment seizures.

4. Ignoring Country-Specific Regulations: Overlooking import restrictions or labeling rules may result in rejected shipments.

5. Missing Import Licenses or Permits: Failing to secure necessary licenses for regulated goods delays customs approval.

6. Delayed ISF or Entry Filings: Late filing of import documents can result in costly penalties and shipment delays.

7. Lack of Coordination With Logistics Partners: Poor communication between brokers and carriers increases the risk of clearance errors.

8. Not Using Technology to Track Shipments: Skipping digital tracking tools limits visibility and slows issue resolution.

9. Ignoring Post-Clearance Compliance: Not maintaining import records can lead to penalties during customs audits.

10. Overlooking Duty Relief Programs: Missing eligible FTAs or duty drawback schemes means paying higher import costs.

Related: How To Export Tea From India? A Growing Opportunity

When customs holds your package, it means your shipment is under review to verify its contents, documentation, or compliance with import regulations.

This is a common step in international shipping and doesn’t always indicate a problem, but understanding what happens next can help you respond quickly and avoid unnecessary delays.

1. Inspection and Verification: Customs officials may open the package to inspect its contents, check the declared value, and ensure it matches the shipping documents and HS code.

2. Documentation Review: The commercial invoice, packing list, and certificates of origin are reviewed to confirm product details and assess applicable duties or taxes.

3. Duty and Tax Assessment: If duties, taxes, or import fees are due, customs will calculate them before releasing the shipment. The importer (or their broker) must make payment to proceed.

4. Request for Additional Information: Customs may ask for missing paperwork, product details, or proof of purchase. Promptly submitting these documents helps speed up clearance.

5. Clearance or Detainment: Once the review is complete and all payments are made, the shipment is cleared and forwarded to the destination. However, if the package violates import laws, such as containing restricted or undeclared items, it may be detained, returned, or destroyed.

6. How to Avoid Customs Holds: Always ensure your documentation is accurate, declare the correct value, use proper HS codes, and comply with all import regulations. Working with a licensed customs broker or experienced freight forwarder can also minimize the risk of delays.

Related: What Is A Certificate Of Origin For A Vehicle? Key Details

After CBP clears your goods, importers still have ongoing obligations to maintain compliance and manage post-clearance processes.

1. Record‑Keeping: Importers must keep all import records, including entry summaries, invoices, bills of lading, and permits, for five years from the date of entry. Drawback records should be retained until three years after claim payment. Packing lists generally require 60 days of retention.

2. Compliance Audits & Enforcement: CBP conducts audits on entries from the past five years, focusing on classification, valuation, and country of origin. In 2025, audits are increasingly data-driven, uncovering significant unpaid duties, over USD 310 million detected in March alone.

3. Post‑Clearance Adjustments: Errors in tariff classification, valuation, quantity, or weight can be corrected via post-entry amendments in ACE or by filing a protest, depending on the issue. ACE enhancements in 2025 introduced stricter controls on certain HTS99 duties.

4. Duty Drawback & Refunds: Duty drawback allows recovery of duties on exported or destroyed goods. Claims must be filed electronically via ACE, with stricter eligibility rules in 2025 for certain HTS codes.

5. Trade Compliance Programs: Programs like C‑TPAT, ISA, and AEO offer benefits such as reduced inspections and expedited clearance. Participation demonstrates compliance and can streamline post-clearance procedures.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

Artemus offers a comprehensive solution to simplify the Importer Security Filing (ISF) process and ensure compliance with U.S. Customs and Border Protection (CBP) regulations. The software allows importers to submit accurate and timely filings, reducing the risk of errors and costly penalties.

With automated record-keeping and real-time tracking, importers can maintain all necessary documentation, including invoices, bills of lading, and entry summaries, ready for audits or post-clearance reviews.

The software’s user-friendly interface and robust features streamline operations, saving time and improving efficiency across the supply chain. Trusted by importers and logistics professionals, Artemus is the go-to software for managing ISF compliance and ensuring smooth customs clearance in the USA.

To clear customs in the USA, submit required documentation to U.S. Customs and Border Protection (CBP) via the Automated Commercial Environment (ACE) system, pay applicable duties and taxes, and comply with post-clearance procedures for record-keeping and any necessary modifications or claims.

Customs clearance fees in the USA vary depending on factors such as the value and type of goods being imported, the complexity of the clearance process, and whether a customs broker is used. Fees typically range from $50 to several hundred dollars per shipment.

The customs process in the USA involves submitting entry documents, paying applicable duties and taxes, potential inspection of goods, and receiving clearance from U.S. Customs and Border Protection (CBP) for lawful entry into the country.

The procedure of customs clearance involves submitting required documentation, such as the commercial invoice and bill of lading, to the customs authority, paying any applicable duties and taxes, and undergoing inspection or examination of goods before they are released for entry into the country.

All goods, currency over $10,000, food, plants, and items purchased abroad must be declared to U.S. Customs.

Prohibited items include illegal drugs, certain firearms, endangered species products, and counterfeit or pirated goods.

Navigating the customs clearance process in the USA for goods requires careful planning, attention to detail, and compliance with regulatory requirements. Throughout this guide, we’ve explored the essential steps involved in customs clearance, from preparing documentation to post-clearance procedures.

By understanding the customs clearance process and leveraging resources such as compliance software from Artemus Transportation Solutions, importers can streamline their operations, minimize delays, and ensure compliance with U.S. customs regulations.

Whether you’re importing goods for commercial purposes or personal use, having a solid grasp of customs clearance procedures is essential for a successful import operation.

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.