What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In the intricate realm of international trade, ensuring the smooth flow of goods while maintaining security remains a constant challenge. Enter the Importer Security Filing (ISF), a critical requirement aimed at bolstering supply chain security and enhancing customs risk assessment. But as goods traverse borders and regulatory landscapes, the question arises: Who Is Responsible For Filing The ISF? Join us as we embark on a journey to unravel this essential aspect of modern trade.

In this blog, we will delve into the roles of key players, the nuances of compliance, and the collaborative efforts that shape the ISF filing process. Whether you’re an importer, a customs broker, or simply intrigued by the mechanics of international commerce, this exploration into the responsibilities behind the ISF filing is bound to shed light on this pivotal facet of modern trade. Moreover, Artemus offers a high-end comprehensive software solution for ISF compliance.

Table Of Contents

In the complex landscape of international trade, ensuring the security of supply chains is of paramount importance. One crucial aspect of maintaining this security is the accurate and timely filing of the Importer Security Filing (ISF), also known as the 10+2 filing. The ISF is a requirement imposed by the U.S. Customs and Border Protection (CBP) to enhance the security of imported goods entering the United States. But the question arises: Who holds the responsibility for filing the ISF?

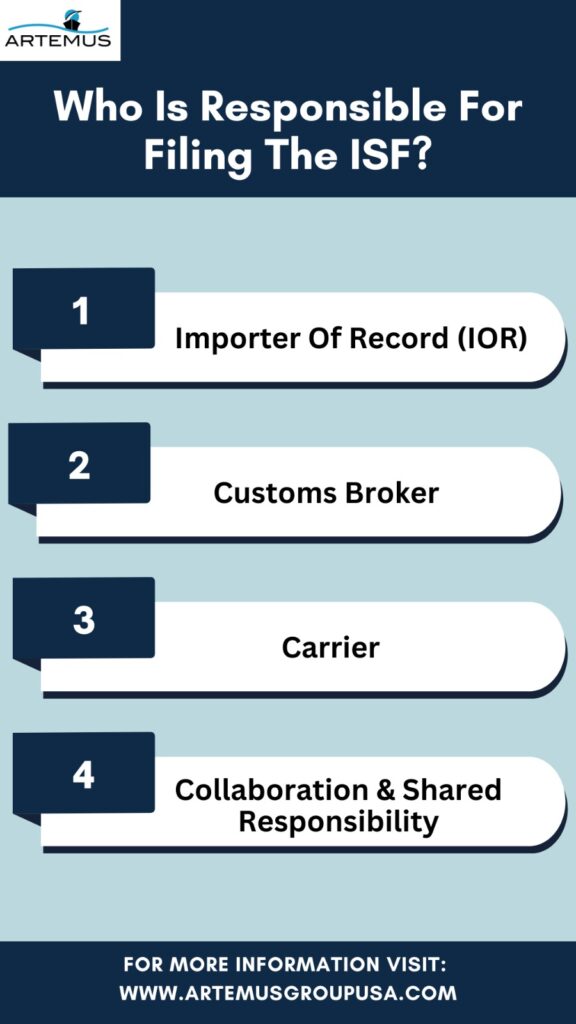

The ISF filing process involves several key players, each with distinct roles and responsibilities. The primary parties responsible for ISF filing include the Importer of Record (IOR), Customs Broker, and Carrier.

When it comes to ISF filing, the responsibility often lies with the importer or their designated agent. At ARTEMUS, we offer a unique opportunity for users to take the reins and file their ISF themselves, provided they’re equipped with our specialized software. This solution empowers importers with control over their filing process, enhancing efficiency and ensuring accurate submissions.

Our platform guides you through each step, simplifying complex requirements and streamlining data entry. By choosing self-filing, users can save time, ensure compliance, and stay up-to-date with their ISF submissions.

The Importer of Record holds a pivotal role in the ISF filing process. The IOR is typically the owner, purchaser, consignee, or agent for the goods being imported. As the legally recognized entity responsible for the imported cargo, the IOR is ultimately accountable for the accuracy and completeness of the ISF information. This includes providing data such as the manufacturer, shipper, consignee, and other critical details.

Compliance with ISF filing requirements is not only a legal obligation for the IOR but also a practical necessity to ensure the smooth flow of goods through customs. Failing to provide accurate and timely ISF data can lead to customs delays, penalties, and potential supply chain disruptions.

Customs brokers play a vital role in facilitating the ISF filing process on behalf of the Importer of Record. These professionals possess a deep understanding of customs regulations, trade laws, and documentation requirements. They serve as intermediaries between the IOR and the CBP, ensuring that all necessary ISF information is submitted accurately and within the specified timelines.

Customs brokers collaborate closely with importers to gather the required data and submit it to the CBP. They also handle communication with other involved parties, such as carriers and freight forwarders, to ensure seamless coordination throughout the import process.

Carriers, including ocean carriers and airlines, are another essential component in the ISF filing process. They are responsible for transmitting specific ISF-related data to the CBP in advance of the cargo’s arrival in the United States. This data provides customs authorities with valuable information about incoming shipments, contributing to the overall security of the supply chain.

