What Does Norway Export To The US? Key Products & Trade Data

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Navigating international trade involves managing various fees, including the Harbor Maintenance Fee (HMF), which is crucial for maintaining U.S. port infrastructure. For businesses exporting goods to the USA, understanding this fee and how it affects your operations is essential for compliance and cost management.

At Artemus, our platform simplifies ISF and AMS filings, ensuring accurate and efficient compliance with U.S. Customs regulations. We help streamline your processes, including managing the Harbor Maintenance Fee, so you can focus on growing your business. In this blog, we’ll break down the Harbor Maintenance Fee and how our solutions can assist you.

Table Of Contents

The Harbor Maintenance Fee (HMF) is a charge created under the Water Resources Development Act of 1986 to help cover the cost of maintaining U.S. ports and harbors. It went into effect on April 11, 1987, requiring those who rely on port facilities to share in the expense of keeping them operational.

At first, the fee was assessed on imports, exports, and domestic cargo and passenger movements between U.S. ports. However, on March 31, 1998, the Supreme Court ruled that applying HMF to exports was unconstitutional. Since then, the fee only applies to imports, domestic shipments, Foreign-Trade Zone (FTZ) admissions, and passenger travel through ports.

The HMF is calculated as 0.125% of the declared value of the commercial cargo when goods are loaded or unloaded at a U.S. port. It does not apply to cargo imported or transported by air.

Once collected by U.S. Customs and Border Protection (CBP), the fees are deposited into the Harbor Maintenance Trust Fund. Congress then authorizes these funds for dredging, infrastructure improvements, and other harbor development projects that keep maritime trade efficient.

Related: Freight Broker License Costs: The Price Of Entry In 2025

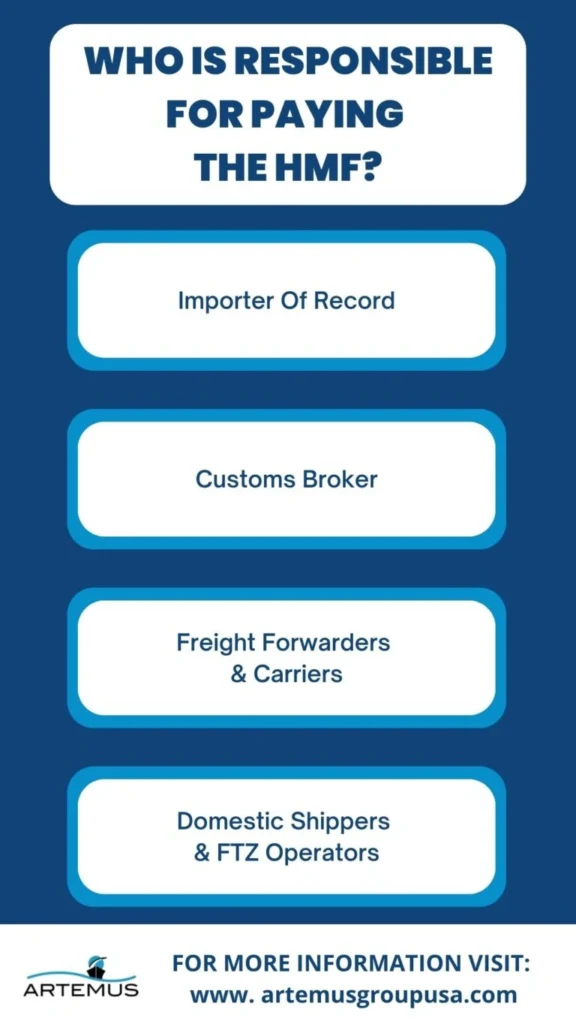

The HMF is typically paid by the importer or consignee of the cargo. The fee is usually collected by the customs broker or freight forwarder on behalf of the importer. Ultimately, the financial responsibility falls on the party receiving the cargo, which is usually outlined in the terms of the shipping contract.

The importer of record is the party legally responsible for paying the HMF. This is usually the owner, purchaser, or consignee of the goods, or an authorized agent designated in the import documentation. The importer must ensure that the HMF, set at 0.125% of the declared value of the commercial cargo, is properly paid at the time of customs clearance.

