What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

When it comes to the intricate world of international trade and customs regulations, one of the most frequently asked questions is whether a customs broker can assume the role of the Importer of Record (IOR). The distinction between these roles is crucial, as it determines the legal and financial responsibilities involved in importing goods. In this blog post, we will delve into this topic, exploring the roles of customs brokers and Importers of Record and clarifying the situations where they intersect or remain separate.

But before we dive into the details, it’s worth mentioning that innovative solutions like Artemus Transportation Solutions offer customs broker software and ISF (Importer Security Filing) software solutions designed to streamline compliance processes. These advanced tools can be invaluable for importers and customs brokers alike, helping them navigate the complexities of international trade seamlessly and efficiently.

Table Of Contents

The role of a customs broker in international trade is to facilitate the smooth passage of goods through customs, ensuring compliance with complex regulations and helping importers avoid delays and penalties. However, one common question that arises is whether a customs broker can also act as the Importer of Record (IOR). Let’s explore this topic in detail.

The Importer of Record is the entity or individual legally responsible for complying with all customs laws and regulations when importing goods into a country. This includes accurate classification of goods, proper valuation, submission of required documentation, payment of duties and taxes, and adherence to importation rules.

In most cases, a customs broker cannot act as the Importer of Record. The reason is simple: the Importer of Record must be the party that has a direct financial interest in the imported goods. This typically means the buyer, owner, or consignee of the goods. They are the ones who will ultimately use or sell the imported products and are therefore legally responsible for their compliance with customs requirements.

However, the customs broker plays a pivotal role in assisting the Importer of Record in meeting these obligations. They offer their expertise in customs procedures, prepare the necessary documentation, ensure the accuracy of customs declarations, and advise on the correct payment of duties and taxes. In essence, the customs broker acts as an agent for the importer, helping them navigate the complexities of international trade regulations.

In some specialized cases or under unique circumstances, there may be exceptions where a customs broker assumes the role of the Importer of Record. Still, such situations are relatively rare and typically require specific approvals from customs authorities.

Related: What Are The Likely Customs Broker Exam Pass Rate For 2024?

Customs brokers play a pivotal role in facilitating the smooth flow of international trade. Their primary responsibilities encompass a wide array of crucial tasks, including but not limited to:

Ensuring that all import and export activities adhere to the ever-evolving customs regulations and laws is at the core of a customs broker’s duties. They must stay updated with changing requirements to prevent compliance issues.

Meticulous record-keeping and the preparation of accurate customs documentation, such as import/export permits, bills of lading, and invoices, are essential to facilitate the clearance process.

Properly classifying goods and determining their accurate value is pivotal for calculating applicable duties and taxes. Customs brokers must possess expertise in this area to minimize costs for their clients.

Calculating the appropriate tariff rates for goods is another critical responsibility. This involves understanding the intricate details of international trade agreements and tariff schedules.

Customs brokers serve as intermediaries between importers/exporters and customs authorities, relaying information, addressing inquiries, and resolving issues on behalf of their clients.

Coordinating the logistics of transporting goods, including arranging for shipping, warehousing, and delivery, is often part of their role to ensure timely clearance.

Related: Custom Broker Fees Explained: The Figures You Need To Know

The Importer of Record (IOR) is a crucial figure in the international trade process, bearing significant responsibilities that impact the successful flow of goods across borders. Some key responsibilities of an IOR include:

The IOR is legally responsible for ensuring that all imported goods comply with the customs regulations and laws of the destination country. This involves accurate classification, valuation, and adherence to import restrictions and quotas.

The IOR is accountable for paying any applicable import duties, taxes, and fees on behalf of the imported goods. Timely and accurate financial transactions are essential to prevent delays and penalties.

Providing complete and accurate documentation, including invoices, bills of lading, and permits, is essential for customs clearance. Errors or omissions can lead to delays and compliance issues.

Maintaining organized and up-to-date records of all import-related transactions and documentation is crucial for audits, compliance, and tracking purposes.

Identifying and managing compliance risks, such as potential disputes or customs audits, is part of the IOR’s responsibilities. They must have strategies in place to mitigate these risks.

