What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Navigating the complexities of international shipping requires understanding key compliance processes—one of which is the Importer Security Filing (ISF). Mandatory for all ocean shipments entering the United States, ISF ensures that U.S. Customs and Border Protection (CBP) receives vital shipment information in advance. Missing or incorrect filings can lead to hefty fines, shipment delays, or cargo holds.

In this detailed step-by-step guide, we’ll break down the entire ISF filing process, ensuring you know exactly what information is required, who is responsible, and how to avoid common pitfalls. Whether you’re an importer, freight forwarder, or customs broker, this guide will help streamline your compliance efforts.

To simplify and automate the filing process, Artemus Transportation Solutions offers advanced ISF, AMS, and AES software, designed to ensure seamless compliance with U.S. import regulations. Stay compliant and efficient with Artemus—your trusted partner for transportation solutions.

Table Of Contents

The Importer Security Filing (ISF) process is a mandatory requirement by U.S. Customs and Border Protection (CBP) for ocean shipments entering the United States. Commonly referred to as “10+2,” it requires importers to submit ten key pieces of data about their cargo, and carriers to provide two additional data elements. This information helps CBP assess potential security risks and ensure smooth cargo clearance.

The ISF must be filed at least 24 hours before the goods are loaded onto a vessel destined for the U.S. Key details include the seller’s name, buyer’s name, importer of record, consignee number, manufacturer information, and Harmonized Tariff Schedule (HTS) codes. Accurate and timely submission is critical, as late or incorrect filings can lead to fines of up to $5,000 per violation, shipment delays, or cargo holds.

Related: ISF Form (Import Security Filling): Elements & Top Practices

The primary responsibility for the ISF (Importer Security Filing) process lies with the importer of record or their authorized agent, such as a licensed customs broker. The importer is accountable for ensuring that the required shipment information is accurately submitted to U.S. Customs and Border Protection (CBP) at least 24 hours before the cargo is loaded onto a vessel bound for the United States.

In some cases, the foreign supplier or freight forwarder may assist by providing necessary details, but the ultimate responsibility for timely and accurate filing rests with the importer. Carriers are also responsible for submitting additional data related to the vessel and cargo.

To streamline the filing process and reduce the risk of errors, importers can utilize automated ISF filing solutions like those offered by Artemus Transportation Solutions, ensuring compliance with U.S. import regulations.

Related: ISF Fees (Import Security Filing): When & How To Pay?