While responsibility lies with the importer, most importers rely on a licensed customs broker to manage the payment. Brokers calculate the fee, file the necessary entry summaries (CBP Form 7501), and remit the payment to CBP on the importer’s behalf. Even if a broker handles the process, the importer of record remains legally liable.

Freight forwarders and carriers play a crucial role in the logistics chain but do not directly bear the responsibility for paying the HMF. They are responsible for the transportation and handling of the goods, but the financial responsibility for the HMF lies with the importer of record. Freight forwarders may assist in arranging the payment of the fee through the customs broker, but the importer must ensure that the fee is paid in full and on time.

In addition to importers, domestic shippers moving cargo between U.S. ports and operators admitting goods into a Foreign-Trade Zone (FTZ) are also subject to the HMF. In these cases, the party filing the entry documents for the domestic shipment or FTZ admission is responsible for payment.

Related: How Much Does It Cost To Become A Freight Broker In 2025

The Harbor Maintenance Fee (HMF) is a federal user fee collected by U.S. Customs and Border Protection (CBP) on certain commercial cargo arriving at U.S. ports. The revenue is deposited into the Harbor Maintenance Trust Fund, which supports dredging, repairs, and other projects that keep U.S. harbors navigable.

The fee is calculated based on the declared value of the cargo, specifically the Cost, Insurance, and Freight (CIF) value. Below is a step-by-step guide to calculate the HMF:

The HMF is assessed on the CIF value of the imported goods. This includes:

This value must be reported on the Importer’s Entry Summary (CBP Form 7501). If your invoice shows the cost of goods and freight separately, add them together (plus insurance, if applicable) to determine the CIF value.

The current Harbor Maintenance Fee rate is 0.125% (or 1/8 of one percent) of the CIF value. This rate has been stable for decades, but importers should confirm with CBP in case of future updates.

Use the formula:

HMF = CIF Value × 0.00125

Example:

If the CIF value of your shipment is $50,000, then:

HMF = $50,000 × 0.00125 = $62.50

So, the Harbor Maintenance Fee payable on this shipment is $62.50.

Not all shipments are subject to HMF. Exemptions include:

For domestic waterborne shipments and Foreign-Trade Zone (FTZ) admissions, the HMF still applies, and the responsible party is the one filing the entry.

Related: OTI License Requirements, Costs, Renewal, & Regulations

Understanding the distinctions between the Harbor Maintenance Fee (HMF) and the Merchandise Processing Fee (MPF) is crucial for businesses involved in importing goods into the United States. Here’s a breakdown of the key points of differentiation between these two fees:

By understanding these key differences, importers and businesses can better navigate the complexities of U.S. customs fees and ensure compliance with the relevant regulations.

Related: ISF Late Filing Fee: Exact Cost & 6 Tips To Manage Appeals

The Harbor Maintenance Fee (HMF) for 2025 remains consistent with the rates applied in previous years. The HMF is levied on the value of commercial cargo shipped through U.S. ports to fund the maintenance and improvement of these ports and harbors. For 2025, the fee is set at 0.125% of the value of the cargo.

This fee is crucial for ensuring that U.S. ports are well-maintained and can efficiently handle the nation’s import and export activities. The collected funds are used to cover dredging and other necessary maintenance activities to keep the ports operational and capable of accommodating international trade.

Related: AMS Filing Penalty Cost: Most Common Pitfalls & Solutions

The Harbor Maintenance Fee (HMF) is a U.S. federal tax imposed on the value of commercial cargo shipped through ports and harbors. Its primary purpose is to fund the maintenance of harbor channels and port infrastructure, ensuring they remain navigable and safe for commercial use.

However, there are specific exemptions to this fee that businesses and stakeholders should be aware of. Here’s a detailed look at the exemptions to the Harbor Maintenance Fee:

Exports are fully exempt from the Harbor Maintenance Fee following the 1998 U.S. Supreme Court U.S. Shoe decision, which ruled that charging HMF on export shipments was unconstitutional. Since then, no fee has been collected on any export cargo, whether containerized, bulk, or specialized shipments, regardless of the destination.

