What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In a world where global trade is the lifeblood of economies, the role of a customs broker is paramount. These experts are the gatekeepers, ensuring the seamless flow of goods while navigating the intricacies of international regulations.

But how does one become a customs broker, and what steps are involved in pursuing this rewarding career path? In this blog, we’ll explore the journey to becoming a customs broker, from educational requirements to the Customs Broker Exam, and how a cutting-edge solution like Artemus Transportation can assist in this endeavor.

Moreover, Artemus Transportation Solutions offers advanced customs broker software tailored for ISF (Importer Security Filing), AMS (Automated Manifest System), and AES (Automated Export System) filings, streamlining compliance for international shipments into and out of the U.S.

This comprehensive software enables brokers to manage complex filing requirements efficiently, ensuring adherence to Customs and Border Protection (CBP) regulations.

Table Of Contents

Pursuing the journey of advancing as a customs broker is a career path suited for individuals with specific qualities and interests. Those who should consider becoming a customs broker include:

1. Detail-Oriented Individuals: Customs brokers deal with intricate regulations, documentation, and compliance requirements. Being detail-oriented is crucial for accuracy.

2. Analytical Thinkers: Customs brokers need to interpret complex customs codes, tariff schedules, and trade regulations, requiring strong analytical skills.

3. Compliance Enthusiasts: Compliance is paramount in international trade. Customs brokers ensure that businesses adhere to laws and regulations, making a passion for compliance crucial.

4. Strong Communicators: Effective communication with clients, government agencies, and shipping companies is essential in this role.

5. Problem Solvers: Customs brokers often encounter unique challenges. Those who enjoy problem-solving and finding creative solutions excel in this field.

6. Multilingual Individuals: Proficiency in multiple languages can be an asset, given the global nature of trade.

7. Logistics & Trade Enthusiasts: Individuals with an interest in logistics, supply chain management, and international trade find customs brokerage a natural fit.

8. Legal Backgrounds: Some customs brokers have legal backgrounds, and a deep understanding of trade laws and regulations is invaluable.

9. Business Owners And Importers/Exporters: Those involved in their own businesses or trade activities may benefit from customs brokerage knowledge to handle compliance and streamline operations.

10. Continuous Learners: Customs regulations evolve, and staying up-to-date is vital. Individuals who enjoy continuous learning thrive in this dynamic field.

Related: What Does A Customs Broker Do? 10 Key Responsibilities

Customs brokers play a pivotal role in international trade, facilitating the smooth flow of goods across borders. Here are five key aspects that shed light on their crucial responsibilities:

