What Is Inbound Logistics & Outbound Logistics? A 2025 Guide

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

Understanding customs clearance is essential for any business involved in international trade. The process ensures that goods entering or leaving a country meet all legal requirements, with each shipment undergoing checks to ensure compliance with local regulations, payment of duties, and adherence to security protocols.

From managing documentation to calculating duties and taxes, customs clearance can be a complex task—especially with the strict regulations that vary by country.

Artemus Transportation Solutions simplifies this process by offering powerful software solutions for Importer Security Filing (ISF), Automated Manifest System (AMS), Automated Export System (AES), and customs broker software.

These tools streamline filings, minimize errors, and support smooth cross-border transactions, allowing companies to handle customs compliance confidently.

Table Of Contents

Customs clearance is the formal process through which goods are authorized to enter or leave a country. It involves a series of procedures conducted by customs authorities to ensure compliance with local regulations and international trade laws.

During customs clearance, the imported or exported goods are inspected, and relevant documentation, including invoices, permits, and certificates, is reviewed. Customs officials assess duties and taxes, and once all requirements are met, the goods are released for further transportation or distribution.

Efficient customs clearance is essential for facilitating the smooth flow of international trade, ensuring that goods move across borders legally and without unnecessary delays.

Related: Customs Compliance Software: Key Benefits & Top Suggestions

Customs clearance is an essential process in global shipping that ensures goods meet regulatory standards when crossing international borders.

When shipments arrive at or depart from a country, customs officials review and approve them based on the required documentation, taxes, and duties, ensuring compliance with local laws.

Related: What Does Customs Clearance Completed Mean? Key Takeaways

A Customs Declaration is a formal statement provided to customs authorities detailing information about goods being imported or exported. It includes essential data such as the type, quantity, and value of the items, along with relevant documents like invoices and certificates.

Customs declarations help authorities assess duties, ensure legal compliance, and monitor the movement of goods across borders.

Related: What Can I Do With A Customs Broker License? A 2024 Guide

A Customs Broker is a licensed professional or company that assists importers and exporters in navigating the complexities of customs clearance.

Acting as an intermediary between businesses and government customs authorities, customs brokers handle the necessary documentation, ensure regulatory compliance, calculate and submit duties and taxes, and manage any inspections or security filings (such as ISF or AMS).

By leveraging their expertise in customs regulations, brokers help streamline the import/export process, ensuring goods clear customs efficiently and legally.

Customs brokers are especially valuable for businesses unfamiliar with international trade requirements, as they help prevent costly delays, penalties, and compliance issues.

With their knowledge of specific country regulations, tariff classifications, and trade agreements, customs brokers are a critical resource for companies looking to expand their global reach with minimal disruption.

Related: What Does A Customs Broker Do? 10 Key Responsibilities

Customs brokers provide a wide range of services designed to simplify and expedite the customs clearance process, ensuring that businesses can move goods across international borders efficiently and in compliance with complex regulations.

Here are some key services offered by customs brokers:

Related: Customs Broker VS Freight Forwarder: 5 Key Differences

Yes, it’s possible to handle customs clearance on your own, but it requires a solid understanding of customs regulations, detailed documentation, and attention to legal requirements. For smaller shipments or those with straightforward requirements, individuals and businesses may choose to self-manage the process.

This involves preparing and submitting all necessary paperwork, such as the Bill of Lading, and Commercial Invoice, and paying applicable duties and taxes. It also requires being familiar with tariff classifications, and product-specific regulations, and, for certain shipments, completing security filings like the Importer Security Filing (ISF) or Automated Manifest System (AMS) submission.

However, customs clearance can become complex when dealing with larger or more specialized shipments, as errors in documentation or compliance can result in significant delays, fines, or even the seizure of goods.

In these cases, working with a licensed customs broker may be beneficial, as they possess the expertise to navigate customs procedures efficiently and help ensure shipments meet all regulatory standards.

Related: How Long Does Sea Cargo Take? What To Expect

In the customs clearance process, the responsibility for paying customs charges—such as duties, taxes, and fees—typically falls on the importer, unless otherwise agreed upon. This includes any tariffs based on the product’s classification, origin, and value, as well as specific import duties or taxes.

Related: What Can I Do With A Customs Broker License? A 2024 Guide

Here are five key aspects highlighting the indispensable role of customs authorities in facilitating, regulating, and securing international trade:

Customs is pivotal in ensuring adherence to international trade laws and regulations. It oversees the compliance of imported and exported goods with the specific requirements of the destination country, including tariffs, quotas, and safety standards.