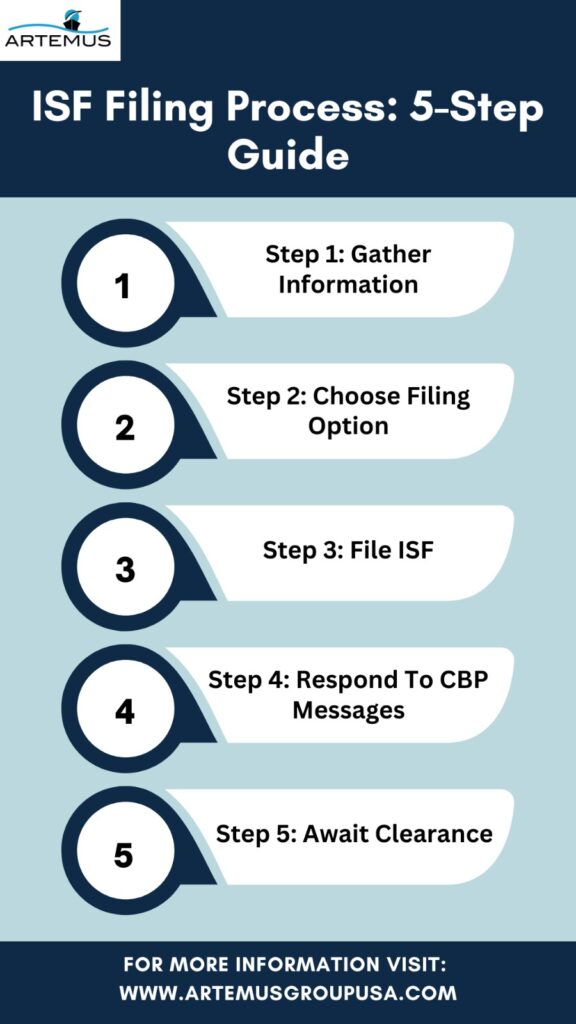

The Importer Security Filing (ISF), or 10+2 filing, is required by U.S. Customs and Border Protection (CBP) for importers to provide key shipment details prior to arrival in the U.S. This improves security and risk assessment. Follow this 5-step ISF guide:

Collect essential details about the imported goods, such as the shipper’s name, consignee’s information, seller’s name and address, buyer’s name and address, and a detailed description of the goods.

Decide whether to file the ISF yourself or through a licensed customs broker. Brokers are well-versed in the process and can ensure accurate and timely submissions.

Submit the ISF to the U.S. Customs and Border Protection (CBP) at least 24 hours before the cargo is loaded onto the vessel at the foreign port. Include accurate details, like the bill of lading number, container number, and estimated arrival information.

Be attentive to any messages or inquiries from CBP regarding the ISF filing. Respond promptly and address any requested clarifications or corrections.

Once CBP reviews and accepts the ISF, your cargo can proceed to its U.S. destination. Compliance with the ISF filing requirements ensures a smoother customs clearance process upon arrival.

Remember, ISF is crucial for imports. If unsure, work with a skilled Customs Broker for guidance. Stay updated on CBP rules and changes.

Related: Who Is Responsible For Filing The ISF? Know The Key Roles

The Importer and various other parties play distinct roles in the Importer Security Filing (ISF) process. Each party has specific responsibilities to ensure the accurate and timely submission of the required information to U.S. Customs and Border Protection (CBP). Here’s an overview of the roles of the importer and other relevant parties:

Effective coordination and communication among these parties ensure compliance and a smooth import process. Customs Brokers often guide importers through customs intricacies for accurate and timely ISF submissions.

Related: What Is ISF Bond? Types, Cost, & Components To Know

The Importer Security Filing (ISF) process can be complex, and there are potential challenges and mistakes that importers may encounter. Being aware of these challenges and taking proactive measures to avoid common mistakes is essential for a smooth ISF filing process. Here are some potential challenges and mistakes to watch out for:

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

The Importer Security Filing (ISF) requirements apply to various modes of transport, including ocean freight, air freight, rail, and trucking. While the fundamental ISF process remains similar across these modes, there are specific considerations to keep in mind for each mode. Here’s an overview of ISF filing for different modes of transport:

1. Ocean Freight: ISF filing for ocean freight involves providing key shipment details to U.S. Customs and Border Protection (CBP) before the cargo is loaded onto the vessel. Some considerations include:

2. Air Freight: ISF filing for air freight is generally similar to ocean freight, but there are differences due to the nature of air transportation:

3. Rail Freight: Rail transportation has unique requirements for ISF filing:

4. Trucking (Land Transport): While ISF filing is primarily associated with ocean and air transport, certain situations may require ISF information for land transport:

In all modes of transport, the core steps of gathering accurate information about the shipment, selecting the filing method (self-filing or using a Customs Broker), and submitting the ISF within the specified timeframe remain consistent. However, due to the different logistics involved in each mode, the specific details required may vary.

It’s crucial to work closely with your chosen Customs Broker or logistics provider to ensure that you’re following the correct ISF procedures for the specific mode of transport you’re utilizing. Additionally, stay informed about any mode-specific requirements and updates from CBP or relevant authorities to ensure compliance and a smooth import process.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

After the initial Importer Security Filing (ISF) submission, there are several post-filing procedures and considerations that importers should be aware of to ensure a smooth import process. Here are some key steps and actions to take after completing the ISF filing:

Overall, the post-filing procedures involve staying vigilant, maintaining effective communication, and collaborating closely with your chosen Customs Broker to address any developments and ensure a successful import process. Adhering to these steps will help minimize potential issues and keep your import operations running smoothly.

