What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In the intricate world of international trade, regulatory measures are the compass guiding the smooth flow of goods across borders. One such crucial component is the Importer Security Filing (ISF), an imperative process designed to enhance the security of shipments entering the United States. Also known as 10+2, this filing requirement demands timely and accurate submission of specific information about cargo before it reaches U.S. ports.

As we set sail into the depths of understanding ISF filing, this blog aims to demystify its complexities, shedding light on who needs to file, the key components of the filing process, and the implications of compliance.

Moreover, as compliance becomes the anchor for successful international trade ventures, technology emerges as a trusted ally. In this realm, Artemus Transportation Solutions takes the helm, offering a state-of-the-art ISF software solution. Tailored to meet the intricate requirements of ISF filing, their software ensures not only accuracy and efficiency but also peace of mind for importers, brokers, and other entities involved in the importation process.

Table Of Contents

ISF, or Importer Security Filing, is a critical process in U.S. international trade. Also known as the 10+2 program, ISF filing mandates importers to submit key cargo information 24 hours before loading onto an ocean vessel.

This data includes shipper details, consignee information, commodity specifics, and voyage details. The objective is to bolster border security and expedite customs clearance by enabling the U.S. Customs and Border Protection to assess potential risks associated with incoming shipments.

Compliance is essential, as errors or omissions may lead to penalties and shipment delays, underscoring the importance of understanding and meeting ISF filing requirements for businesses involved in global trade.

Related: ISF 5: Meaning, Compliance Requirements, & Best Practices

Navigating the intricacies of Importer Security Filing (ISF) is essential for a seamless international trade process. Here’s a concise breakdown of the key elements and data requirements integral to the ISF process:

1. Shipper’s Information: Full name and address of the entity shipping the goods.

2. Consignee Details: Complete information about the entity receiving the shipment in the United States.

3. Manufacturer (or Supplier) Details: Name and address of the entity manufacturing or supplying the goods, if different from the shipper.

4. Seller’s Information: Details about the entity selling the goods to the U.S. buyer, if different from the shipper or manufacturer.

5. Buyer’s Information: Full details of the U.S. buyer, including name and address.

6. Importer of Record Number (IOR): The unique identification number is assigned to the entity responsible for customs clearance.

7. HTSUS Code: Harmonized Tariff Schedule of the United States code for imported goods.

8. Country of Origin: The country where the goods were produced.

9. Consolidator (Stuffer) Details: Information about the party responsible for stuffing the container.

10. Container Stuffing Location: Location where the container is stuffed.

11. Vessel Voyage Information: Details about the vessel carrying the goods, including name and voyage number.

12. Bill of Lading Number: The unique identifier for the shipment.

Related: ISF 5 Filing Requirements: Data Elements & Audit Process

The Importer Security Filing (ISF), also known as 10+2, is a crucial component of the U.S. Customs and Border Protection’s (CBP) risk assessment strategy. It requires certain information about cargo destined for the United States to be submitted in advance of the goods arriving at a U.S. port. While not everyone involved in international trade is required to file an ISF, there are specific entities that must adhere to this regulatory requirement.

The primary responsibility for filing the ISF lies with the “Importer of Record.” This is the party responsible for ensuring that the goods comply with all laws and regulations and for paying any duties owed on the imported items.

NVOCCs, entities that consolidate smaller shipments into larger containers for ocean transport, are also required to file ISF. They must provide information about the consolidated cargo they are handling.

VOCCs, the companies that operate the vessels transporting goods, are responsible for submitting ISF for the containers they transport. This filing includes information about the vessel itself, its voyage, and the cargo being carried.

Freight forwarders, entities that arrange for the transportation of goods but do not take ownership of the products, are obligated to file ISF on behalf of their clients.

Customs brokers, individuals, or entities licensed by CBP to assist importers with the clearance of goods through customs, also play a role in ISF filing. They may file on behalf of the importer or coordinate with other parties involved in the shipment.

Importers have the option to designate a third party, such as a customs broker or another authorized agent, to file the ISF on their behalf.

Related: ISF Fees (Import Security Filing): When & How To Pay?

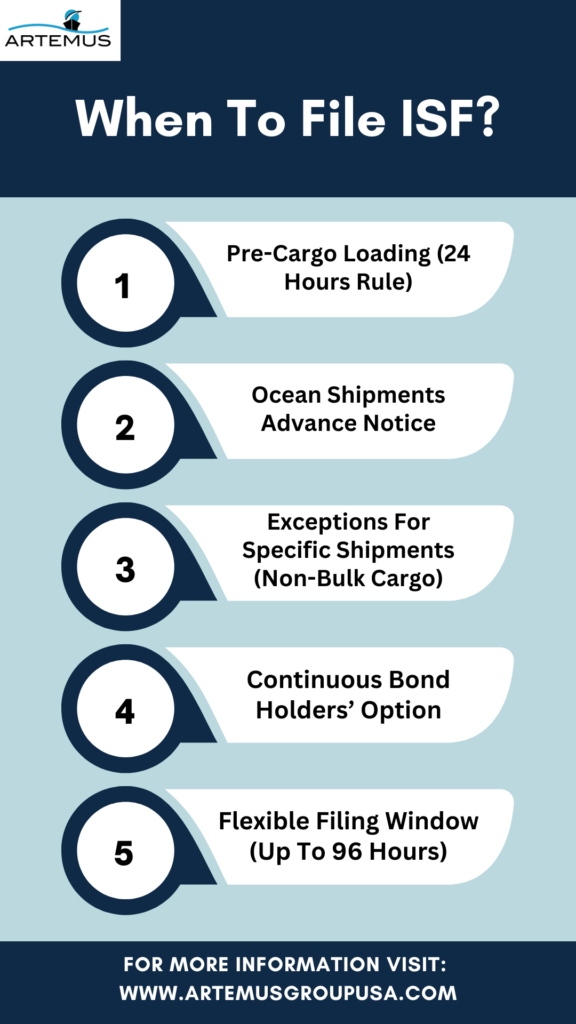

Navigating the intricacies of international trade demands a keen understanding of Importer Security Filing (ISF) timelines. Here’s a detailed breakdown of when and how to file ISF:

Before cargo is loaded onto an ocean vessel bound for the U.S., ISF submission is mandatory and must occur at least 24 hours in advance. This lead time ensures customs authorities have adequate time for risk assessment, promoting security and efficiency in the supply chain.

ISF is specifically tailored for ocean shipments, providing authorities with crucial advance information. This early notice aids in evaluating potential risks associated with the incoming cargo, contributing to enhanced border security measures.

For non-bulk cargo arriving by truck, rail, or air, the ISF deadline differs. In these cases, the filing must be completed one hour before the goods reach the United States, accommodating the distinct nature of these transport modes.

Importers with continuous bonds have the flexibility to file a single ISF covering multiple shipments. This option streamlines the process for frequent importers, reducing administrative burden while ensuring compliance with ISF requirements.

While the standard filing time is 24 hours, a flexible window allows adjustments up to 96 hours before cargo loading. This accommodates unforeseen circumstances or delays in obtaining necessary information, emphasizing the importance of early and accurate filing to prevent penalties and ensure a seamless customs clearance process.

Related: How To Check ISF Filing Status? A Step-By-Step Guide

Navigating the complex landscape of international trade requires adherence to crucial regulations, with Importer Security Filing (ISF) being a key aspect. Here are the best practices for ensuring smooth and compliant ISF filing:

1. Early Filing: Submit the ISF at least 24 hours before cargo loading to provide ample time for authorities to assess potential risks and facilitate a seamless customs clearance process.

2. Accurate Information: Ensure all information provided in the ISF is accurate and up-to-date, including shipper details, consignee information, and commodity specifics, to avoid penalties and delays.

3. Collaboration With Partners: Foster effective communication with suppliers, shippers, and authorized agents to obtain necessary information promptly, enhancing the efficiency of the ISF filing process.

4. Continuous Monitoring And Updates: Regularly monitor shipments and update the ISF if there are changes to the initial information, maintaining compliance and transparency throughout the shipping process.

5. Utilize Technology: Leverage advanced customs broker software, such as Artemus Transportation Solutions, to streamline ISF filing processes, automate documentation, and enhance overall efficiency in managing international trade operations.

6. Stay Informed About Regulatory Changes: Keep abreast of any changes in customs regulations to ensure continued compliance, avoiding potential issues and ensuring a smooth flow of goods across borders.

7. Maintain Proper Documentation: Keep thorough records of ISF filings and related documentation, facilitating audits and providing a clear trail of compliance for regulatory purposes.

8. Training & Education: Invest in training and educating staff involved in the ISF filing process to stay informed about best practices, regulatory updates, and the efficient use of customs broker software.

9. Review Internal Processes: Regularly review and update internal processes related to ISF filing to identify areas for improvement and enhance overall efficiency in customs compliance.

10. Engage With Customs Brokers: Collaborate with experienced customs brokers to navigate complex regulations, receive guidance on best practices, and ensure that ISF filings align with current compliance standards.

Related: ISF Late Filing Fee: Exact Cost & 6 Tips To Manage Appeals

Artemus Transportation Solutions stands out as offering ISF filing software, & provides a cutting-edge solution for seamless compliance in international trade. With its advanced features and user-friendly interface, Artemus simplifies the complexities of Importer Security Filing (ISF) by automating documentation processes and ensuring accuracy in data submission.

This comprehensive software not only facilitates early filing, a crucial aspect of ISF compliance but also enhances collaboration among stakeholders, including suppliers and authorized agents. By leveraging Artemus, businesses can efficiently navigate the intricacies of ISF filing, stay informed about regulatory changes, and maintain a transparent and compliant approach to customs procedures, making it an indispensable tool for optimizing global trade operations.

Related: ISF Bond Cost Breakdown & Management For Import Success

The purpose of ISF (Importer Security Filing) is to enhance the security of the U.S. supply chain by requiring advance submission of essential cargo information, enabling authorities to assess and mitigate potential risks associated with incoming shipments.

The responsibility for Importer Security Filing (ISF) lies with the party receiving the imported goods, typically the importer or consignee.

ISF filing is typically done by the importer or an authorized agent, such as a licensed customs broker, acting on behalf of the importer.

In summary, Importer Security Filing (ISF) is the backbone of secure and efficient international trade. Timely and accurate information submission is not just a requirement but a strategic imperative for the seamless flow of goods. Whether undertaken directly by importers or through authorized agents like customs brokers, the commitment to transparent data submission is crucial.

Artemus Transportation Solutions further elevates this process, emphasizing that ISF compliance is not just about adherence but a driver of operational excellence in the dynamic landscape of global trade.

Related: Late ISF Filing: What To Do If Missed The Deadline?

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.