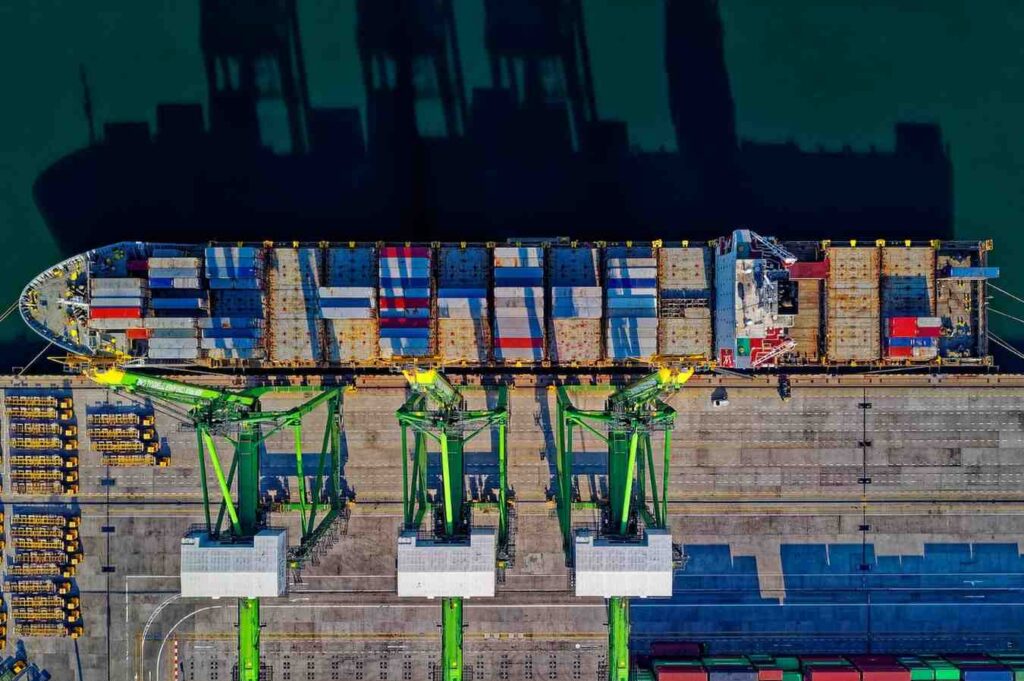

What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Navigating the complex world of international shipping involves various considerations, and one critical aspect is understanding the cost associated with Importer Security Filing (ISF) bonds. Importers must be well-informed about these costs, as they play a pivotal role in ensuring compliance with U.S. Customs and Border Protection (CBP) regulations while managing expenses efficiently.

As importers seek to strike a balance between adhering to ISF requirements and optimizing their financial operations, this blog will delve into the factors influencing ISF bond costs and offer valuable insights on how to calculate and potentially reduce these expenses. Moreover, it’s worth noting that Artemus provides ISF and AMS software solutions, streamlining the compliance process for importers and enhancing their supply chain efficiency.

Table Of Contents

The cost associated with an Importer Security Filing (ISF) bond is a crucial consideration for importers. An ISF bond serves as a financial guarantee to U.S. Customs and Border Protection (CBP) that the importer will comply with all ISF requirements. Understanding the ISF bond cost is essential for importers looking to streamline their operations and minimize expenses.

ISF bond costs can vary depending on several factors, including the type of bond, the coverage required, and the provider you choose. Here’s a breakdown of typical ISF bond costs:

Related: ISF Filing Requirements: Important Facts & Documents

The ISF bond cost is a crucial factor for importers for several reasons:

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

The cost of an Importer Security Filing (ISF) bond is not set in stone; it can vary significantly based on various factors. Understanding these factors is crucial for importers seeking to manage their expenses effectively. Here are the key factors that influence ISF bond cost:

The type of ISF bond you choose has a significant impact on the cost. There are three primary types: Single Entry Bonds, Continuous ISF Bonds, and Continuous Importer/Broker Bonds. Single-entry bonds are cheaper because they cover only one transaction, while Continuous Bonds offer ongoing coverage for a set period, making them more expensive.