Related: Customs Broker VS Freight Forwarder: 5 Key Differences

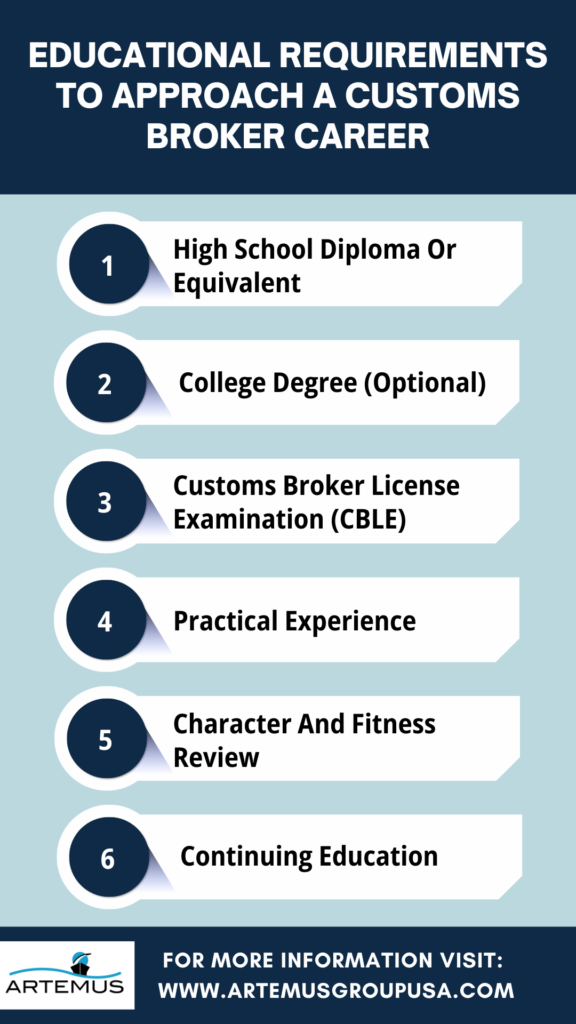

Becoming a customs broker is a rewarding career path that requires specific educational and professional qualifications. Here are the educational requirements to become a customs broker:

The foundational educational requirement is a high school diploma or its equivalent, such as a GED (General Educational Development) certificate. This serves as the starting point for pursuing further education in the field.

While not mandatory, many customs brokers hold a bachelor’s degree in fields related to international trade, business, or law. A degree can provide a solid academic foundation and enhance career prospects.

The primary educational requirement for becoming a customs broker is successfully passing the Customs Broker License Examination (CBLE). This comprehensive exam assesses a candidate’s knowledge of customs regulations, trade laws, and other relevant topics. It is essential to prepare rigorously for the CBLE, which tests candidates on a wide range of subjects related to customs brokerage.

In addition to the educational requirements, customs brokers must gain practical experience in the field. This often involves working in the customs brokerage industry or a related field, such as logistics, supply chain management, or international trade. The amount of required experience can vary, but it typically spans several years.

Customs brokers are subject to a character and fitness review by the U.S. Customs and Border Protection (CBP). This review ensures that candidates meet the necessary ethical and legal standards to work in the field.

Customs brokers are expected to stay updated with the ever-evolving customs regulations and international trade laws. Continuing education and professional development are essential to maintaining their credentials and serving their clients effectively.

Related: Can A Customs Broker Be The Importer Of Record Legally?

Going after a customs broker as a career path comes with a set of well-defined legal requirements and obligations. As intermediaries between importers, exporters, and government authorities, customs brokers play a crucial role in ensuring that international trade complies with the law. In this blog, we’ll explore the customs broker license and the legal requirements associated with this profession.

To legally practice as a customs broker in the United States, passing the Customs Broker License Examination (CBLE) is a fundamental requirement. This comprehensive exam evaluates a candidate’s knowledge of customs regulations, tariff schedules, trade laws, and more. Successfully passing the CBLE is the gateway to obtaining a customs broker license.

Customs brokers must receive approval from the U.S. Customs and Border Protection (CBP), the federal agency responsible for overseeing international trade. CBP conducts background checks and character reviews to ensure that individuals meet the ethical and legal standards required for the profession.

The educational requirements for obtaining a customs broker license typically begin with a high school diploma or its equivalent, such as a GED certificate. This stands as the fundamental educational requirement.

In addition to the educational prerequisites, customs brokers are required to gain practical experience in the field. This often involves working in the customs brokerage industry or related fields, accumulating a specified number of years of experience.

The customs brokerage profession is dynamic, with customs regulations and trade laws frequently evolving. Customs brokers must engage in continuing education to stay updated with the latest legal and regulatory changes, ensuring that they remain compliant in their practice.

Customs brokers are legally obligated to maintain accurate and organized records of all transactions and customs-related documents. This meticulous record-keeping is crucial for transparency, accountability, and compliance.

Customs brokers are expected to adhere to the highest ethical standards in their professional conduct. This includes honesty, integrity, and transparency in all dealings with clients, government agencies, and other stakeholders.

Customs broker licenses require periodic renewal, typically every three years. The renewal process may involve meeting specific continuing education requirements, character reviews, and adherence to all legal obligations.

