What Does The US Export To Switzerland? Trade Insights

International trade between the United States and Switzerland highlights the strong economic relationship between the two nations. With its highly

Filing AMS (Automated Manifest System) for shipments bound for the United States is a vital step in the import process. Understanding the requirements and procedures of AMS filing is crucial for importers and carriers to ensure compliance, expedite customs clearance, and maintain a smooth flow of trade.

In this blog, we will provide you with a concise yet comprehensive guide on how to file AMS for USA shipments. From gathering the necessary information to choosing the suitable filing method, we will walk you through the step-by-step process, highlighting key considerations and best practices along the way.

Moreover, Artemus offers a comprehensive Automated Manifest System (AMS) software solution, providing robust compliance support for streamlined AMS filing and efficient customs operations.

Table Of Contents

The Automated Manifest System (AMS) is a important aspect of the U.S. import process, designed to streamline cargo entry and enhance border security. A proper understanding of AMS requirements is essential for ensuring compliance, avoiding delays, and maintaining smooth supply chain operations.

AMS is managed primarily by U.S. Customs and Border Protection (CBP) under the oversight of Department of Homeland Security (DHS). CBP enforces AMS regulations to promote trade efficiency, protect national security, and ensure timely, accurate cargo data submission.

Carriers, NVOCCs, and freight forwarders must submit detailed shipment information through AMS. This includes the bill of lading number, cargo descriptions, shipper/consignee details, and container numbers. Inaccurate or incomplete filings can result in shipment holds, fines, or denied entry.

Timely submission is crucial. For ocean freight, AMS data must be filed at least 24 hours before vessel departure from the foreign port. Filing timelines vary for other transport modes (e.g., air, rail, truck), so staying current with CBP requirements is key to avoiding penalties.

Complying with AMS regulations facilitates faster customs clearance, reduces inspection risks, and improves cargo visibility across the supply chain. It also enhances security through more accurate risk assessments by customs authorities.

Related: AMS Filing Requirements For Importers, Carriers, & NVOCCs

When it comes to filing AMS (Automated Manifest System) for shipments to the United States, gathering accurate and essential information is crucial. The AMS filing process requires specific data elements to ensure compliance and facilitate efficient customs clearance. Here are some key aspects to consider when gathering information for AMS filing:

Related: A Quick Guide On Import Security Filing: What Is ISF?

When it comes to filing AMS (Automated Manifest System) for shipments to the United States, importers and carriers have two primary options: self-filing or utilizing a customs broker or freight forwarder. Each method has its pros and cons, and selecting the right approach depends on various factors. Here’s a closer look at the two options to help you make an informed decision:

Self-filing AMS allows importers or carriers to handle the entire filing process independently. It offers more control and flexibility, especially for those with in-house expertise in customs compliance and AMS procedures. Self-filing can be cost-effective and allows for direct management of data accuracy and submission timelines.

However, self-filing requires a thorough understanding of the AMS system, regulations, and ongoing updates. It also demands resources, including dedicated personnel and the necessary technology infrastructure to connect with the AMS platform. It’s crucial to assess whether your organization has the expertise, resources, and bandwidth to handle self-filing effectively.

Utilizing a customs broker or freight forwarder involves outsourcing the AMS filing process to a professional service provider. Customs brokers are licensed professionals well-versed in customs regulations, procedures, and AMS requirements. They can handle AMS filing on your behalf, ensuring compliance and timely submission.

Working with a customs broker or freight forwarder can alleviate the burden of managing AMS filing internally. They bring expertise and industry knowledge, reducing the risk of errors or non-compliance. By leveraging their services, you can focus on your core business operations while relying on their experience and support.

Ultimately, the choice between self-filing and outsourcing AMS filing depends on your organization’s specific needs, resources, and expertise. Assess your capabilities, evaluate the complexity of your shipments, and consider the cost-effectiveness and potential risks of each approach.

