What Does Switzerland Export To The US? A Detailed Guide

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

Understanding how to export medicine from the USA is a complex and highly regulated process, involving adherence to stringent federal laws, documentation, and compliance with international trade requirements.

From ensuring FDA approval and acquiring the necessary certifications to navigating customs procedures and adhering to import regulations of the destination country, the process can be overwhelming for businesses.

However, with the right knowledge and tools, it can be efficiently managed. One such tool is Artemus’ Automated Export Filing (AES) Solution, which simplifies the export declaration process.

Table Of Contents

The United States is a leading global exporter of medicinal and pharmaceutical products, with significant trade figures indicating the scope of its industry. In recent years, U.S. medicine exports have consistently grown, driven by innovation, high-quality standards, and global demand.

In 2023, U.S. pharmaceutical exports reached approximately $77 billion, showing robust growth. Key markets include developed economies like Germany, which imported over $50 billion worth of pharmaceuticals, and France, importing over $11 billion.

Other prominent export destinations are Japan, the United Kingdom, and Canada, emphasizing the strong trade relationships in regions such as Europe and North America.

The United States also caters to emerging markets, reflecting a diverse export portfolio. For example, countries in Asia and Latin America have shown increasing demand for U.S. medical products. India, a significant player in the global pharmaceutical industry, imported about $3.4 billion worth of U.S. medicines in 2022.

This upward trajectory in U.S. pharmaceutical exports highlights its competitive edge in drug development, regulatory compliance, and manufacturing excellence, positioning it as a key player in the global healthcare landscape.

Related: Exporting Mangoes From India To The USA: How To Ship?

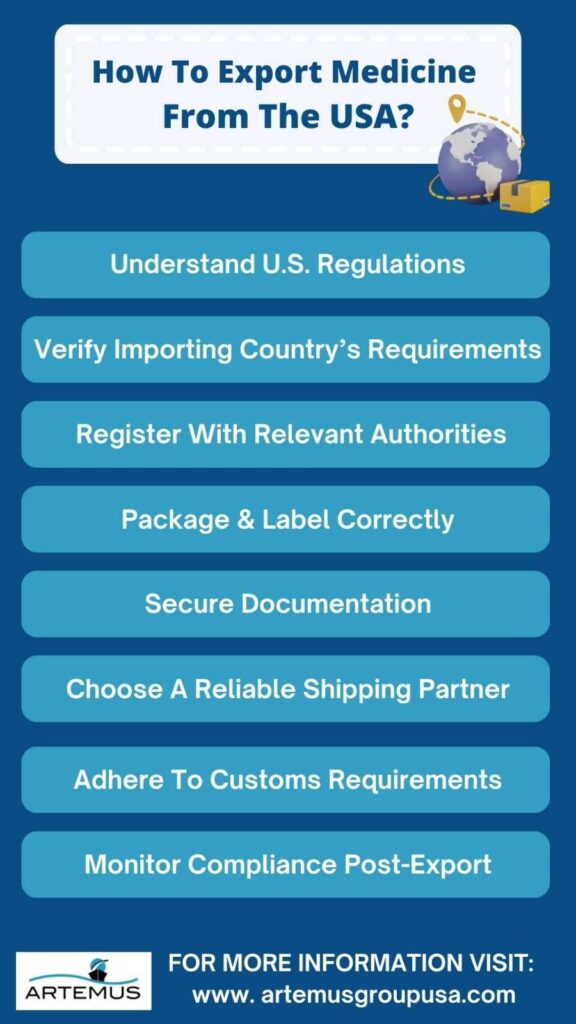

Exporting medicine from the USA is a complex process that requires compliance with U.S. regulations and the requirements of the destination country. Here is a comprehensive, step-by-step guide to assist you in navigating this process:

1. Understand U.S. Regulations

The U.S. Food and Drug Administration (FDA) oversees the export of pharmaceutical products. Medicines must meet specific standards outlined in the Federal Food, Drug, and Cosmetic Act and comply with FDA regulations:

Exporters may also need an FDA Export Certificate, such as:

Each country has its own pharmaceutical import regulations. Confirm:

Before exporting, ensure compliance with the following:

Proper labeling is critical:

Prepare the necessary paperwork:

Select a logistics company experienced in handling pharmaceutical products. They must adhere to cold-chain requirements (if applicable) and ensure secure transport to prevent tampering.

Work with customs brokers to:

Maintain records for each shipment for at least five years. Be prepared for audits from the FDA or importing country authorities.

The primary federal agency responsible for regulating medicine exports in the United States is the Food and Drug Administration (FDA). The FDA ensures that medicines exported from the U.S. comply with federal laws and international standards.