Customs brokers are responsible for ensuring that imports and exports comply with trade laws, customs regulations, and international agreements. They must assist their clients in adhering to these legal requirements to avoid potential penalties and issues with customs authorities.

These professionals are expected to demonstrate a high level of moral character and trustworthiness. This requirement helps ensure that individuals in this profession maintain the highest ethical standards throughout their careers.

Related: Customs Broker Exam (CBLE): A Comprehensive 2024 Overview

A career as a customs broker is dynamic, offering variety and the opportunity to work across international trade, logistics, and regulatory compliance. Customs brokers play a crucial role in facilitating the import and export of goods, ensuring that shipments meet all legal requirements and move efficiently through customs.

For those interested in a challenging, detail-oriented career, it’s a path that combines problem-solving, communication skills, and a deep understanding of trade laws.

As you progress in the field, you’ll encounter diverse industries—from retail to pharmaceuticals—and handle various documentation, tariffs, and compliance checks. Each day brings unique cases, requiring brokers to adapt to regulatory updates, manage client expectations, and coordinate with customs officials.

Success in this field often means staying current with changing trade laws, developing strong client relationships, and sharpening analytical skills.

For those motivated to build expertise, customs brokerage offers a solid, often rewarding career path with opportunities for specialization in areas like global logistics, compliance consulting, or supply chain management.

With experience, brokers may also move into senior roles, managing teams or overseeing larger compliance projects, which can lead to significant career growth and responsibility.

To be eligible for the U.S. Customs Broker License Exam (CBLE), candidates must meet specific criteria set by Customs and Border Protection (CBP). Here are the main requirements:

Beyond these eligibility requirements, those who pass the CBLE will need to submit a formal application to CBP, which includes a background check, fingerprints, and a credit report, to secure their customs broker license.

The salary for licensed customs brokers in the U.S. varies widely based on experience, location, and the complexity of the role. The median annual salary is approximately $67,285, with entry-level roles earning around $37,500 and experienced brokers making up to $120,700.

Factors such as state demand and specific industry needs can also impact salaries; for example, brokers in Washington, D.C., and Maryland tend to earn on the higher end. Overall, customs broker salaries are competitive but vary across states and job responsibilities.

Related: Customs Broker Exam Registration: In-Person & Remote CBLE

The Customs Broker License Exam (CBLE) is a challenging assessment administered by U.S. Customs and Border Protection (CBP) for individuals seeking to become licensed customs brokers.

The exam, offered twice yearly in April and October, tests comprehensive knowledge of customs regulations, classification, valuation, entry procedures, trade agreements, fines, and penalties, among other complex trade compliance topics.

The CBLE comprises 80 multiple-choice questions that candidates must answer within 4.5 hours. To pass, examinees must score at least 75%, correctly answering 60 questions.

It is an open-book exam, allowing the use of specific reference materials like Title 19 of the Code of Federal Regulations (CFR) and the Harmonized Tariff Schedule of the United States (HTSUS). However, the open-book format demands a strong familiarity with navigating these resources, as time management is essential under exam conditions.

Candidates must be U.S. citizens, at least 21 years of age, and demonstrate good moral character. Registration opens several months before each exam date, with a fee of approximately $390. The CBLE can be taken in person at designated testing centers or remotely with approved proctoring standards.

Due to its historically low pass rates (around 15-20%), the CBLE is considered difficult, even for experienced trade professionals.

Candidates often spend 3-6 months preparing, utilizing study methods like practice exams, timed assessments, and prep courses to familiarize themselves with the complex question format and develop efficient resource navigation skills.

The exam’s high difficulty stems from its detail-oriented questions that require a precise interpretation of trade regulations.

Achieving a customs broker license offers significant career advantages in international trade and compliance.

Licensed brokers play a crucial role in customs clearance, compliance, and logistics, potentially leading to competitive salaries and opportunities within brokerage firms, logistics companies, or corporate compliance departments.

Related: What Are The Likely Customs Broker Exam Pass Rate For 2024?