Intraport shipments, which involve moving cargo within the same port limits, are also exempt from the Harbor Maintenance Fee. For example, when goods are transferred by barge or feeder vessel from one terminal to another in the same port, no additional burden is placed on harbor maintenance, so no fee is assessed.

Cargo owned or shipped by the U.S. Government, including Department of Defense and military shipments, is exempt from the Harbor Maintenance Fee. This ensures federal operations are not charged for contributing to a federal harbor maintenance program.

Items that are not considered commercial cargo, such as bunker fuel, ship’s stores, sea stores, and vessel equipment for onboard use, are not subject to HMF. For example, marine fuel used to power the vessel or provisions supplied for the crew are excluded from assessment.

Cargo transported on ferries, passenger-only vessels, or certain small watercraft is exempt from HMF. These types of movements place minimal demand on harbor dredging or maintenance projects and therefore are not included in the fee’s scope.

Cargo entering the U.S. in bond for transportation and direct export to a foreign country is exempt, unless a contiguous country (Canada or Mexico) imposes a substantially equivalent port fee or a study finds no significant economic loss or diversion occurs.

Cargo owned or financed by nonprofit organizations or cooperatives for humanitarian or development assistance overseas is exempt. CBP certification is required, and refund procedures involve submitting HMF Amended Quarterly Summary Reports via ACH or mail, along with supporting documentation.

Special loadings and unloadings of cargo between the U.S. mainland, Alaska, Hawaii, or other U.S. possessions are exempt in certain cases. For example, cargo loaded in the mainland for consumption in Alaska or vice versa, or cargo loaded and unloaded within the same state or possession, is not subject to HMF. Crude oil is excluded from these exemptions for Alaska.

Related: ISF Bond Cost Breakdown & Management For Import Success

To apply for a Harbor Maintenance Fee (HMF) refund, complete the required refund request forms and submit them to U.S. Customs and Border Protection (CBP) with supporting documentation. Ensure all information is accurate to avoid processing delays. For detailed instructions, consult the CBP’s website or customer service.

You may be eligible for an HMF refund if:

Related: What Is ISF Bond? Types, Cost, & Components To Know

The Harbor Maintenance Fee (HMF) directly shapes how U.S. ports operate. By funding maintenance and dredging, it helps ports stay efficient and competitive. At the same time, it introduces certain financial and structural challenges that influence how ports function in the long run.

Here’s a detailed look at how the HMF affects U.S. ports, both in terms of infrastructure and operational efficiency, as well as the challenges it creates:

One of the most visible effects of HMF is the improvement of physical infrastructure. Funds are used for dredging channels, repairing docks, and maintaining navigation routes. This keeps ports safe for vessel traffic, prevents costly disruptions, and ensures they are ready to handle future shipping demands.

Modern shipping relies on mega-ships that require deep and reliable channels. Ports backed by HMF-funded maintenance can receive these vessels, positioning them as preferred hubs in international trade. Without this support, ports risk losing business to global competitors with better facilities.

Maintenance funded by HMF has a direct impact on day-to-day port activity. Ships can dock, unload, and depart faster when channels are clear and infrastructure is in good condition. This reduces waiting times, increases vessel turnover, and maximizes overall cargo throughput.

While HMF strengthens infrastructure, it also adds to shipping costs. For some importers, this fee can make routing cargo through Canadian or Mexican ports more attractive. Such diversions reduce traffic through U.S. ports, cutting into their revenue and slowing potential growth.

The HMF applies only to imports, leaving exports exempt. As a result, ports that depend heavily on inbound cargo bear a greater share of the fee burden. This imbalance makes some ports less competitive compared to those that handle more exports.

Not every port receives funding equal to what it contributes. Some high-volume ports generate millions in HMF collections but see only a fraction of that returned for local projects. This mismatch can cause uneven infrastructure quality, with some ports thriving while others struggle to keep up.

Related: What Is A Freight Broker & How Do They Work In 2025?

The Harbor Maintenance Fee (HMF) plays a vital role in U.S. ports’ contribution to international trade. By funding dredging, infrastructure upgrades, and maintenance, the HMF ensures that ports can handle larger vessels, maintain efficient operations, and remain competitive in the global shipping network.