Here are key points about the FDA’s role in regulating medicine exports:

The FDA oversees the safety, efficacy, and labeling of pharmaceutical products, both for domestic use and export. Under the Federal Food, Drug, and Cosmetic Act (FDCA), the FDA regulates the export of:

The FDA issues various certificates to facilitate pharmaceutical exports:

Medicines must be properly labeled as export-only and meet the packaging and documentation requirements of both U.S. and importing country regulations. The FDA ensures that exported drugs are not adulterated or misbranded according to U.S. law.

The FDA works alongside other federal agencies, such as:

Yes, you need specific licenses and certifications to export medicine from the USA. The process involves compliance with various federal and international regulations. Below are the primary requirements for obtaining the necessary licenses:

The Food and Drug Administration (FDA) mandates that pharmaceutical exporters secure appropriate export certificates, depending on the nature of the medicine:

In addition to FDA requirements, you may need:

Exporters must:

The destination country may have its own licensing requirements for pharmaceuticals, including:

Related: How To Export From India To USA? A 2024 Updated Guide

To export medicines from the USA, several critical documents are required to ensure compliance with U.S. federal regulations and the importing country’s requirements. Here’s a detailed list of the essential documents:

The required documents may vary depending on the destination country and the type of drug being exported. It’s essential to consult with the FDA and local authorities in the importing country for precise requirements.

Related: 10 International Shipping Documents To Must Have In 2024

When exporting medicine from the USA, various governing laws and regulations must be followed to ensure compliance with both domestic and international requirements. Here are the key legal frameworks to be aware of:

The FDCA, overseen by the Food and Drug Administration (FDA), is a critical law governing the safety, efficacy, and marketing of pharmaceutical products in the U.S. This act mandates that all drugs manufactured or marketed for export must comply with FDA standards, including ensuring that they meet Current Good Manufacturing Practices (CGMP).

It also stipulates that the FDA issue export certificates to confirm the quality and compliance of the drugs for international trade.

The FDA regulates the export of drugs through specific rules under the FDCA. Exporters must obtain necessary certificates, such as the Certificate of Pharmaceutical Product (CPP), to confirm that drugs meet FDA standards.

In addition, the FDA’s Center for Drug Evaluation and Research (CDER) ensures that drug exports comply with international safety regulations.

Administered by the Bureau of Industry and Security (BIS) within the U.S. Department of Commerce, the EAR governs the export of dual-use items, which include goods and technologies that have both civilian and military applications.

Some pharmaceutical products, especially those classified as controlled substances or having sensitive technologies, may require a license for export.

Though primarily concerned with defense-related items, ITAR can impact pharmaceutical exports if the products are considered to have military applications. Medicines containing controlled substances or that fall under certain categories of biological agents may be subject to these regulations.

For narcotic and controlled substances, the DEA plays a key role in regulating their export. Exporters must comply with DEA’s controlled substance export regulations, including obtaining necessary permits when shipping drugs classified as narcotics or other controlled substances. This ensures that these drugs are not diverted to illegal markets.

For international trade, the WTO’s Trade-Related Aspects of Intellectual Property Rights (TRIPS) agreement may influence the export of medicines. TRIPS sets out the international standards for intellectual property (IP) rights, which can affect the export of patented pharmaceuticals.

In addition to U.S. laws, exporters must also adhere to the import regulations of the country to which the medicine is being shipped. This may include providing certificates of compliance, registration with the destination country’s health authority, and meeting their specific import standards.

Many countries require import permits or health clearance certificates before allowing pharmaceutical products into their borders.

Related: What Is Global Trade Compliance & Its Key Components

When exporting medicine from the USA, it’s essential to comply with a range of regulatory and documentation requirements to ensure that the pharmaceutical products meet safety and quality standards for both the U.S. and international markets. Here are the key compliance requirements:

The Food and Drug Administration (FDA) is the primary regulatory body overseeing the export of pharmaceutical products from the U.S. Exporters must comply with the Food, Drug, and Cosmetic Act (FDCA), which mandates that all drugs meet FDA’s stringent safety and efficacy standards.

This includes compliance with Current Good Manufacturing Practices (CGMP) for manufacturing drugs, ensuring they are produced under conditions that guarantee their quality.

Exporters must also obtain a Certificate of Pharmaceutical Product (CPP), issued by the FDA, to confirm the drug’s compliance with these standards for the destination country.

To comply with U.S. export regulations, several documents are required, such as:

These documents ensure that the export is legal, safe, and in compliance with international trade laws.

If exporting controlled substances or narcotics, the Drug Enforcement Administration (DEA) enforces additional compliance rules. Exporters must obtain specific permits for such shipments, ensuring that the products do not enter illicit markets. This process includes filing an export permit application with the DEA.