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

Staying compliant with U.S. import and export regulations is crucial for seamless international trade. Artemus Transportation Solutions offers advanced ISF, AMS, and AES filing software designed to simplify and automate the compliance process.

Whether it’s ensuring timely Importer Security Filing (ISF), accurate Automated Manifest System (AMS) submissions, or seamless Automated Export System (AES) filings, Artemus provides efficient solutions that reduce errors and prevent costly delays.

With user-friendly interfaces, real-time tracking, and automated data validation, Artemus software ensures that every filing meets U.S. Customs and Border Protection (CBP) requirements. Trusted by industry professionals, Artemus is the go-to solution for businesses seeking reliable, compliant, and efficient shipping operations.

Related: ISF Declaration: Meaning, Purpose, Timeline, & Process

ISF filing requires importers to submit key shipment information, including parties involved, goods description, and more, to U.S. Customs and Border Protection (CBP) before cargo arrives in the U.S., enhancing security and risk assessment.

You can file an ISF shipment by entering accurate details into the Automated Commercial Environment (ACE) portal or having a licensed Customs Broker handle the submission.

Documents needed to file an ISF include importer information, consignee details, seller and buyer information, manufacturer details, ship-to party, and specifics about the imported goods, such as HS code, quantity, weight, and value.

The ISF (Importer Security Filing) process involves submitting detailed information about cargo shipments to U.S. Customs and Border Protection (CBP) at least 24 hours before goods are loaded onto a vessel bound for the USA.

AMS (Automated Manifest System) filing is the process of electronically submitting cargo information to CBP for shipments entering or leaving the USA, ensuring efficient customs clearance and cargo tracking.

ISF 5 is typically filed by carriers or freight forwarders for goods transiting through the USA or remaining in bonded warehouses, ensuring CBP has the necessary shipment data.

ISF stands for Importer Security Filing, a U.S. Customs requirement mandating importers to submit shipment details for ocean cargo prior to loading.

The ISF filing fee varies but typically ranges from $30 to $100 per filing, depending on the service provider.

Key details required for ISF filing include the seller’s name, buyer’s name, importer of record, consignee number, manufacturer information, HTS code, container stuffing location, and ship-to party details.

The importer or their authorized customs broker is responsible for ensuring timely and accurate ISF filing with CBP.

The primary purpose of the ISF is to enhance U.S. homeland security by allowing CBP to identify high-risk shipments and prevent unlawful cargo entry.

Late ISF filings can result in fines of up to $5,000 per violation, shipment delays, or cargo holds by CBP.

The ISF plays a critical role in facilitating secure and efficient trade by providing CBP with advance shipment information for risk assessment.

ISF filing costs typically range from $30 to $100, depending on the service provider and the complexity of the shipment.

The ISF is created and submitted by the importer or their authorized agent, such as a customs broker.

Certain shipments, like bulk cargo, goods transported by air, or cargo in transit through the USA, may be exempt from ISF filing requirements.

The ISF functions to enhance cargo security, ensure regulatory compliance, and facilitate smoother customs processing for ocean imports into the USA.

While ISF itself does not involve duties, proper ISF filing ensures customs duties are accurately assessed based on the provided shipment information.

The Foreign Supplier Verification Process (FSVP) involves ensuring that imported food products meet U.S. safety standards, verifying supplier compliance, and maintaining proper documentation.

In conclusion, the ISF filing process is a crucial component of the import journey, aimed at enhancing security and risk assessment. By meticulously gathering accurate information, selecting the appropriate filing method, and timely submission, importers can ensure compliance and facilitate smoother cargo clearance.

Whether opting for self-filing or utilizing a Customs Broker, staying informed about changing regulations and maintaining effective communication will lead to a successful ISF filing and an efficient import process overall.

Related: ISF Filing Requirements: Important Facts & Documents

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.