The carrier’s role involves transmitting details like vessel or flight information, container numbers, and estimated arrival times. Accurate transmission of this data aids in customs risk assessment and allows CBP to identify potential security threats efficiently.

In the realm of ISF filing, responsibility is shared among the importer, customs broker, and carrier. Effective collaboration among these parties is crucial for ensuring that accurate and timely information is provided to the CBP. While the IOR holds ultimate responsibility, customs brokers and carriers play indispensable roles in facilitating compliance and streamlining the filing process.

The ISF filing process serves as a prime example of how interconnectedness and cooperation are vital in the world of international trade. The shared responsibility for accurate data submission contributes to supply chain security, efficient customs clearance, and the overall success of global commerce. By understanding and embracing their respective roles, the Importer of Record, customs brokers, and carriers collectively contribute to a safer and more resilient trade ecosystem.

Related: ISF Filing Requirements: Important Facts & Documents

The Importer Security Filing (ISF) demands a range of key information to facilitate secure and efficient international trade. Essential data includes:

Mastery of these ISF requirements ensures compliance, streamlined customs processes, and heightened supply chain security.

Related: ISF Filing Deadline: Timeline, Consequences, & Exceptions

The Importer Security Filing (ISF) rules, enforced by U.S. Customs and Border Protection (CBP), aim to enhance cargo security and streamline the importation process. Here are some key pointers regarding ISF rules:

Related: ISF Declaration: Meaning, Purpose, Timeline, & Process

Efficient and accurate filing of the Importer Security Filing (ISF) is essential for a smooth and secure import process. Here are five best practices to ensure successful ISF filing:

1. Self-Filing Via Software: Empowering importers with control, self-filing via specialized software is a prevailing best practice in ISF filing. This approach streamlines data entry, ensuring accuracy, and enables timely submissions, averting penalties.

2. Early Preparation is Key: Start gathering ISF information as soon as possible. Early preparation allows for thorough data collection, reducing the risk of errors and last-minute rushes. Anticipate potential delays and plan accordingly.

3. Collaborate with Your Customs Broker: Engage a knowledgeable customs broker who understands ISF regulations. Collaborate closely to ensure all necessary information is accurate and complete. Open communication with your broker minimizes discrepancies and streamlines the filing process.

4. Maintain Data Accuracy: Ensure every detail submitted in the ISF is accurate and up-to-date. Small errors can lead to significant delays and penalties. Double-check manufacturer information, commodity descriptions, and other critical data points.

5. Timely Submission: Adhere to the ISF filing timeline. Submit your ISF data well before the shipment’s departure to avoid penalties and customs delays. This proactive approach provides ample time for corrections if needed.

6. Stay Informed About Regulatory Changes: Keep abreast of any updates to ISF regulations. Changes in requirements or deadlines can impact your filing process. Regularly consult reliable sources to stay informed and adjust your practices accordingly.

Related: 5 Types Of ISF Penalty & Fines To Know To Avoid Losses

Artemus stands as a leading software solution for Importer Security Filing (ISF) compliance, offering a seamless way to navigate the intricacies of international trade regulations. This robust platform empowers importers, customs brokers, and carriers by simplifying the ISF filing process. With its intuitive interface,

Artemus enables accurate data submission while ensuring timely compliance with customs requirements. By centralizing essential information and automating crucial tasks, Artemus enhances efficiency, minimizes errors, and reduces the risk of penalties and delays. Whether you’re a seasoned trade professional or new to the industry, Artemus is your trusted ally for maintaining supply chain security and operational excellence.

Related: ISF Filing Cost: Elements, Hidden Costs, & Minimization Tips

Absolutely! You can file your own ISF directly with U.S. Customs and Border Protection using software providers like ARTEMUS, or choose assistance from NVOCCs, Freight Forwarders, Customs Brokers, and Service Providers

The Importer Security Filing (ISF) must be filed no later than 24 hours before the cargo is loaded onto the vessel departing to the United States.

To fill out the Importer Security Filing (ISF) form, provide accurate details about the shipper, consignee, manufacturer, and other relevant information, ensuring compliance with U.S. Customs and Border Protection regulations.

The importer or their authorized agent is responsible for filing the Importer Security Filing (ISF) form, also known as the “10+2” form, with US Customs and Border Protection (CBP) prior to the shipment’s arrival in the United States.

In our journey to understand who is responsible for filing the Importer Security Filing (ISF), we’ve uncovered a web of collaboration. While the Importer of Record shoulders the ultimate obligation, the expertise of customs brokers and the involvement of carriers form a trifecta of responsibility. This collective effort ensures accurate data submission, smooth customs processes, and heightened supply chain security.

The ISF filing process isn’t just paperwork; it’s a reflection of the intricate relationships that underpin modern trade. By embracing their roles and working in tandem, importers, customs brokers, and carriers contribute to a safer and more efficient global trade landscape, where responsibility is a shared commitment and success rests on collaboration.

Related: ISF Filing Online: A Beginner’s Guide To Your Import Process

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.