How To Import Goods For Resale In The USA? A 2025 Guide

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Filing AMS (Automated Manifest System) for shipments bound for the United States is a vital step in the import process. Understanding the requirements and procedures of AMS filing is crucial for importers and carriers to ensure compliance, expedite customs clearance, and maintain a smooth flow of trade. In this blog, we will provide you with a concise yet comprehensive guide on how to file AMS for USA shipments.

From gathering the necessary information to choosing the suitable filing method, we will walk you through the step-by-step process, highlighting key considerations and best practices along the way. Whether you’re new to AMS filing or looking to enhance your knowledge, this blog will equip you with the essential knowledge and insights to navigate the AMS filing process successfully. So, let’s dive in and discover the necessary steps to file AMS for your USA shipments effectively.

Artemus offers a comprehensive Automated Manifest System (AMS) software solution, providing robust compliance support for streamlined AMS filing and efficient customs operations.

Table Of Contents

The Automated Manifest System (AMS) is a vital component of the import process for shipments entering the United States. To ensure smooth customs clearance and compliance with the law, it is crucial to understand the AMS requirements and regulations.

AMS is governed by various regulatory bodies and agencies, including U.S. Customs and Border Protection (CBP) & the U.S. Department of Homeland Security (DHS). These entities enforce regulations to enhance border security, facilitate trade, and ensure accurate and timely data submission.

As an importer or carrier, it is your responsibility to comply with AMS filing obligations. This includes providing accurate and complete information about your shipment, such as bill of lading (B/L) details, cargo descriptions, and consignee information. Failure to meet filing requirements or submitting erroneous data can lead to delays, penalties, or even shipment holds.

Timely submission of AMS filings is crucial. The exact timelines depend on the mode of transport and vessel type. For example, ocean shipments typically require AMS filing 24 hours before vessel departure, while air shipments have different timeframes. It is essential to stay updated on the specific timelines to ensure compliance.

Complying with AMS requirements offers several benefits. It helps expedite the customs clearance process, reduces the risk of shipment holds or examinations, and enhances supply chain visibility. AMS compliance also contributes to improved security measures and enables efficient risk assessment by customs authorities.

Related: AMS Filing Requirements For Importers, Carriers, & NVOCCs

When it comes to filing AMS (Automated Manifest System) for shipments to the United States, gathering accurate and essential information is crucial. The AMS filing process requires specific data elements to ensure compliance and facilitate efficient customs clearance. Here are some key aspects to consider when gathering information for AMS filing:

Related: A Quick Guide On Import Security Filing: What Is ISF?

When it comes to filing AMS (Automated Manifest System) for shipments to the United States, importers and carriers have two primary options: self-filing or utilizing a customs broker or freight forwarder. Each method has its pros and cons, and selecting the right approach depends on various factors. Here’s a closer look at the two options to help you make an informed decision:

Self-filing AMS allows importers or carriers to handle the entire filing process independently. It offers more control and flexibility, especially for those with in-house expertise in customs compliance and AMS procedures. Self-filing can be cost-effective and allows for direct management of data accuracy and submission timelines.

However, self-filing requires a thorough understanding of the AMS system, regulations, and ongoing updates. It also demands resources, including dedicated personnel and the necessary technology infrastructure to connect with the AMS platform. It’s crucial to assess whether your organization has the expertise, resources, and bandwidth to handle self-filing effectively.

Utilizing a customs broker or freight forwarder involves outsourcing the AMS filing process to a professional service provider. Customs brokers are licensed professionals well-versed in customs regulations, procedures, and AMS requirements. They can handle AMS filing on your behalf, ensuring compliance and timely submission.

Working with a customs broker or freight forwarder can alleviate the burden of managing AMS filing internally. They bring expertise and industry knowledge, reducing the risk of errors or non-compliance. By leveraging their services, you can focus on your core business operations while relying on their experience and support.

Ultimately, the choice between self-filing and outsourcing AMS filing depends on your organization’s specific needs, resources, and expertise. Assess your capabilities, evaluate the complexity of your shipments, and consider the cost-effectiveness and potential risks of each approach.