The Customs Broker License Exam (CBLE) is known for its challenging content and rigorous format, so thorough preparation is essential. Here are key steps to get ready:

Dedicate ample time to preparation, as the Customs Broker License Exam has a notoriously low pass rate. With a well-organized study plan, consistent practice, and a strong familiarity with customs regulations, you’ll be well-positioned to tackle the exam confidently.

Related: What Can I Do With A Customs Broker License? A 2024 Guide

Here are five essential tips on how to successfully become a customs broker:

1. Understand The Requirements: Start by thoroughly understanding the prerequisites and legal requirements for becoming a customs broker. This includes passing the Customs Broker License Exam (CBLE), accumulating practical experience, and meeting character and fitness standards. Familiarize yourself with the process from the outset.

2. Invest In Comprehensive Preparation: The CBLE is a challenging exam that covers a wide array of customs regulations and trade laws. Invest in comprehensive exam preparation, which may involve enrolling in preparatory courses, using study materials, and practicing with sample questions. Dedicate ample time to study, as early and thorough preparation is key.

3. Gain Practical Experience: Practical experience is a vital component of becoming a customs broker. Work in the customs brokerage industry or a related field to accumulate the required number of years of experience. Real-world experience will enhance your understanding of customs procedures and regulations.

4. Stay Informed & Updated: The field of customs brokerage is dynamic, with regulations and trade laws continuously evolving. Develop the practice of keeping up-to-date with changes and updates. This can be achieved through ongoing education, attending industry seminars, and keeping abreast of relevant news and publications.

5. Network & Seek Mentoring: Networking with experienced customs brokers and seeking mentorship can be invaluable. Establish connections within the industry to gain insights, guidance, and advice from those who have already succeeded in the profession. A mentor can provide valuable support and knowledge.

Related: How To Find A Customs Broker? 7 Important Factors To Know

Artemus Transportation Solutions provides a specialized customs broker software designed to streamline and ensure compliance with Importer Security Filing (ISF), Automated Manifest System (AMS), and Automated Export System (AES) requirements.

This software is tailored to help brokers and logistics teams handle complex U.S. Customs and Border Protection (CBP) filing requirements efficiently. By automating data entry, reducing errors, and ensuring timely submissions, Artemus’s software enhances the accuracy and reliability of customs documentation.

Related: Custom Broker Fees Explained: The Figures You Need To Know

Customs brokers’ earnings can vary widely but often fall within the range of $45,000 to $100,000 or more annually, depending on factors such as experience, location, and the complexity of the work.

A licensed customs broker is an individual or entity authorized by a government agency to facilitate the import and export of goods by ensuring compliance with customs regulations and laws.

Customs brokers can earn a competitive salary, with the potential for high pay based on experience and the volume and complexity of trade transactions they handle.

To become a customs broker, studying international trade, logistics, and U.S. customs regulations can be helpful. Many brokers also benefit from courses in business, economics, and law.

In the U.S., to be eligible for a customs broker license, you must be a U.S. citizen, at least 21 years old, and not a federal employee.

A customs broker helps importers and exporters comply with U.S. customs regulations, handling documentation, payments, and ensuring smooth customs clearance.

To get a customs broker license in the USA, you need to pass the Customs Broker License Exam, submit an application, and undergo a background check by U.S. Customs and Border Protection (CBP).

Becoming a customs agent typically involves applying to U.S. Customs and Border Protection, completing training, and meeting specific fitness, education, and background requirements.

The cost for a customs broker license includes a $300 exam fee and additional application fees, with potential costs for study materials and other resources.

In conclusion, pursuing a customs broker career path involves passing the Customs Broker License Examination, gaining practical experience, and staying committed to compliance. Customs brokers are vital to international trade, ensuring seamless cross-border commerce. With the right qualifications and tools like Artemus’s Customs Broker Software for Compliance, you can embark on a fulfilling career in this dynamic field.

Related: What Does ISF Stand For In Shipping? The 10+2 Rule Explained

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.