What Does Norway Export To The US? Key Products & Trade Data

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

When navigating the complexities of international trade, understanding various fees and regulations is crucial for smooth and compliant operations. One such fee that every importer to the United States should be familiar with is the Merchandise Processing Fee (MPF).

This fee, imposed by U.S. Customs and Border Protection (CBP), applies to most goods entering the country and is essential for maintaining the efficiency of import processes.

In this blog, we’ll delve into the details of the MPF—what it is, how it’s calculated, and why it’s important for anyone involved in exporting goods to the USA.

Artemus offers comprehensive software solutions that streamline the ISF filings & AMS filing processes, automating critical filing processes to ensure accuracy & compliance with CBP regulations.

Table Of Contents

The Merchandise Processing Fee (MPF) is a charge levied by the U.S. Customs and Border Protection (CBP) on most imports into the United States. It is designed to offset the costs associated with processing goods entering the country and maintaining U.S. customs operations.

Whether you’re a seasoned importer or new to international trade, understanding the MPF is essential for ensuring compliance and managing costs effectively.

Related: What Is Harbor Maintenance Fee (HMF)? A 2024 Guide

The Merchandise Processing Fee (MPF) is a charge levied by the U.S. Customs and Border Protection (CBP) on most imports into the United States. Understanding how it’s charged is crucial for the customs process, as it helps importers accurately estimate costs and ensure compliance with U.S. regulations.

The MPF applies to nearly all imports into the U.S., with a few exceptions, such as certain free trade agreements or specific duty-free goods. Importers, whether they are individuals or businesses, are responsible for paying the MPF on applicable shipments.

The fee is assessed at the time of entry and is typically paid as part of the customs clearance process.

The MPF is calculated based on the value of the imported goods, excluding duties, taxes, and other fees. It is assessed as a percentage of the declared value of the merchandise, but with a minimum and maximum charge that importers should be aware of:

Here’s how the MPF might be charged for different import values:

The MPF is due at the time of entry summary, which is when the final data and payment for the shipment are submitted to CBP. This usually occurs within 10 business days of the entry date. The fee must be paid along with any applicable duties and taxes to clear the goods through customs.

Importers typically pay the MPF electronically through the Automated Commercial Environment (ACE) system, which is the CBP’s portal for processing imports and exports. Payments can be made directly by the importer or through a customs broker who handles the transaction on their behalf.

The MPF is often bundled with other import duties and fees in a single payment to simplify the process.

Related: Customs Clearance Delays In 2024: Top 10 Reasons & Solutions

The Merchandise Processing Fee (MPF) is a charge imposed by U.S. Customs and Border Protection (CBP) on most imported goods to cover the costs associated with processing these imports. For Fiscal Year 2025, beginning October 1, 2024, adjustments have been made to the MPF to account for inflation, as mandated by the Fixing America’s Surface Transportation Act (FAST Act).

Key Updates Effective October 1, 2024:

Informal Entries:

For shipments valued under $2,500, a flat MPF is applied:

It’s important for importers to note that while the percentage rate remains the same, the adjustments to the minimum and maximum fees may impact the total MPF payable, especially for shipments at the lower and higher ends of the value spectrum. Keeping up with these updates is essential for maintaining compliance and effectively budgeting for import operations.

Related: OTI License Requirements, Costs, Renewal, & Regulations

The Merchandise Processing Fee (MPF) for 2024 is set to see some adjustments starting October 1, 2024. The MPF is a fee imposed by U.S. Customs and Border Protection (CBP) on formal entries. The ad valorem rate of 0.3464% of the value of imported goods remains unchanged, but the minimum and maximum fees have been updated.

The minimum MPF will increase from $31.67 to $32.71, and the maximum will rise from $614.35 to $634.62. These changes apply specifically to formal entries under class code 499. This fee is calculated based on the value of the merchandise being imported, excluding duties, freight, and insurance costs.

Related: What Happens After Custom Clearance Completed? 9 Next Steps

For 2024, the Merchandise Processing Fee (MPF) includes both a minimum and maximum fee that are set to increase starting October 1, 2024. These fees apply to formal entries processed by U.S. Customs and Border Protection (CBP).

These adjustments are part of CBP’s regular updates to account for inflation and ensure the fees remain equitable for importers across various shipment values.

Related: Ocean Freight Documentation For Imports: A Crucial Checklist

MPF consolidation refers to the process of aggregating the Merchandise Processing Fee (MPF) from multiple shipments into a single payment. This method is typically employed by importers who handle numerous small shipments, allowing them to streamline their financial management and reduce the administrative burden associated with individual MPF payments.

Here’s how it works:

Related: What Is Import Compliance & Why It Matters?