Different countries have their own regulatory frameworks for importing medicines. Most nations require pharmaceutical products to be registered and comply with their local health authorities’ regulations.

These might include import permits, drug testing, and clearance by the country’s equivalent of the FDA or health ministry. It’s essential to ensure that all required certifications are in place before shipment.

Many countries follow international certification schemes, like the World Health Organization (WHO) certification, to ensure the quality of drugs being imported. Some nations also rely on Free Sale Certificates, which verify that the drugs are legally available in the U.S. market and meet quality standards

Certain medicines, particularly those containing sensitive technologies, may fall under the Export Administration Regulations (EAR), enforced by the Bureau of Industry and Security (BIS). These regulations control the export of dual-use goods, which have both civilian and military applications, and certain drugs may require additional licensing.

The TRIPS (Trade-Related Aspects of Intellectual Property Rights) agreement under the World Trade Organization (WTO) also impacts pharmaceutical exports. It requires compliance with international intellectual property rights and patents, ensuring that pharmaceutical exporters respect the patents of drugs produced by other manufacturers FDA.

Customs laws in the destination country must also be followed. This includes ensuring that proper tariff codes are applied to the medicines being exported and that the correct customs duties are paid. Inaccuracies in this area can delay shipments or result in fines

Related: What Is Import Compliance & Why It Matters?

Artemus provides an efficient Automated Export Filing (AES) solution tailored for businesses & individuals exporting goods from the USA. With compliance at its core, the Artemus AES software simplifies the process of filing export declarations to the U.S. Census Bureau via the Automated Export System (AES).

This solution automates the documentation process, ensuring that exporters meet all regulatory requirements, including reporting export data, tracking shipments, and maintaining necessary records.

By streamlining AES filings, Artemus helps businesses reduce errors, avoid penalties, and expedite export operations, making it an indispensable tool for exporters looking to navigate complex U.S. export regulations seamlessly.

Related: 10 Supply Chain Best Practices In Shipping: A 2025 Guide

To import medicine from the USA to India, you need to follow the guidelines set by the Central Drugs Standard Control Organization (CDSCO). Importers must register the products with the CDSCO, ensure they comply with Indian regulations, and acquire an Import License. Additionally, medicines must pass quality control checks by the Drug Controller General of India (DCGI).

To become a medicine exporter, you need to ensure compliance with regulations like FDA approval for the products, obtain an export license, and adhere to documentation and customs requirements. Additionally, you must register with the U.S. Census Bureau for export filings and possibly obtain certifications like the Certificate of Pharmaceutical Product (CPP) from the FDA.

India is one of the largest medicine exporters globally, with India accounting for approximately 20% of the world’s generic medicine supply. In terms of country exports, Germany and the United States are also major players in the pharmaceutical export industry.

Yes, you can ship medicine to India from the USA, but the shipment must comply with Indian regulations, including obtaining an Import License and ensuring the medicines are registered with the CDSCO. It’s essential to provide documentation such as FDA certificates to ensure smooth customs clearance.

The cost of obtaining a drug import license in India varies depending on the type of drug being imported and the processing fees set by the CDSCO. For example, the license application fee can range from ₹1000 to ₹5000 for different drug categories, though additional costs may apply for inspections and documentation.

Yes, medications can be shipped to the USA, but they must comply with FDA regulations and be authorized for importation. Certain controlled substances may require special permits from the Drug Enforcement Administration (DEA).

Shipping medicines from India to the USA is possible, but the drugs must meet FDA standards and be registered with the FDA for importation. Specific documentation, such as importer declarations and FDA certification, is required to ensure compliance with U.S. laws.

To import medicine into the USA, you must comply with FDA regulations, ensure the product is FDA-approved, and submit necessary documentation such as Import Drug License and FDA certificates. Controlled substances require additional compliance with DEA regulations.

Related: Understanding Roll-On/Roll-Off Ships: A Complete Guide

Exporting medicine from the USA is a complex and highly regulated process, involving adherence to stringent federal laws, documentation, and compliance with international trade requirements.

From ensuring FDA approval and acquiring the necessary certifications to navigating customs procedures and adhering to import regulations of the destination country, the process can be overwhelming for businesses.

Related: Customs Clearance Delays In 2024: Top 10 Reasons & Solutions

Switzerland plays a vital role in U.S. trade, supplying a wide range of high-value and specialized products. From pharmaceuticals and

In 2026, the US-Europe trade relationship continues to power global commerce, driven by exports of energy, advanced machinery, and pharmaceuticals

The economic partnership between the United States and Norway is a sophisticated and evolving pillar of transatlantic commerce. U.S. exports

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.