Customs is responsible for scrutinizing and verifying the accuracy and completeness of the documentation accompanying shipments. This includes invoices, certificates of origin, and other relevant paperwork, ensuring transparency and legality in international transactions.

Customs authorities assess and levy tariffs and duties on imported goods. The accurate determination of these fees is crucial for fair trade practices and contributes to the economic functioning of the importing country.

Customs plays a vital role in enhancing the security of international trade. Through inspections and risk assessments, it helps identify and prevent the illegal movement of goods, ensuring the safety of nations and their citizens.

While enforcing regulations, customs also aim to facilitate the smooth flow of international trade. By efficiently processing imports and exports, customs contribute to the timely and cost-effective movement of goods across borders, fostering economic growth and global commerce.

Related: Where Can I Buy A Customs Bond? Understand Your Options

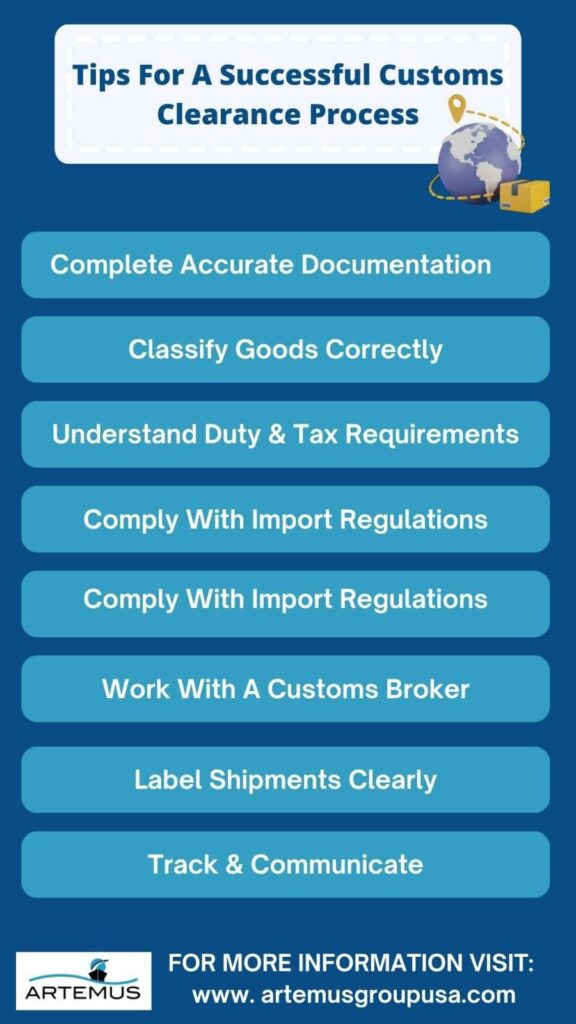

Navigating customs clearance smoothly is key to ensuring timely delivery and avoiding unexpected delays. Here are essential tips to help you streamline the process and ensure your shipments comply with all customs requirements:

1. Complete Accurate Documentation: Ensure all documents, including invoices, packing lists, and certificates, are fully accurate and match the shipment details. Incomplete or inaccurate documentation is a common cause of customs delays.

2. Classify Goods Correctly: Use the proper HS (Harmonized System) codes to classify goods accurately. Misclassification can lead to incorrect duty charges, penalties, or additional inspections, slowing down the clearance process.

3. Understand Duty & Tax Requirements: Be aware of import duties, taxes, and fees for the destination country, and prepare for any applicable payments in advance. Having these ready speeds up processing time.

4. Comply With Import Regulations: Research any specific regulations or restrictions for the destination country, such as licensing requirements, product certifications, or prohibited items, to avoid issues at customs.

5. Submit Security Filings Promptly: For countries like the U.S., complete mandatory security filings like the Importer Security Filing (ISF) or Automated Manifest System (AMS) on time to prevent costly fines and delays.

6. Work With A Customs Broker: For complex shipments, a licensed customs broker can assist in navigating regulations, managing paperwork, and ensuring compliance, significantly reducing the risk of delays.

7. Label Shipments Clearly: Ensure packages are labeled correctly with clear information on contents, weight, and destination. Proper labeling reduces the chances of misplacement and helps customs officers verify shipment details quickly.