The amount of coverage required can vary based on the value of your shipments. Higher-value shipments typically require more coverage, which can increase the bond cost. It’s essential to accurately assess your coverage needs to avoid overpaying or underinsuring.

Your compliance history plays a role in determining ISF bond cost. Importers with a history of timely ISF filings and compliance with customs regulations may be eligible for lower bond premiums as they are considered lower risk.

The agency or provider you choose to issue your ISF bond matters. Different providers may offer varying rates and fees. It’s advisable to shop around and compare quotes from different surety/insurance agencies, customs brokers, or freight forwarders to find the most competitive rates.

Importers with a high volume of shipments may have different cost considerations than those with occasional shipments. Your shipping frequency can impact your choice of bond type and, subsequently, the overall cost.

For Continuous ISF Bonds and Continuous Importer/Broker Bonds, the duration of coverage can vary (usually one year). The longer the coverage period, the higher the upfront cost, but it may offer savings compared to renewing single-entry bonds for each shipment.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

Calculating the cost of an Importer Security Filing (ISF) bond is a straightforward process that depends on a few key variables. Here’s a simplified guide:

Related: What Does ISF Stand For In Shipping? The 10+2 Rule Explained

Reducing ISF bond costs is a strategic move for importers seeking to optimize their shipping expenses. Here are three effective ways to achieve savings and enhance financial efficiency:

1. Optimize Bond Type: To lower your ISF bond cost, select the most suitable bond type for your import volume. If you have frequent shipments, consider a Continuous Importer/Broker Bond, which often provides more coverage at a lower overall cost compared to single-entry bonds for each transaction. Carefully evaluate your shipping needs to make an informed choice.

2. Enhance Compliance: A strong track record of compliance with ISF regulations can lead to lower bond premiums. Ensure timely and accurate ISF filings for your shipments. Implementing robust compliance procedures and measures within your supply chain can mitigate risk factors that affect your bond cost.

3. Negotiate With Providers: Don’t hesitate to negotiate with bond providers, such as surety/insurance agencies, customs brokers, or freight forwarders. Seek competitive rates and fee structures. Leverage your compliance history and shipping volume to negotiate more favorable terms. Comparing quotes from multiple providers can also help you identify the most cost-effective option.

Related:ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

Artemus is the trusted choice for importers seeking top-notch AMS (Automated Manifest System) and ISF (Importer Security Filing) software solutions. With a proven track record in the industry, Artemus offers cutting-edge technology that streamlines the compliance process, ensuring seamless and efficient customs filings. The user-friendly platform empowers importers to meet U.S. Customs and Border Protection (CBP) regulations with ease, reducing the risk of penalties while optimizing supply chain operations.

Related – ISF Form (Import Security Filling): Elements & Top Practices

Yes, in most cases, importers are required to have a bond to file an Importer Security Filing (ISF) with U.S. Customs and Border Protection (CBP). The bond serves as a financial guarantee to ensure compliance with ISF regulations and responsibilities.

The bond for ISF, or Importer Security Filing, is a financial guarantee that importers provide to U.S. Customs and Border Protection (CBP) to ensure compliance with ISF requirements. It serves as a commitment to fulfill obligations related to timely and accurate ISF filings.

The bond fee for shipping, including Importer Security Filing (ISF) bonds, can vary widely depending on factors such as bond type, coverage amount, and provider. Typically, ISF bond fees range from $50 to $550 or more.

In the world of international shipping, understanding and managing ISF bond costs is paramount for importers. As we conclude our exploration of this crucial topic, it’s evident that ISF bond costs are not one-size-fits-all. Instead, they vary based on factors like bond type, coverage, compliance history, and provider choice.

However, armed with knowledge and informed decision-making, importers can strategically approach ISF bond costs. Whether it’s optimizing bond types, enhancing compliance practices, or negotiating with providers, there are concrete steps importers can take to mitigate expenses while ensuring smooth customs clearance and compliance with U.S.

Related: ISF Filing Online: A Beginner’s Guide To Your Import Process

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.