The Harbor Maintenance Fee (HMF) has influenced trade discussions, notably under the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA). Canada has raised concerns that the HMF creates an uneven playing field by applying only to goods entering the U.S. by sea, not by land.

This discrepancy has been a point of contention in trade negotiations, highlighting how domestic policies can impact international agreements.

U.S. ports, such as the Port of Savannah, have utilized HMF funding for significant infrastructure projects. The Savannah Harbor Expansion Project (SHEP) deepened the harbor from -42 feet to -47 feet, allowing it to accommodate larger vessels and reduce tidal restrictions. Additionally, plans are in place to increase the port’s capacity by adding new berths and rail infrastructure, aiming for a 12.5 million TEU capacity by 2035.

HMF-funded maintenance also supports environmentally responsible port operations. Regular dredging and sediment management help mitigate ecological risks associated with shipping and harbor activity. For example, maintaining clear navigation channels reduces fuel consumption and vessel idling, which lowers emissions and benefits surrounding ecosystems.

Ports with reliable infrastructure, funded by HMF, reduce delays in cargo handling and vessel turnaround. This reliability is crucial for global supply chains, ensuring that imports and exports reach their destinations on time and maintaining confidence in U.S. ports as a trade hub.

The HMF also helps optimize the flow of goods through U.S. ports. By maintaining clear channels and operational facilities, ports can handle higher cargo volumes without bottlenecks. Efficient cargo movement not only benefits domestic businesses but also strengthens the U.S.’s position in global logistics networks.

Related: ISF Form (Importer Security Filing): Elements & Top Practices

Artemus Transportation Solutions offers state-of-the-art ISF (Importer Security Filing) and Automated Manifest Filing software solutions, designed to streamline compliance and enhance efficiency in the import process.

The software ensures that all necessary ISF data elements are accurately reported to U.S. Customs and Border Protection (CBP) well within the required timelines, minimizing the risk of penalties and shipment delays. By automating the filing process, our solution reduces manual data entry errors and provides real-time tracking and updates, ensuring a seamless flow of information.

In addition to ISF filing, our Automated Manifest Filing software integrates smoothly with existing logistics and supply chain systems, facilitating quick and accurate transmission of manifest data for both ocean and air shipments.

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

To calculate the Harbor Maintenance Fee (HMF), multiply the value of the cargo being imported by the applicable rate, which is currently 0.125%. The fee is assessed on the value of cargo entering U.S. ports.

Harbor charges are fees assessed by port authorities for services and facilities used by vessels at the port, such as docking, mooring, and cargo handling.

The harbor maintenance fee is a charge levied on cargo imports and exports to fund the maintenance and improvement of Canadian port facilities, ensuring they remain efficient and effective.

HMF stands for Harbor Maintenance Fee, a fee collected to maintain and improve U.S. ports and harbors. MPF, or Merchandise Processing Fee, is a fee assessed on imports to cover the cost of customs processing.

The Harbor Maintenance Fee (HMF) is collected to fund the maintenance and improvement of U.S. ports and harbors. It ensures safe navigation, efficient port operations, and the ability to accommodate larger vessels for international trade.

Ports that do not handle significant commercial cargo or certain inland ports may be exempt from HMF. Additionally, intraport shipments and some small harbors are not subject to the fee.

There is no fixed maximum HMF fee. The fee is calculated as 0.125% of the commercial cargo’s value, so the total depends on the shipment’s CIF (cost, insurance, and freight) value.

Harbor Maintenance Fee (HMF) plays a critical role in maintaining and improving the infrastructure of U.S. ports and harbors, ensuring they remain efficient and capable of handling the demands of modern shipping. While it is a necessary cost for importers and exporters, understanding its purpose and how it is calculated can help businesses manage their logistics budgets more effectively.

By contributing to the upkeep of vital port facilities, the HMF supports the smooth flow of goods and enhances the overall competitiveness of U.S. ports in the global trade landscape.

Related: NVOCC Bond & OTI Bonds – Federal Maritime Commission

Cold Nordic waters, advanced engineering, and a strong maritime economy make Norway a powerful exporter despite its size. Many of

Trade between the United States and Canada is one of the largest bilateral trading relationships in the world. Understanding what

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.