8. Track & Communicate: Regularly monitor the shipment status and maintain open communication with all parties involved. If customs requires additional information, prompt responses can help resolve issues quickly and keep the process on track.

Related: How To Become A Customs Broker? A Step-By-Step Journey

Artemus offers robust customs clearance support with specialized software solutions for Importer Security Filing (ISF), Automated Manifest System (AMS), and Automated Export System (AES) filings, designed to streamline compliance in global shipping.

These filing solutions help companies meet U.S. Customs and Border Protection (CBP) requirements quickly and accurately, minimizing the risk of delays and penalties. With Artemus’s ISF software, importers can easily submit the essential cargo information CBP requires for security screening before arrival, ensuring compliance with stringent U.S. regulations.

The AMS and AES filing software from Artemus provides end-to-end support for both importers and exporters, enabling seamless management of cargo data and efficient transmission to customs authorities.

For exporters, AES filing software helps manage and submit mandatory electronic export information (EEI), streamlining the process and reducing the potential for costly errors.

Related: Can A Customs Broker Be The Importer Of Record Legally?

Customs clearance is the formal process of validating and authorizing the import or export of goods, involving meticulous documentation and adherence to specific regulations.

The responsibility for customs clearance typically rests with the importer or exporter, although customs brokers can be engaged for assistance.

The customs clearance fee is a charge imposed by customs brokers or agents for facilitating the process of clearing goods through customs, ensuring compliance with regulations.

There are two main types of customs clearance: import customs clearance for goods entering a country and export customs clearance for goods leaving a country.

The importer typically pays for customs clearance charges unless otherwise specified in the shipping agreement.

This means your package is being reviewed by customs to ensure all necessary duties, taxes, and documentation are in order before it can proceed.

Customs clearance requires a commercial invoice, bill of lading, packing list, and any necessary import/export permits or certificates.

Once customs clearance is complete, delivery time varies depending on the shipping method and carrier, usually within a few days.

Customs clearance is required for all goods crossing international borders to ensure compliance with local regulations.

Yes, a shipment can still be held after customs clearance if there are outstanding fees, issues with documentation, or additional inspections required by other regulatory authorities or the carrier.

Using a customs broker can be beneficial, as they streamline the clearance process, help ensure compliance, and minimize the risk of delays or penalties, especially for complex or high-value shipments.

You can find customs brokers through logistics companies, freight forwarders, or by searching for licensed customs brokers in your area.

You can check customs clearance status through the tracking feature provided by your shipping carrier or contact your customs broker for updates.

Customs clearance costs vary based on the shipment value, type, and destination, along with any broker fees and duties.

While you can handle customs clearance independently, using a broker simplifies the process and helps avoid compliance errors.

A strategic customs partner helps ensure compliance, expedites clearance and can reduce costs associated with delays and errors.

Customs brokers handle documentation, calculate duties, ensure compliance, and coordinate with customs authorities on behalf of the importer or exporter.

An ECTN (Electronic Cargo Tracking Note) Certificate is required for shipping to certain African countries to track cargo and ensure regulatory compliance.

Failure to obtain an ECTN Certificate may result in penalties, delays, or refusal of entry at the destination port.

An ECTN Certificate typically includes shipment details such as the exporter, importer, cargo description, value, and shipping route.

The ECTN Certificate process usually takes 1-3 business days, depending on document availability and submission accuracy.

Several African countries require an ECTN Certificate, including Angola, Benin, and the Democratic Republic of Congo, among others.

In Conclusion, customs clearance is the pivotal process that ensures the legal and smooth movement of goods across international borders. Requiring meticulous documentation and compliance with regulations serves as the final step in international trade.

Whether handled by importers, exporters, or with the assistance of customs brokers, accuracy and timely adherence to regulations are paramount. Technological solutions like Artemus further streamline this process, contributing to the overall success of global commerce.

Related: Customs Broker Exam (CBLE): A Comprehensive 2024 Overview

In the dynamic world of supply chain management, understanding the nuances of inbound and outbound logistics is crucial for operational

In today’s interconnected world, businesses rely heavily on global trade to expand their markets, access new resources, and drive growth.

Importing goods for resale in the USA presents a lucrative business opportunity, but navigating the complexities of U.S. customs regulations,

Get In Touch

Artemus’ Software Solutions for ISF, AMS, Japan AFR, eManifest Canada, & Panama B2B filings.