Related: AMS Fee In Shipping: Overview & 5 Key Considerations

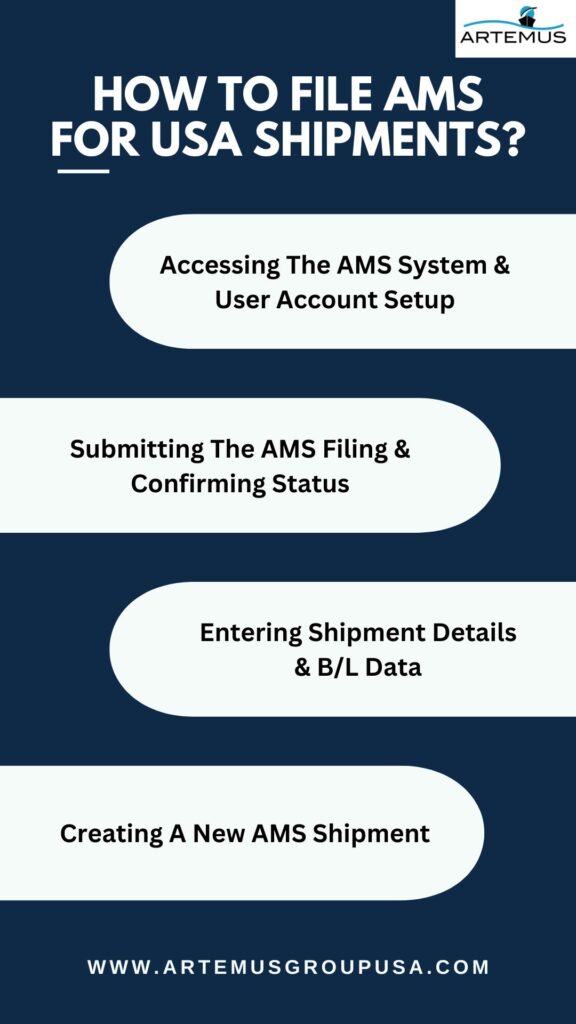

Filing AMS (Automated Manifest System) for shipments to the United States requires careful attention to detail and adherence to specific procedures. Follow this step-by-step guide to ensure a smooth and successful AMS filing process:

Related: A Quick Guide On Import Security Filing: What Is ISF?

Artemus is the ultimate software solution for AMS (Automated Manifest System) filings, making the process efficient, accurate, and hassle-free. With its advanced features and user-friendly interface, Artemus stands out as the best choice for importers and carriers looking to streamline their AMS filing operations.

Artemus offers a comprehensive set of tools specifically designed to simplify the AMS filing process. Its intuitive user interface makes it easy to navigate through the system, enter shipment details, and submit filings with just a few clicks. The software ensures compliance with AMS regulations by validating data accuracy and completeness, reducing the risk of errors or omissions that could lead to customs delays or penalties.

Moreover, Artemus provides real-time updates and status notifications, keeping users informed about the progress of their AMS filings. The software also offers robust reporting capabilities, allowing users to generate comprehensive reports for auditing and analysis purposes. With Artemus, importers and carriers can have peace of mind, knowing that their AMS filings are in safe hands and that they have a reliable software solution to rely on for their compliance needs.

Related: AMS Filing Penalty Cost: Most Common Pitfalls & Solutions

To file AMS for shipping, gather shipment details, and submit the filing electronically through the AMS system for compliance with customs regulations.

The AMS rule for the USA requires importers and carriers to electronically provide detailed cargo information to the Automated Manifest System (AMS) before arrival, ensuring efficient customs processing and security measures.

Importers or their authorized agents, such as customs brokers or freight forwarders, are responsible for submitting the AMS filing on behalf of the shipments entering the United States.

Filing AMS (Automated Manifest System) for USA shipments is a crucial task for importers and carriers. By understanding the process and following the steps outlined in this blog, you are now well-equipped to navigate the AMS filing requirements successfully. Remember to gather accurate information, choose the right filing method, and stay updated with the latest regulations.

Filing AMS may initially seem daunting, but with practice and adherence to best practices, you can streamline your customs operations and ensure the smooth clearance of your shipments. By maintaining compliance, you contribute to efficient trade processes and minimize the risk of delays or penalties.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Cargo agents are the backbone of the global logistics and shipping industries, managing the complex web of tasks that ensure

Ocean container dimensions are essential for efficient global shipping, ensuring that goods are transported safely and cost-effectively. Understanding container sizes,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.