Related: AMS Fee In Shipping: Overview & 5 Key Considerations

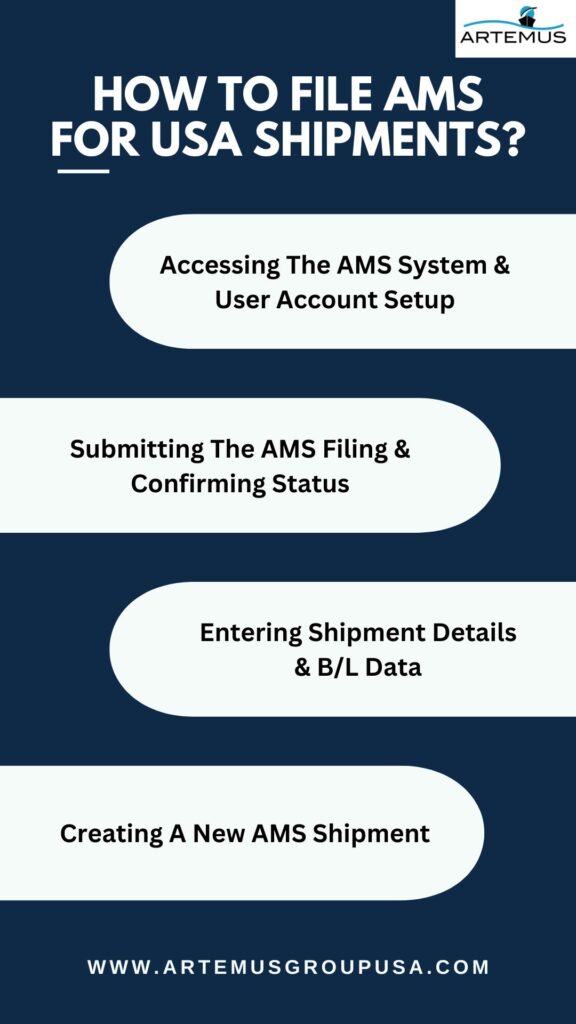

Filing AMS (Automated Manifest System) for shipments to the United States requires careful attention to detail and adherence to specific procedures. Follow this step-by-step guide to ensure a smooth and successful AMS filing process:

Related: A Quick Guide On Import Security Filing: What Is ISF?

Artemus simplifies AMS (Automated Manifest System) filings with a powerful, user-friendly platform built for importers and carriers. Designed for efficiency and accuracy, it streamlines the entire filing process from data entry to submission, while ensuring full compliance with CBP regulations.

With real-time status updates, built-in data validation, and comprehensive reporting tools, Artemus minimizes errors, reduces delays, and keeps your operations running smoothly. Whether you’re managing high volumes or complex shipments, Artemus is the reliable AMS software you can count on.

Related: AMS Filing Penalty Cost: Most Common Pitfalls & Solutions

To file AMS for shipping, gather shipment details, and submit the filing electronically through the AMS system for compliance with customs regulations.

The AMS rule for the USA requires importers and carriers to electronically provide detailed cargo information to the Automated Manifest System (AMS) before arrival, ensuring efficient customs processing and security measures.

Importers or their authorized agents, such as customs brokers or freight forwarders, are responsible for submitting the AMS filing on behalf of the shipments entering the United States.

Filing AMS (Automated Manifest System) for USA shipments is a crucial task for importers and carriers. By understanding the process and following the steps outlined in this blog, you are now well-equipped to navigate the AMS filing requirements successfully. Remember to gather accurate information, choose the right filing method, and stay updated with the latest regulations.

Filing AMS may initially seem daunting, but with practice and adherence to best practices, you can streamline your customs operations and ensure the smooth clearance of your shipments. By maintaining compliance, you contribute to efficient trade processes and minimize the risk of delays or penalties.

International trade between the United States and Switzerland highlights the strong economic relationship between the two nations. With its highly

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.