Ensuring the quality and safety of imported goods is paramount. The IOR should inspect products when necessary and be prepared to address any issues related to product quality or safety.

Related: Customs Bond Renewal: All Facts You Need To Know

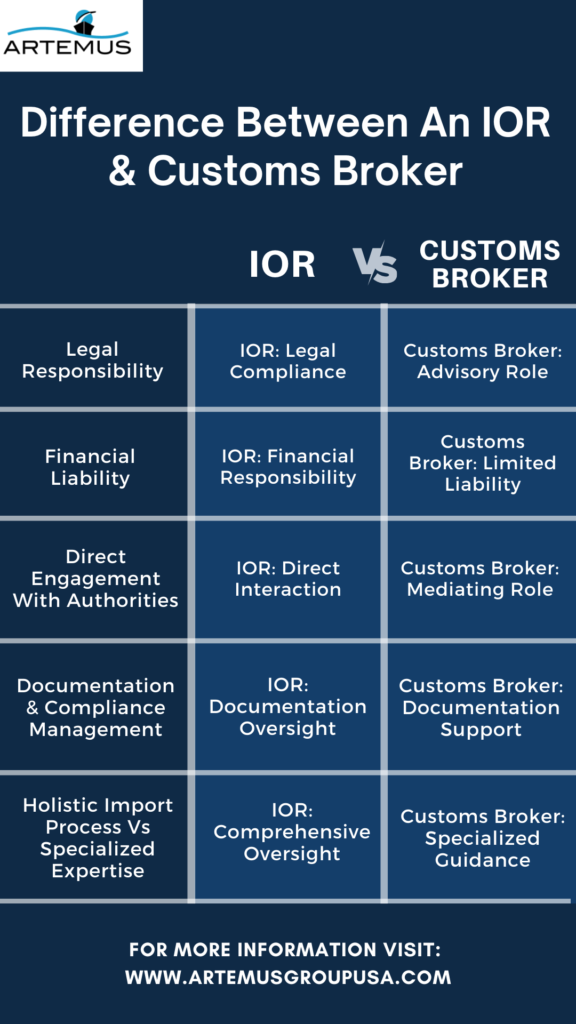

Distinctions Between an Importer of Record (IOR) and a Customs Broker:

Related: How To Get A Customs Bond In 5 Easy Steps: Beginner’s Guide

Artemus is a leading provider of Customs Broker Software and ISF (Importer Security Filing) Software Solutions, offering a cutting-edge platform that streamlines international trade processes. Their Customs Broker Software automates tasks like document preparation, tariff classification, and compliance checks, reducing human error and expediting customs clearance. This tool empowers businesses to efficiently manage customs declarations, saving valuable time and resources for other critical operations.

Additionally, Artemus’ ISF Software Solution ensures importers’ full compliance with U.S. Customs and Border Protection’s ISF requirements. It offers a user-friendly interface for accurate and timely ISF filings, preventing costly penalties and delays. The software provides real-time updates and alerts, keeping importers informed about their ISF filing statuses. With Artemus’ unwavering commitment to efficiency, accuracy, and compliance, they are the preferred choice for customs brokers and importers navigating the complexities of international trade effortlessly.

Related: Customs Broker Exam (CBLE): A Comprehensive 2024 Overview

Without a customs broker, navigating the complex customs clearance process can lead to delays, compliance issues, and potential financial penalties for importers and exporters.

No, you don’t always need a customs broker to import, but they can simplify the process and ensure compliance with customs regulations.

In many cases, you can import without an import license, but it depends on the type of goods, country regulations, and specific requirements.

In summary, while a customs broker can also be the importer of record, this requires careful consideration of legal responsibilities and liabilities. Customs brokers primarily assist with clearance and compliance, whereas the importer of record bears legal and financial obligations. If a customs broker takes on this role, a formal agreement is essential. The choice depends on specific needs, emphasizing the importance of navigating these roles wisely for a smooth and compliant import process.

Related: When Is A Customs Bond Required? Key Factors To Consider

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.