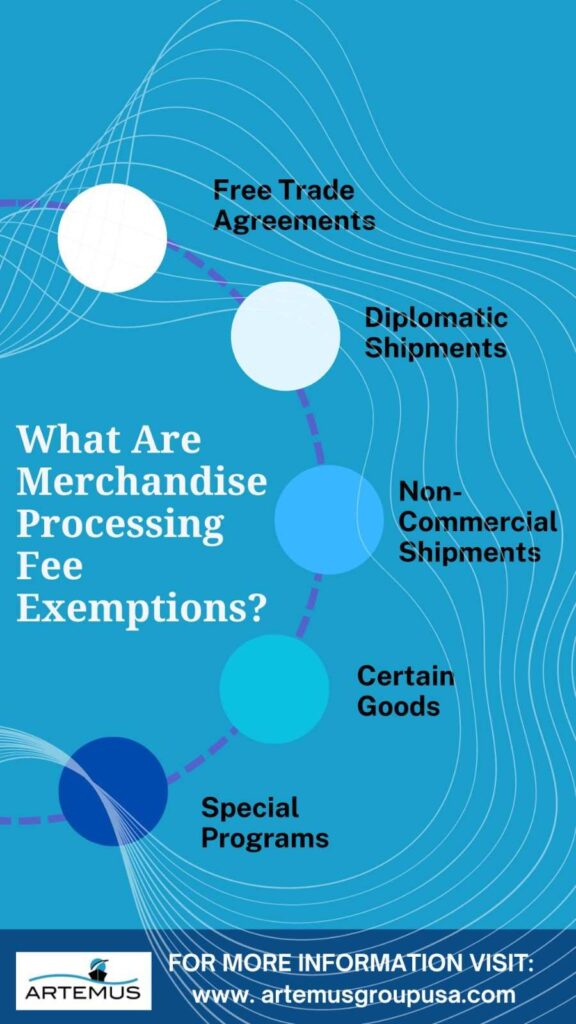

Merchandise Processing Fee (MPF) exemptions refer to specific cases where certain goods are not subject to the standard MPF that U.S. Customs and Border Protection (CBP) imposes on imported items. These exemptions are designed to reduce the financial burden on certain types of imports. Key exemptions include:

Related: What Is A Certificate Of Origin? Types & Importance

The Merchandise Processing Fee (MPF) plays a significant role in determining the overall cost of importing goods into the United States. As a customs fee imposed on most commercial shipments valued at over $2,500, MPF directly affects the total landed cost of imports.

The fee is calculated as 0.3464% of the shipment’s value, with a minimum charge of $32,71 and a maximum cap of $634.62 per entry.

For businesses engaged in international trade, MPF adds to shipping expenses, impacting profit margins, especially for frequent or high-value imports. While some goods qualify for MPF exemptions under free trade agreements like the USMCA (United States-Mexico-Canada Agreement), many shipments still incur this fee.

Understanding MPF and factoring it into cost calculations is crucial for importers to ensure accurate budgeting and pricing strategies. Additionally, businesses may explore ways to optimize supply chain operations and customs processes to minimize the financial impact of MPF on their overall shipping costs.

Related: Freight Broker License Costs: The Price Of Entry In 2025

Artemus provides cutting-edge ISF and AMS software solutions designed to simplify and streamline customs compliance for businesses engaged in international trade.

The platform offers seamless integration and automation of Importer Security Filing (ISF) filings and Automated Manifest System (AMS) processes, ensuring that all required filings are accurate, timely, and fully compliant with U.S. Customs and Border Protection (CBP) regulations.

By automating these critical filings, Artemus minimizes the risk of errors and reduces the likelihood of customs delays, allowing businesses to operate more efficiently and confidently.

With real-time updates and a user-friendly interface, Artemus enhances operational efficiency, supports regulatory compliance, and helps businesses navigate the complexities of global trade with ease.

Related: What Is A Certificate Of Origin For A Vehicle? Key Details

The Merchandise Processing Fee (MPF) is a tariff imposed by U.S. Customs and Border Protection on most imported goods, calculated as a percentage of the value of the merchandise, to cover the costs of processing imports.

To calculate Merchandise Processing Fees (MPF), apply a percentage (typically 0.3464%) of the value of the imported goods, with a minimum and maximum fee cap set by U.S. Customs and Border Protection (CBP).

The Merchandise Processing Fee (MPF) for imports into the U.S. is 0.3464% of the declared value of the goods, with a minimum fee of $27.75 and a maximum fee of $538.40 per entry.

HMF (Harbor Maintenance Fee) is a charge levied on importers to fund harbor maintenance, while MPF (Merchandise Processing Fee) is a fee applied to most imports to cover the costs of processing and customs services.

Merchandising fees, often referred to as Merchandise Processing Fees (MPF), are charges imposed by U.S. Customs and Border Protection (CBP) on imported goods to cover the cost of processing and inspecting shipments entering the United States.

Processing merchandise refers to the administrative and operational tasks involved in clearing imported goods through customs. This includes document review, inspection, and assessment of duties or fees to ensure compliance with U.S. trade regulations.

The Merchandise Service Fee is another term for the Merchandise Processing Fee (MPF), which is charged by CBP on eligible imports. It is calculated based on the value of the goods and helps fund customs operations and services.

The Merchandise Processing Fee (MPF) is paid by importers bringing goods into the United States. It applies to most imported shipments, although certain goods, such as those from Free Trade Agreement (FTA) countries, may qualify for exemptions.

For 2024, the MPF rate for formal entries is 0.3464% of the declared value of the goods, with a minimum fee of $29.66 and a maximum fee of $575.35 per entry. Informal entries have a flat fee, usually $2, $6, or $9.

As of now, the MPF rate for 2025 has not been officially updated. Typically, CBP adjusts MPF rates annually based on inflation or other regulatory changes, so it’s advisable to monitor official CBP announcements for the latest rates.

In conclusion, the Merchandise Processing Fee (MPF) is a vital component of the import process, ensuring that U.S. Customs and Border Protection can efficiently manage and process incoming goods.

Understanding how the MPF is calculated and its impact on your import costs can help businesses navigate international trade more effectively.

Related: Air Freight VS Sea Freight: What To Choose In 2024?

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.